Itemize Zip Code Release Gratis

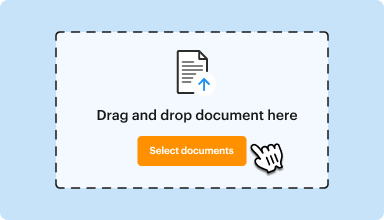

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

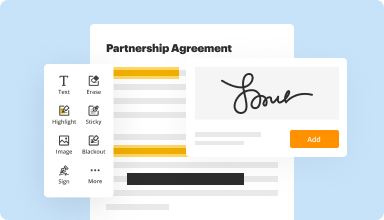

Fill out, edit, or eSign your PDF hassle-free

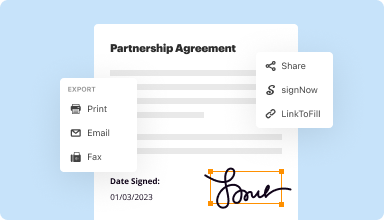

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

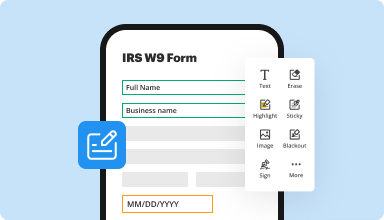

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

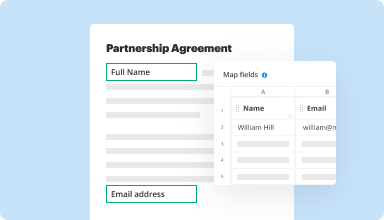

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

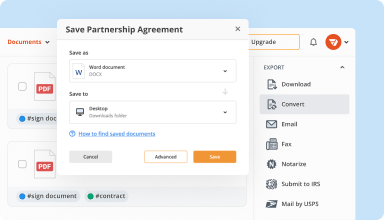

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

Collect data and approvals

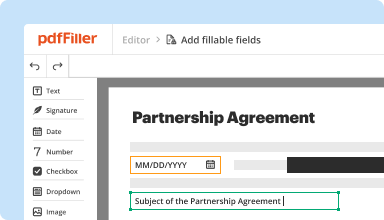

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

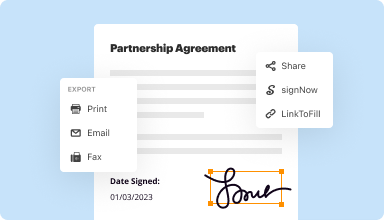

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

After a slow start and feeling misled by the "fill in your form for free" and then having to pay, I did get a full refund. The tech support was excellent - they were the only ones, that I could find, that could get me the rather complex fill in form from NY State Tax authorities (RP-5217). I still feel I should not have to pay a third party to file a required tax form - but that is an issue I'll have to take up with NYS, wish me good luck with that one.

2016-03-02

The first time I downloaded the software, I mistakenly selected the one for use with Microsoft and all features did not work on my Chromebook. After going back I found the correct program for use with Chrome. The only problem I still have is creating my signature which I have described below under features to add.

2017-11-11

PDF Filler has been extremely easy to use and navigate. It has all the features that I need to fill out pdf forms. I've been using the service for over a year now and have never had any complaints.

2018-11-12

Everything was easy to mange till I got to printing & I get an error message. I could not print from your Site. I used my computer system to print.printing

2019-01-12

Love the ease of use.

I would highly recommednd this product to any business person.

Initially, I was hesistant because learning new software is always my dread. However, once I signed on it was so easy. Makes daily document updates and creations easy. I can always find an Accord form I needed with this as well. And edit of pdfs are no longer an avoidance.

Sometimes there is a delay from screen to screen. But nothing to really complain about.

2019-01-22

I had an unsuspicious activity on my…

I had an unsuspicious activity on my card. Didn’t knew the company at first, contacted them thru email and got the best support ever and my money back :)

2023-08-05

What do you like best?

I love that it makes editing a pdf file quick & easy.

What do you dislike?

I've not run into any features of the program that I do not like yet.

Recommendations to others considering the product:

Great little program!! I do recommend.

What problems are you solving with the product? What benefits have you realized?

I use this program to do quick edits on pdf files.

2022-05-17

The soft didn't work for me but the…

The soft didn't work for me but the customer service (Shennen) was answering in seconds and proceed for my refund!

Amazing experience!

2021-11-23

I really appreciate being able to transform a regular, annoying PDF into an easily accessible document my clients can sign from any device and be sent by almost any app or service. This will definitely make going paperless a reality for our business

2020-04-30

Itemize Zip Code Release Feature

The Itemize Zip Code Release feature streamlines location management for your business. This tool allows you to effectively handle and analyze your customer data based on specific postal codes. With this feature, you can enhance your marketing strategies and improve customer interactions.

Key Features

Accurate location tracking for improved data analysis

User-friendly interface for easy management

Customizable settings to fit your business needs

Real-time updates to keep your information current

Seamless integration with existing systems

Potential Use Cases and Benefits

Targeted marketing campaigns based on specific regions

Enhanced customer service through localized communication

Data-driven decision making for better business strategies

Improved delivery accuracy and logistics management

Increased customer engagement through personalized offers

By utilizing the Itemize Zip Code Release feature, you can tackle common challenges such as data inaccuracies and inefficient marketing efforts. This tool simplifies the process of managing location-based data, making it easier for your team to focus on what matters most: growing your business. Experience the difference with this essential feature.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

Can you itemize on 2018 taxes?

Generally speaking, itemizing is a good idea if the value of your itemized expenses is more than the value of the standard deduction. Because the new tax plan nearly doubled the standard deduction for the 2018 tax year, some people who itemized their 2017 taxes will not benefit from itemizing their 2018 taxes.

Can I itemize deductions in 2018?

For single filers, the deduction for the 2018 tax year is $12,000. That's nearly double the 2017 value of $6,350. For married taxpayers filing jointly, the standard deduction for the 2018 tax year is $24,000, up from $12,700. ... Let's say you're a single filer with $10,000 worth of deductions if you itemize.

Can I itemize deductions in 2019?

Summary of 2019 Tax Law Changes If you're filing as a single taxpayer in 2019or you're married and filing separately you will likely be better off taking the standard deduction of $12,000 if your itemized deductions total less than that amount.

What itemized deductions are allowed in 2019?

The standard deduction amounts will increase to $12,200 for individuals, $18,350 for heads of household, and $24,400 for married couples filing jointly and surviving spouses. For 2019, the additional standard deduction amount for the aged or the blind is $1,300.

What can I itemize in 2018?

If you are a single taxpayer and your deductions exceed $12,000 you will itemize in 2018, and likewise, if you are married filing joint and your deductions exceed $24,000. If not, you will be taking the standard deduction in 2018. Keep in mind all of these changes are scheduled to sunset in 2025.

When should you itemize vs standard deduction?

You should itemize deductions if your allowable itemized deductions are greater than your standard deduction or if you must itemize deductions because you can't use the standard deduction. You may be able to reduce your tax by itemizing deductions on Form 1040, Schedule A, Itemized Deductions (PDF).

Is it better to itemize or take standard deduction?

You can claim the standard deduction or itemized deductions to lower your taxable income. The standard deduction lowers your income by one fixed amount. On the other hand, itemized deductions are made up of a list of eligible expenses. You can claim whichever lowers your tax bill the most.

Is it better to itemize or take standard deduction for 2018?

Generally speaking, itemizing is a good idea if the value of your itemized expenses is more than the value of the standard deduction. Because the new tax plan nearly doubled the standard deduction for the 2018 tax year, some people who itemized their 2017 taxes will not benefit from itemizing their 2018 taxes.

Should I itemize or take standard deduction in 2019?

Itemizing means deducting each and every deductible expense you incurred during the tax year. For this to be worthwhile, your inevitable deductions must be greater than the standard deduction to which you are entitled. For the vast majority of taxpayers, itemizing will not be worth it for the 2018 and 2019 tax years.

Can you itemize and take standard deduction?

The standard deduction, which is the itemized deduction's counterpart, is basically a flat-dollar, no-questions-asked reduction in your adjusted gross income. You can take either the standard deduction or itemized deductions on your tax return. You can't do both.

#1 usability according to G2

Try the PDF solution that respects your time.