Safeguard Line Notice Gratis

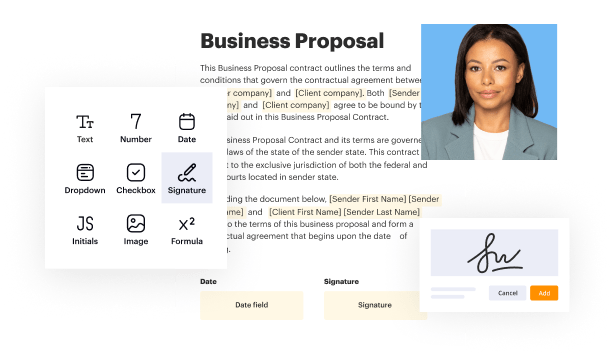

Create a legally-binding electronic signature and add it to contracts, agreements, PDF forms, and other documents – regardless of your location. Collect and track signatures with ease using any device.

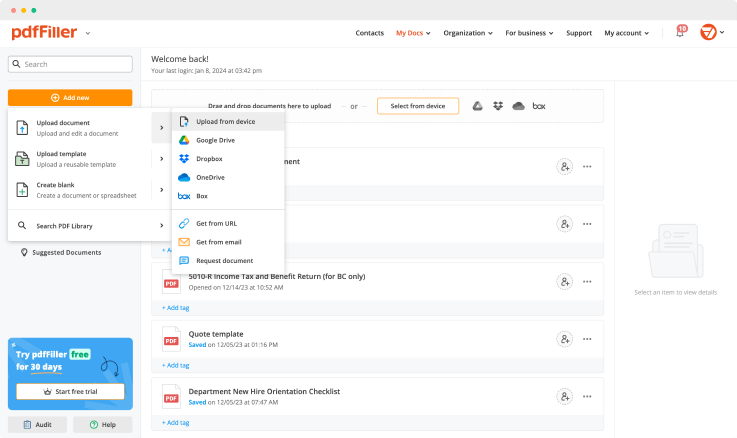

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

Upload a document

Generate your customized signature

Adjust the size and placement of your signature

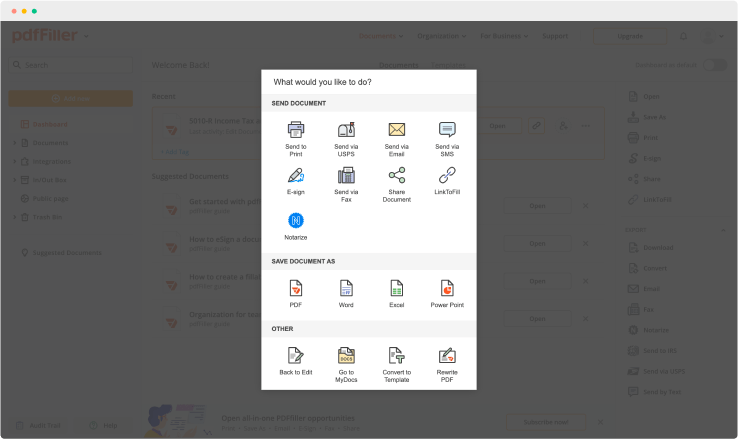

Download, share, print, or fax your signed document

Join the world’s largest companies

Employees at these companies use our products.

How to Add a Signature to PDF (and Send it Out for Signature)

Watch the video guide to learn more about pdfFiller's online Signature feature

pdfFiller scores top ratings in multiple categories on G2

4.6/5

— from 710 reviews

Why choose pdfFiller for eSignature and PDF editing?

Cross-platform solution

Upload your document to pdfFiller and open it in the editor.

Unlimited document storage

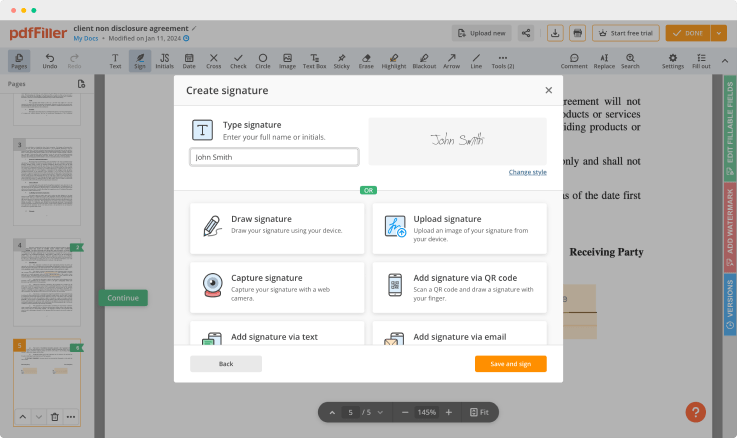

Generate and save your electronic signature using the method you find most convenient.

Widely recognized ease of use

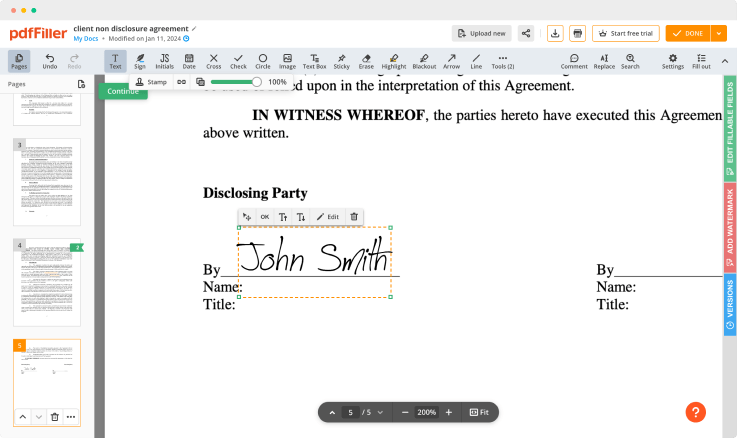

Resize your signature and adjust its placement on a document.

Reusable templates & forms library

Save a signed, printable document on your device in the format you need or share it via email, a link, or SMS. You can also instantly export the document to the cloud.

The benefits of electronic signatures

Bid farewell to pens, printers, and paper forms.

Efficiency

Enjoy quick document signing and sending and reclaim hours spent on paperwork.

Accessibility

Sign documents from anywhere in the world. Speed up business transactions and close deals even while on the go.

Cost savings

Eliminate the need for paper, printing, scanning, and postage to significantly cut your operational costs.

Security

Protect your transactions with advanced encryption and audit trails. Electronic signatures ensure a higher level of security than traditional signatures.

Legality

Electronic signatures are legally recognized in most countries around the world, providing the same legal standing as a handwritten signature.

Sustainability

By eliminating the need for paper, electronic signatures contribute to environmental sustainability.

Enjoy straightforward eSignature workflows without compromising data security

GDPR compliance

Regulates the use and holding of personal data belonging to EU residents.

SOC 2 Type II Certified

Guarantees the security of your data & the privacy of your clients.

PCI DSS certification

Safeguards credit/debit card data for every monetary transaction a customer makes.

HIPAA compliance

Protects the private health information of your patients.

CCPA compliance

Enhances the protection of personal data and the privacy of California residents.

Safeguard Line Notice Feature

The Safeguard Line Notice feature offers you a reliable way to manage and monitor important notifications. This tool helps ensure that you never miss critical messages while maintaining an organized workflow.

Key Features

Automatic notifications for upcoming deadlines

Customizable alerts tailored to your needs

User-friendly interface for easy navigation

Integration with existing systems for seamless operation

Comprehensive tracking of all communications

Potential Use Cases and Benefits

Streamlining project management and meeting deadlines

Enhancing team communication to avoid misunderstandings

Improving compliance with regulatory requirements

Simplifying personal reminders for important dates

Ensuring timely responses in customer service interactions

The Safeguard Line Notice feature addresses your need for effective communication and organization. By automating notifications and providing a clear overview of your tasks, it helps you stay on top of your obligations. This way, you can focus on what truly matters—achieving your goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

When should a privacy notice be given?

The General Data Protection Regulation (GDPR), which takes effect from 25 May 2018, requires organizations to give individuals certain information about how their personal data is collected and used. This can be done via a privacy notice.

When must a privacy notice be provided?

(1) For customers, the initial privacy notice must be provided at the time of establishing a customer relationship. (2) For consumers who are not customers, the initial privacy notice must be provided prior to disclosing nonpublic personal information about the consumer to a nonaffiliated third party.

Are annual privacy notices still required?

Under a law passed by Congress in 2015, banks are no longer required to send an annual privacy notice if they have not changed their policies and practices about how they share customer information since the previous notice was sent, provided they only share nonpublic personal information with third parties as

How often must a financial institution continue to give privacy notices to a customer?

A financial institution must provide an annual notice at least once in any period of 12 consecutive months during the continuation of the customer relationship unless an exception to the annual privacy notice requirement applies. Generally, new privacy notices are not required for each new product or service.

What information is required to be disclosed on a privacy notice?

For example, nonpublic personal information obtained from an application or a third party such as a consumer reporting agency. Categories of information disclosed. For example, information from an application, such as name, address, and phone number. Social Security number. Account information. And account balances.

Which is an acceptable delivery method for a privacy notice?

Delivering Privacy Notices Your written notices may be delivered by mail or by hand. For individuals who conduct transactions with you electronically, you may post your privacy notice on your website and require them to acknowledge receiving the notice as a necessary part of obtaining a particular product or service.

Are banks still required to send annual privacy notices?

Under a law passed by Congress in 2015, banks are no longer required to send an annual privacy notice if they have not changed their policies and practices about how they share customer information since the previous notice was sent, provided they only share nonpublic personal information with third parties as

What is the main purpose of the Grammy Leach Bailey Act Privacy Rule?

Gramm-Leach-Bliley Act. The Gramm-Leach-Bliley Act requires financial institutions companies that offer consumers financial products or services like loans, financial or investment advice, or insurance to explain their information-sharing practices to their customers and to safeguard sensitive data.

Ready to try pdfFiller's? Safeguard Line Notice Gratis

Upload a document and create your digital autograph now.