Set Wage Record Gratis

Drop document here to upload

Up to 100 MB for PDF and up to 25 MB for DOC, DOCX, RTF, PPT, PPTX, JPEG, PNG, JFIF, XLS, XLSX or TXT

Note: Integration described on this webpage may temporarily not be available.

0

Forms filled

0

Forms signed

0

Forms sent

Discover the simplicity of processing PDFs online

Upload your document in seconds

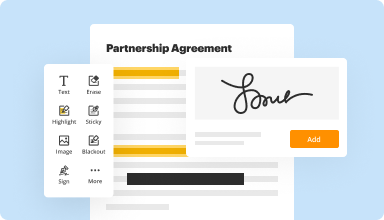

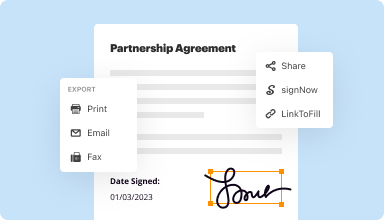

Fill out, edit, or eSign your PDF hassle-free

Download, export, or share your edited file instantly

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Every PDF tool you need to get documents done paper-free

Create & edit PDFs

Generate new PDFs from scratch or transform existing documents into reusable templates. Type anywhere on a PDF, rewrite original PDF content, insert images or graphics, redact sensitive details, and highlight important information using an intuitive online editor.

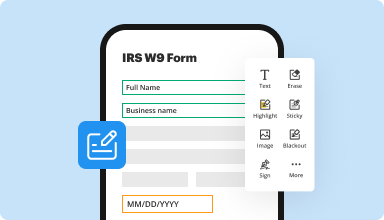

Fill out & sign PDF forms

Say goodbye to error-prone manual hassles. Complete any PDF document electronically – even while on the go. Pre-fill multiple PDFs simultaneously or extract responses from completed forms with ease.

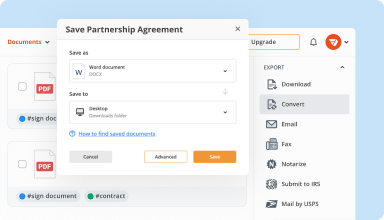

Organize & convert PDFs

Add, remove, or rearrange pages inside your PDFs in seconds. Create new documents by merging or splitting PDFs. Instantly convert edited files to various formats when you download or export them.

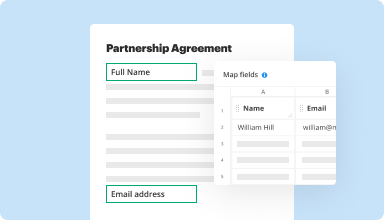

Collect data and approvals

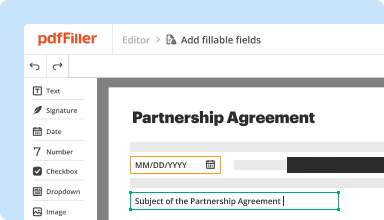

Transform static documents into interactive fillable forms by dragging and dropping various types of fillable fields on your PDFs. Publish these forms on websites or share them via a direct link to capture data, collect signatures, and request payments.

Export documents with ease

Share, email, print, fax, or download edited documents in just a few clicks. Quickly export and import documents from popular cloud storage services like Google Drive, Box, and Dropbox.

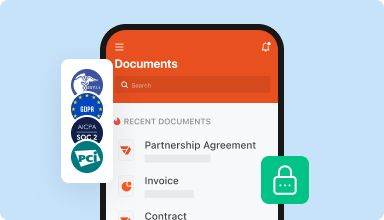

Store documents safely

Store an unlimited number of documents and templates securely in the cloud and access them from any location or device. Add an extra level of protection to documents by locking them with a password, placing them in encrypted folders, or requesting user authentication.

Customer trust by the numbers

64M+

users worldwide

4.6/5

average user rating

4M

PDFs edited per month

9 min

average to create and edit a PDF

Join 64+ million people using paperless workflows to drive productivity and cut costs

Why choose our PDF solution?

Cloud-native PDF editor

Access powerful PDF tools, as well as your documents and templates, from anywhere. No installation needed.

Top-rated for ease of use

Create, edit, and fill out PDF documents faster with an intuitive UI that only takes minutes to master.

Industry-leading customer service

Enjoy peace of mind with an award-winning customer support team always within reach.

What our customers say about pdfFiller

See for yourself by reading reviews on the most popular resources:

An excellent program, my only gripe was/is after paying for this program, I began to experience unsolicited X-rated and non-X rated ads. And, interference using Safari on an Apple PC

2015-05-04

editing document is fine. Underlining is hard to figure out. Simply saving for future use (not exporting) is not clear but I stumbled on a solution that I hope will work.

2016-10-02

Love this program! It allows you to download any document and make it your own. No more handwriting which leaves room for errors. The only part that confuses me is the saving of a document to be used over and over... haven't quite figured that out yet.

2017-03-10

I REALLY enjoy. How simple this app. can make a task such as

" creating a legal document ". (Which, at first can sound super intimidating ".) become. Easy to use, Step by step explanation's & examples. I love the FREE 3o day upgrade trial. I've tried to think, of anything I would do differently... & I honestly can't come up with a thing!, NICE WORK!!

2024-03-21

Pdf filler review

So far so good

The software works great. Have little to no complaints overall

I would like it to have more templates for documents to choose from

2022-06-30

Just what I was looking for!

Just what I was looking for! Affordable. Easy to use website because it's user-friendly. I went ahead and got the year subscription because I was very satisfied. The only issue I had was enlarging my signature to use it. But that might be my own human error.

2021-07-09

Trial Offer

We were reviewing this application and thought we had agreed to the trial offer. Actually, we didn't want the trial offer. When sending an email to their support team, they immediately responded and took care of our request, no questions asked.

2020-09-16

I love the product and service

I love the product and service, and will soon use all my 5 licenses. Honored to reference your Company for any prospects. Keep up the good work and stay safe.Thanks and regardsAlan L. Krishnan(703) 628-6422

2020-06-01

Ryan on the Support Team was extremely helpful and patient. He walked me through all of the steps to complete the form to my satisfaction. Thank you Ryan for teaching me!

2020-05-21

Set Wage Record Feature

The Set Wage Record feature allows users to efficiently manage employee wage data. With this tool, you can document, update, and track wage information in one unified platform. This feature simplifies the wage management process and helps ensure compliance with labor regulations.

Key Features

Easily record employee wages and hours worked

Adjust wage rates for different time periods

Generate reports for payroll and auditing purposes

Store historical wage data for future reference

Integrate with existing HR and payroll systems

Use Cases and Benefits

Track wage changes over time to maintain transparency

Facilitate smooth payroll processing each cycle

Ensure compliance with local and federal wage laws

Provide employees with clear wage documentation

Enhance overall HR efficiency and accuracy

By implementing the Set Wage Record feature, you can solve common wage management challenges. This tool allows you to record and adjust wages easily, which saves time and reduces errors. You can focus on your core business while ensuring that your employees receive accurate and timely payments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How many years is an employer required to retain records of wages paid?

You must keep all payroll records for at least three years, according to the Fair Labor Standards Act (FLEA). And, you need to keep records that show how you determined wages for two years (e.g., time cards that comply with FLEA timekeeping requirements).

How long does an employer have to keep unemployment records?

Unemployment Tax Records Under the records-in-general rule, such records must be retained for four years after the due date of the Form 940, Employer's Annual Federal Unemployment Tax Return or the date the required FTA tax was paid, whichever is later.

How long do companies keep your records on file?

It may vary by state to state, but usually employment records are kept for a minimum of 7 years since the last date of employment. That said, the 7 years figure is a minimum, and any employer could keep records, including performance info and termination records indefinitely.

How long do you have to keep garnishment records?

Fair Labor Standards Act Records that employers are required to maintain for at least three years include personal information about the employee, including Social Security number, sex, position and title, wages earned, pay rate and overtime earnings.

How long should employers keep workers comp records?

Workers' compensation records should be segregated into a separate file as they need to be kept for 30 years after the employee is separated in order to ensure compliance with OSHA. Federal and state payroll taxes, FLEA and EPA records, wages, benefits, bonuses, etc. 4 years after termination.

How long do you have to keep certified payroll records?

Payroll Records Retention Certified payroll reports and supporting documentation are retained by the contractor for three years. In turn, payroll records are retained for seven to 10 years. In the event of a government certified payroll audit, the contractor will be asked to provide these records to the auditor.

How long do we need to keep employee records?

You are required by law to keep records of all employees Tax and National Insurance contributions. You must keep them for three years from the end of the tax year they relate to. HM Revenue & Customs (HMRC) has the right to check your records.

How long do you have to keep payroll tax returns?

Keep all records of employment taxes for at least four years after filing the 4th quarter for the year. These should be available for IRS review. Records should include: Your employer identification number.

#1 usability according to G2

Try the PDF solution that respects your time.