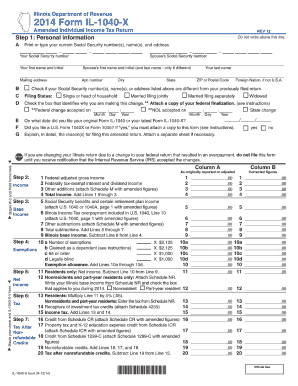

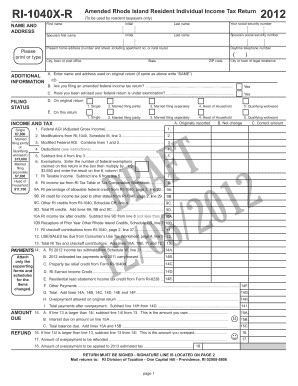

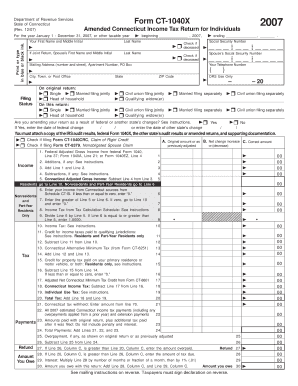

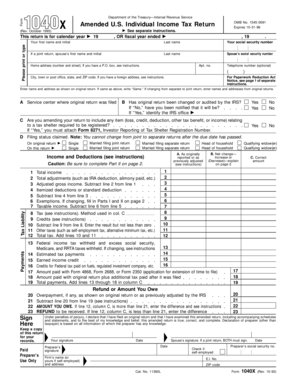

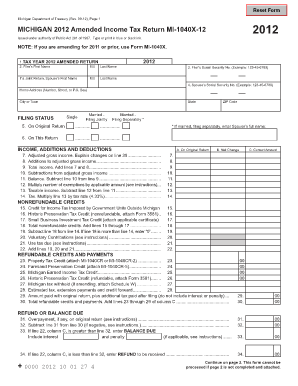

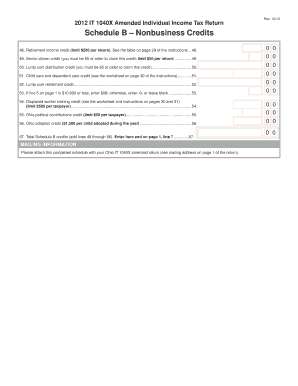

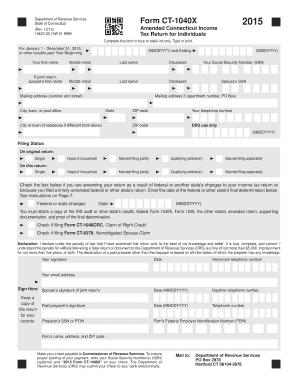

1040x Form 2012

What is 1040x Form 2012?

The 1040x Form 2012, also known as the Amended U.S. Individual Income Tax Return, is a form used by taxpayers to correct errors or make changes to their previously filed 1040 Form for the year 2012. It allows taxpayers to update their income, deductions, credits, and any other relevant information to accurately reflect their tax liability.

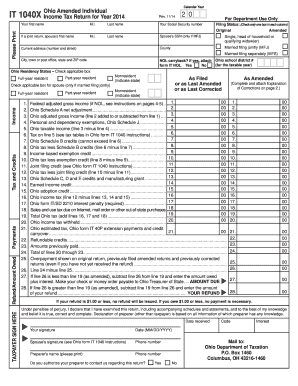

What are the types of 1040x Form 2012?

The 1040x Form 2012 has several types based on the specific changes being made to the original tax return. The most common types include:

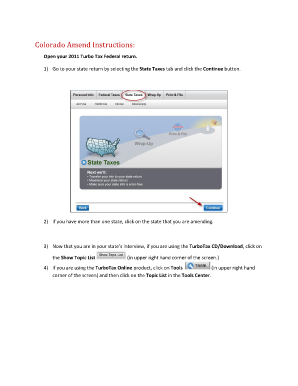

How to complete 1040x Form 2012

Completing the 1040x Form 2012 is a straightforward process. Follow these steps to ensure accuracy:

pdfFiller offers users a convenient solution to create, edit, and share documents online. With a vast collection of fillable templates and robust editing tools, pdfFiller is the go-to PDF editor that simplifies document management tasks and helps users get their documents done efficiently.