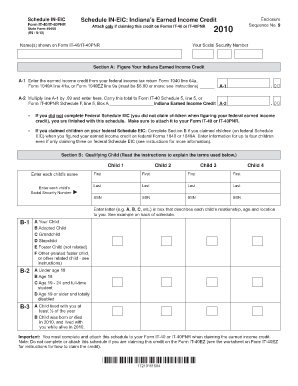

2012 Form 1040 Instructions

What is 2012 form 1040 instructions?

The 2012 form 1040 instructions refer to the guidelines and explanations provided by the Internal Revenue Service (IRS) to assist individuals in completing their 2012 version of the Form 1040, which is the U.S. Individual Income Tax Return. These instructions provide detailed information on how to accurately report income, deductions, credits, and other important information required for filing taxes for the year 2012.

What are the types of 2012 form 1040 instructions?

The types of 2012 form 1040 instructions include:

General instructions on how to fill out the form.

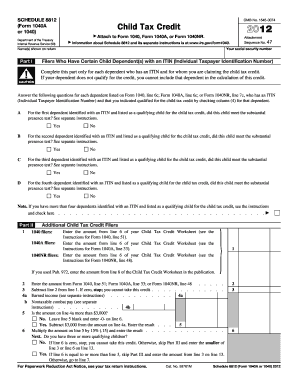

Specific instructions for various sections and schedules of the form.

Guidance on eligibility and claiming of certain deductions, credits, and exemptions.

Information on how to calculate and report taxable income.

Instructions on where and when to file the completed form.

How to complete 2012 form 1040 instructions

Completing the 2012 form 1040 requires the following steps:

01

Gather all necessary documents, including W-2 forms, 1099 forms, and any other relevant income and expense records.

02

Enter personal information, such as your name, Social Security number, and address, in the appropriate sections of the form.

03

Report all sources of income and calculate the total.

04

Claim any eligible deductions, credits, and exemptions.

05

Calculate the taxable income and determine the amount of tax owed or refund due.

06

Sign and date the form before submitting it to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2012 form 1040 instructions

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Where can I get 1040 instructions?

See IRS.gov and IRS.gov/Forms, and for the latest information about developments related to Forms 1040 and 1040-SR and their instructions, such as legislation enacted after they were published, go to IRS.gov/Form1040.

How do I file old tax returns Canada?

You can submit a late tax return using the same methods you would use to file your return on time. You can turn in your taxes using tax preparation software, mailing a return prepared by a tax preparer, or completing the CRA's General Income Tax and Benefit Package and submitting it through the mail.

How do I file a 1040 step by step?

How to Fill Out Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information, and dependents. Step 2: Report Your Income. Step 3: Claim Your Deductions. Step 4: Calculate Your Tax. Step 5: Claim Tax Credits.

Can I still file my 2012 taxes electronically?

2012 Federal Income Tax Forms. You can no longer e-File a 2012 Federal or State Tax Return. Mail-in instructions are below.

How many years back can I file my taxes in Canada?

How far back can you go to file taxes in Canada? According to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term.

Can I still file my 2012 tax return?

Note: If filing for a tax refund the time to file a 2012 tax return has expired. To file a 2012 tax return for a tax refund had to be filed on or before April 15, 2016.

Related templates