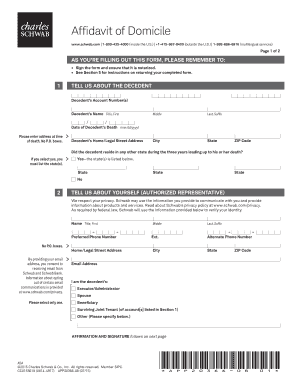

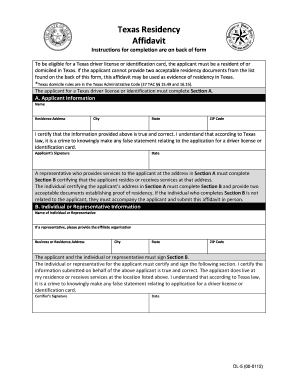

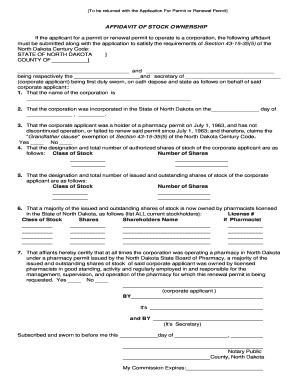

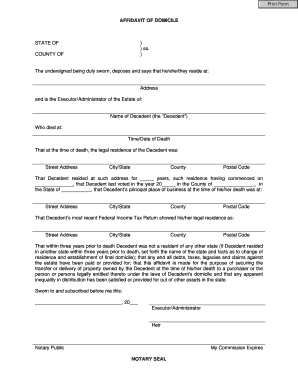

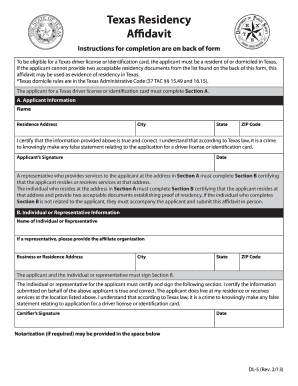

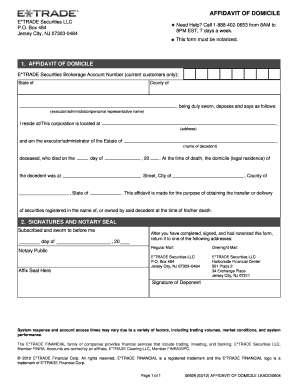

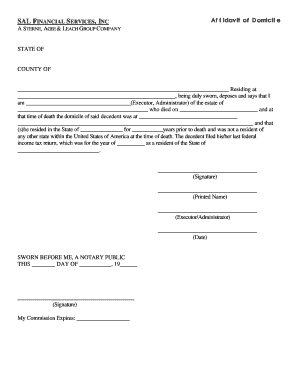

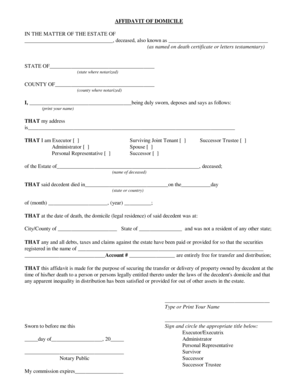

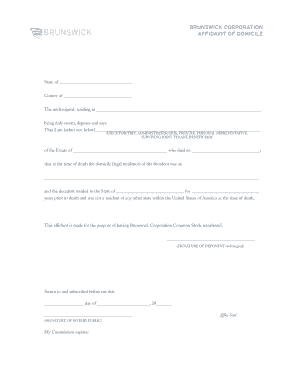

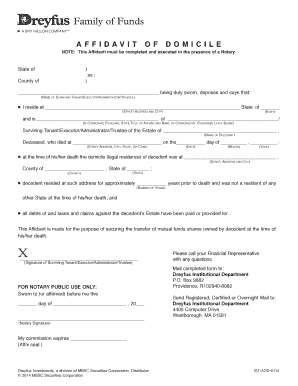

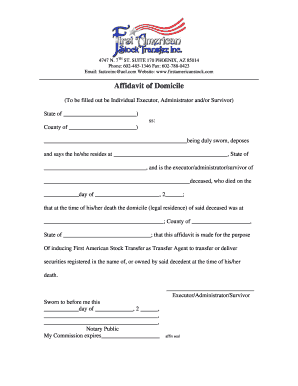

Affidavit Of Domicile

What is Affidavit Of Domicile?

An Affidavit of Domicile is a legal document that confirms the primary residence of a deceased person. It is typically used when transferring assets, such as stocks or bonds, from the deceased person's name to a beneficiary. The purpose of this document is to provide proof of the deceased person's residency at the time of their death.

What are the types of Affidavit Of Domicile?

There are two main types of Affidavit of Domicile: 1. General Affidavit of Domicile: This type of affidavit is used when the deceased person was a resident of a specific geographic area or country. 2. Specific Affidavit of Domicile: This type of affidavit is used when the deceased person was a resident of a specific state or county within the geographic area or country.

How to complete Affidavit Of Domicile

To complete an Affidavit of Domicile, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.