Affidavit Of Domicile Wells Fargo

What is affidavit of domicile wells fargo?

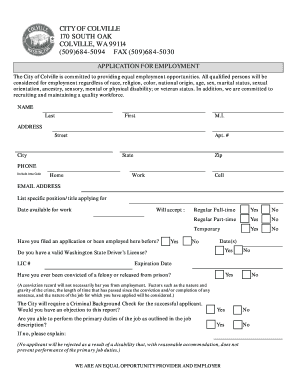

An affidavit of domicile Wells Fargo is a legal document that certifies the residence of a deceased person at the time of their passing. It is commonly required by financial institutions to transfer assets or close accounts after someone has passed away.

What are the types of affidavit of domicile wells fargo?

There are two main types of affidavit of domicile Wells Fargo: 1. Standard affidavit of domicile - used to certify the residence of a deceased individual. 2. Joint affidavit of domicile - used when two individuals need to certify their shared residence, such as spouses or partners.

How to complete affidavit of domicile wells fargo

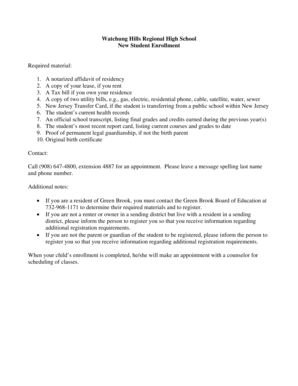

To complete an affidavit of domicile Wells Fargo, follow these steps: 1. Obtain the appropriate form from Wells Fargo or their website. 2. Fill out the form with the required information, including the deceased's name, address, and date of passing. 3. Sign the form in the presence of a notary public. 4. Submit the completed form to Wells Fargo for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.