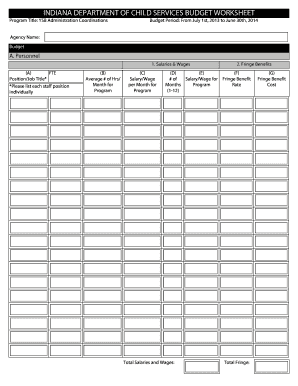

Annual Operating Budget Template

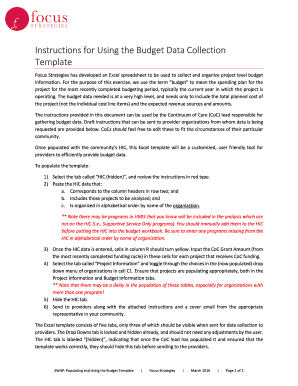

What is annual operating budget template?

An annual operating budget template is a document that helps organizations plan and manage their financial resources for a specific period, typically a year. It outlines the projected revenues and expenses, allowing businesses to track their financial performance and make informed decisions.

What are the types of annual operating budget template?

There are several types of annual operating budget templates available, including:

Basic Annual Operating Budget Template

Departmental Annual Operating Budget Template

Project-based Annual Operating Budget Template

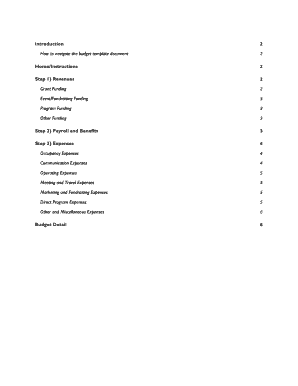

How to complete annual operating budget template

Completing an annual operating budget template can be a straightforward process if you follow these steps:

01

Gather financial data from various sources such as sales records, expense reports, and payroll information.

02

Categorize your revenues and expenses into specific budget line items.

03

Estimate your projected revenues for the upcoming year based on market trends and historical data.

04

Determine your expected expenses, including fixed costs such as rent and variable costs such as marketing expenses.

05

Calculate your net income by subtracting your total expenses from your total revenues.

06

Review and analyze your budget to identify areas for improvement or potential cost-cutting measures.

07

Adjust your budget as necessary to reflect any changes or new goals for the upcoming year.

08

Share your completed annual operating budget template with relevant stakeholders and use it as a reference throughout the year.

09

Regularly monitor and compare your actual financial performance with the budgeted figures to ensure financial stability and make necessary adjustments if needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out annual operating budget template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is an example of an operating budget?

Examples of commonly used operating budgets are sales, production or manufacturing, labor, overhead, and administration. Once budgets are in place, companies can use them to manage activities, compare how they are earning or spending against these budgets, and prepare for future business cycles.

What are the 5 main components of an operating budget?

What Are the Parts of an Operating Budget? Revenue. This includes all the different ways a company makes money by selling goods or services. Variable Costs. These are costs that rise or fall in lockstep with sales volume. Fixed Costs. Non-Cash Expenses. Non-Operating Expenses.

How do you create a simple operating budget?

Creating an operating budget is a fairly simple task for any business owner. Identify expenses for the month. Look at every expenditure for the entire business. Identify production for the month. Divide expenses by production. Determine revenue. Subtract the cost per unit from the revenue per unit.

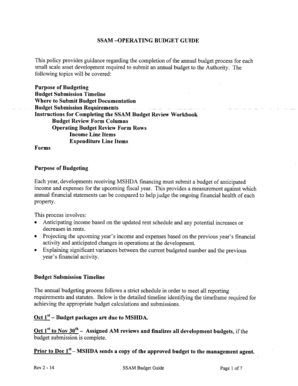

How do you create an annual operating budget?

There are five main steps in preparing an Annual Budget: Decide how to prepare the budget. Estimate your operating expenses for the year. Estimate your operating revenues for the coming year. Work out contributions to reserves. Work out net revenues for the year.

What is operating budget formula?

Operating cost = Cost of goods sold + Operating expenses \text{Operating cost} = \text{Cost of goods sold} + \text{Operating expenses} Operating cost=Cost of goods sold+Operating expenses. From a company's income statement, take the total cost of goods sold, or COGS, which can also be called cost of sales.

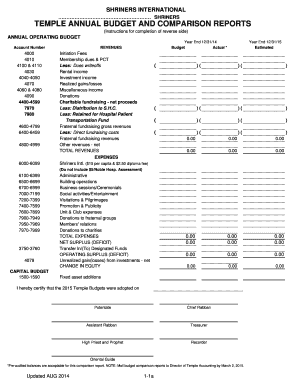

What should be included in operating budget?

The operating budgets include the budgets for sales, manufacturing costs (materials, labor, and overhead) or merchandise purchases, selling expenses, and general and administrative expenses. The sales budget is the starting point in putting together a comprehensive budget for a business.

Related templates