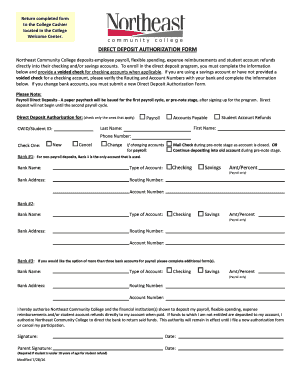

What is Authorization For Direct Deposit?

Authorization for Direct Deposit is a process through which an individual gives permission to their employer or financial institution to deposit their wages, salary, or other payments directly into their bank account. This eliminates the need for physical checks or cash payments and provides a convenient and secure way to receive funds.

What are the types of Authorization For Direct Deposit?

There are several types of Authorization for Direct Deposit that individuals can use depending on their specific needs and requirements. These include:

Basic Authorization: This is the most common type of authorization where individuals authorize their employer to deposit their salary or wages directly into their bank account.

Government Payments Authorization: This type of authorization is used when individuals receive government payments, such as Social Security benefits or tax refunds, directly into their bank account.

Pension or Retirement Payments Authorization: Individuals who receive pension or retirement payments can use this type of authorization to have the funds deposited directly into their bank account.

Vendor or Supplier Payments Authorization: This type of authorization is used by businesses or individuals who receive payments from vendors or suppliers directly into their bank account.

How to complete Authorization For Direct Deposit

Completing Authorization for Direct Deposit is a simple and straightforward process. Here are the steps to follow:

01

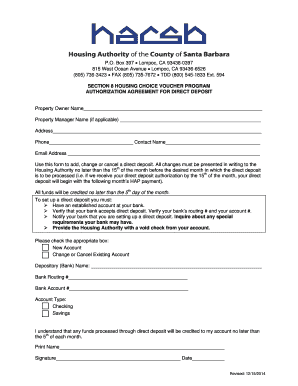

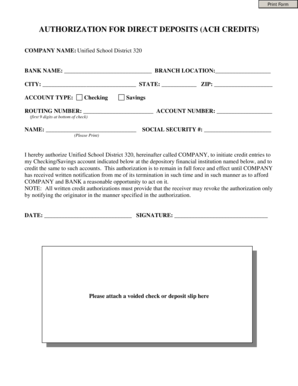

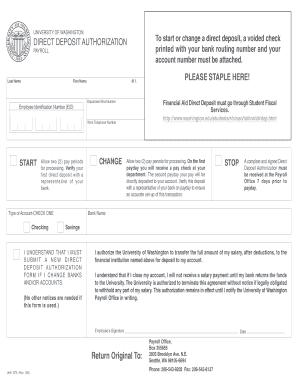

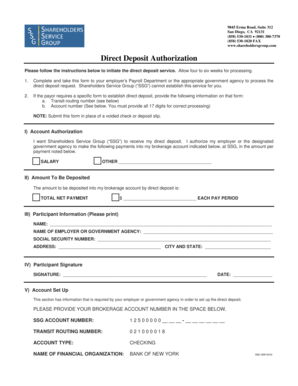

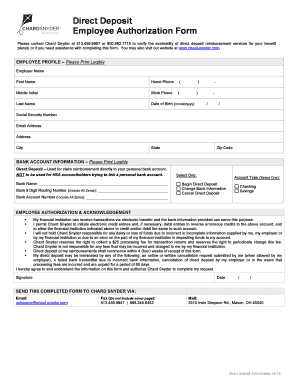

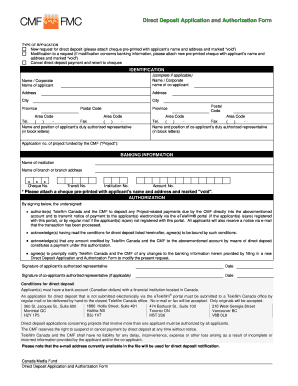

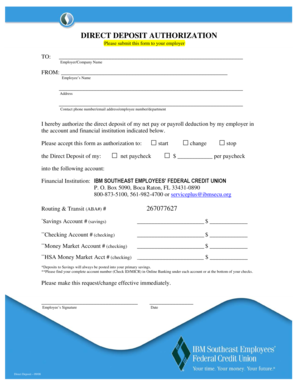

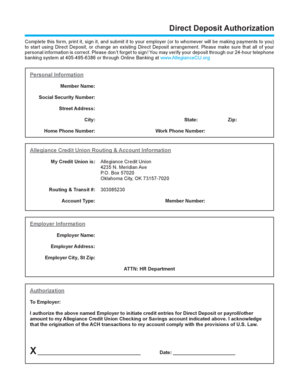

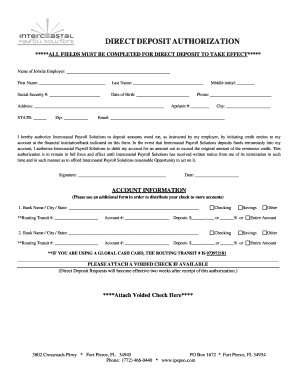

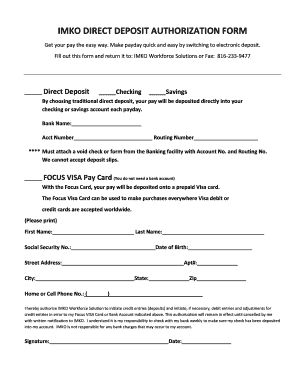

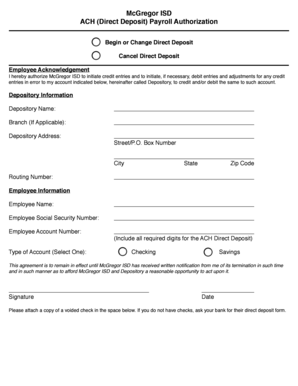

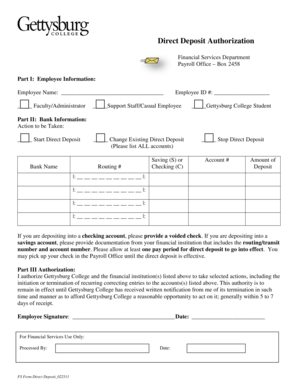

Obtain the Authorization Form: Contact your employer, financial institution, or download the form from their website.

02

Provide Personal Information: Fill in your personal information, including your full name, address, contact details, and banking information such as bank name, account number, and routing number.

03

Specify the Type of Payment: Indicate whether you are authorizing direct deposit for salary, government payments, pension or retirement payments, or vendor/supplier payments.

04

Review and Sign: Review all the information you provided for accuracy and sign the form.

05

Submit the Form: Submit the completed and signed form to your employer or financial institution as instructed.

06

Confirmation: Once your authorization is processed, you will receive a confirmation that direct deposit has been set up for your account.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.