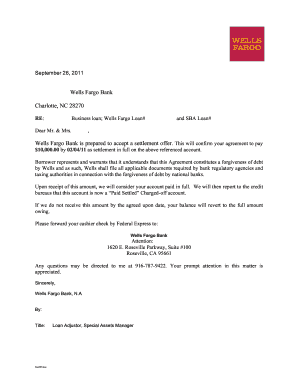

Direct Deposit Authorization Form Wells Fargo

What is direct deposit authorization form Wells Fargo?

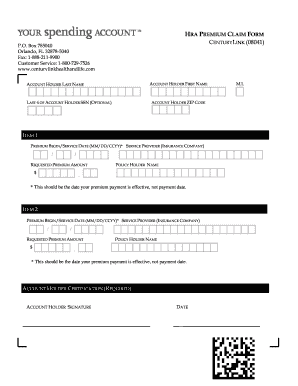

A direct deposit authorization form is a document that allows individuals to authorize their employer or other organizations to deposit their salary, payments, or benefits directly into their Wells Fargo bank account. It provides a convenient and efficient way to receive payments without the need for physical checks or manual depositing.

What are the types of direct deposit authorization form Wells Fargo?

Wells Fargo offers different types of direct deposit authorization forms to meet various needs. These include: 1. Payroll Direct Deposit Authorization: Allows employees to authorize their employer to directly deposit their salary into their Wells Fargo bank account. 2. Government Benefits Direct Deposit Authorization: Enables individuals to authorize government agencies to deposit their benefits, such as Social Security or unemployment, directly into their Wells Fargo bank account.

How to complete direct deposit authorization form Wells Fargo

Completing a direct deposit authorization form with Wells Fargo is a straightforward process. Here is a step-by-step guide: 1. Obtain the form: Visit the Wells Fargo website or your local branch to download or request the direct deposit authorization form. 2. Provide personal information: Fill in your name, address, and contact details as required on the form. 3. Bank account details: Enter your Wells Fargo bank account number and routing number to ensure the correct deposit information. 4. Employer/organization information: Provide the necessary details of your employer or organization, such as their name, address, and contact information. 5. Amount and frequency: Specify the amount and frequency of the direct deposit payments you want to authorize on the form. 6. Sign and date: Read the terms and conditions, sign the form, and include the date of authorization. 7. Submit the form: Return the completed form to your employer, organization, or your local Wells Fargo branch for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.