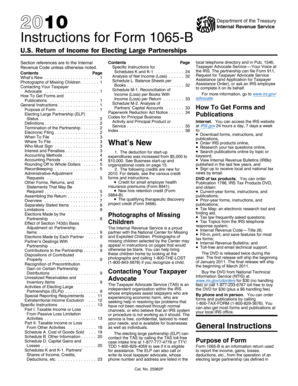

What is form 1065 instructions?

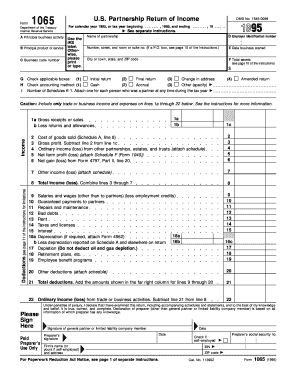

Form 1065 instructions are guidelines provided by the Internal Revenue Service (IRS) to help partnerships and limited liability companies (LLCs) report their income, deductions, and credits. These instructions explain how to fill out and file Form 1065, which is the U.S. Return of Partnership Income.

What are the types of form 1065 instructions?

There are several types of form 1065 instructions that cover different aspects of completing the form. Some of the common types include:

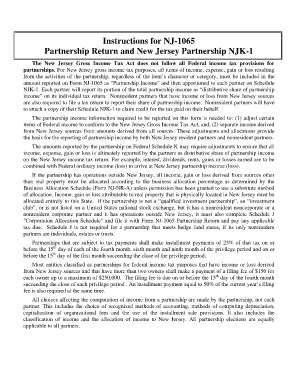

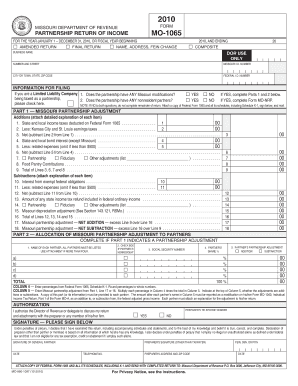

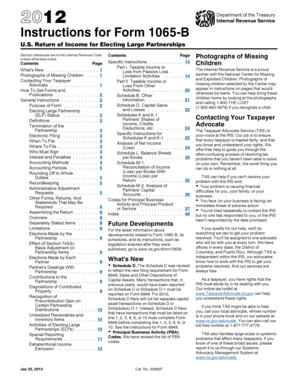

General instructions: These provide an overview of the partnership tax return requirements and explain the purpose of each part of Form 1065.

Specific instructions for certain lines: These offer detailed explanations for specific sections of the form, such as reporting income, deductions, and credits.

Partner's instructions: These instructions are meant for individual partners and provide guidance on how to report their share of partnership income, losses, and other items.

Supplemental instructions: In certain cases, additional instructions may be provided for specific situations or forms that accompany Form 1065, such as Schedule K-1.

How to complete form 1065 instructions

Completing form 1065 requires careful attention to detail. Here are the steps to follow:

01

Gather all necessary information: Collect all relevant financial records, such as income statements, expense receipts, and partnership agreements.

02

Review the general instructions: Familiarize yourself with the general instructions provided by the IRS to understand the requirements and purpose of each part of the form.

03

Fill out the form: Complete each section of the form accurately, ensuring that all information is entered correctly and all calculations are done properly.

04

Include required schedules: Attach any schedules or forms that are required based on the information provided in Form For example, if the partnership has foreign transactions, Form 8865 may need to be included.

05

Review and double-check: Carefully review the completed form and all attached schedules to ensure accuracy and compliance with IRS guidelines.

06

File the form: Submit the completed Form 1065 and any accompanying schedules to the IRS by the designated deadline. Consider using electronic filing for a faster and more efficient process.

pdfFiller is a powerful online tool that empowers users to create, edit, and share documents seamlessly. With unlimited fillable templates and robust editing tools, pdfFiller is the ultimate PDF editor that will help you get your documents done efficiently and effortlessly.