Guarantee Letter Sample - Page 2

What is the Purpose of a Guarantee Letter?

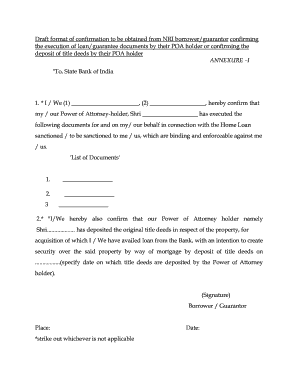

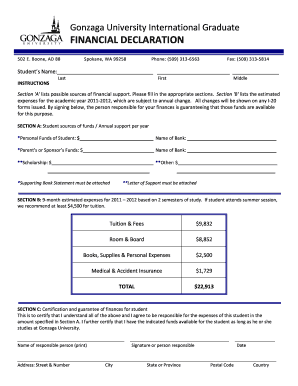

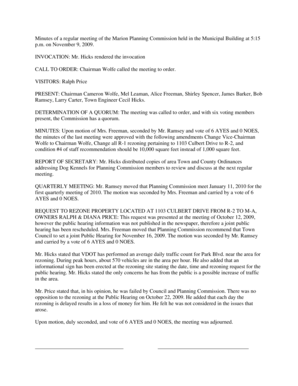

A Guarantee Letter is needed in case an individual or business decides to take financial responsibility for another person.

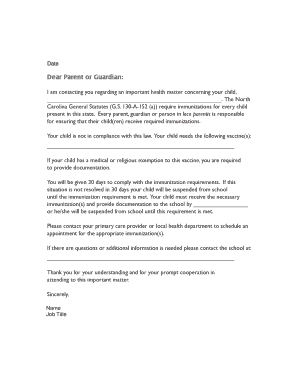

There are numerous examples of how this letter can be used. You may be required to attach this document to your visa application. A landlord could ask for written assurance of a lender’s paying ability. Banks can also issue such a contract in case of a big purchase. In fact, any financial institution may request it in order to claim all participants and their obligations in written form.

The main purpose is to ensure that all borrowed money will be paid back. That’s why it’s very important to discuss all possible risks and clarify all the possible situations. Keep in mind, it’s also advisable to consult with a lawyer in advance.

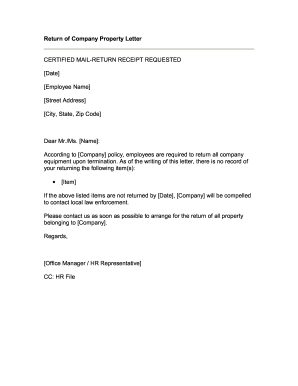

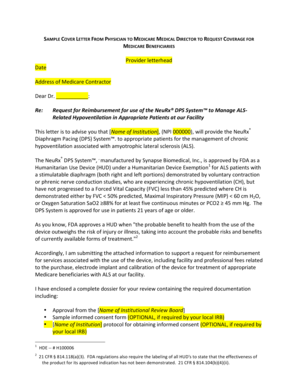

Some institutions have their own versions of this document, and some ask that you fill it out as an attachment. In the second case, you are eligible to set your own conditions or to disagree with those that are already set.

In doing so, you can effectively avoid additional fees.

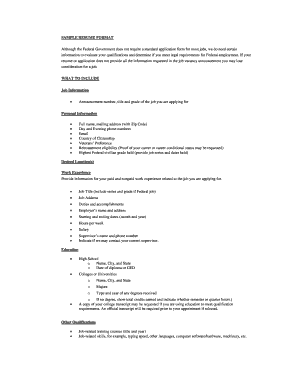

How do I Prepare a Guarantee Letter Sample?

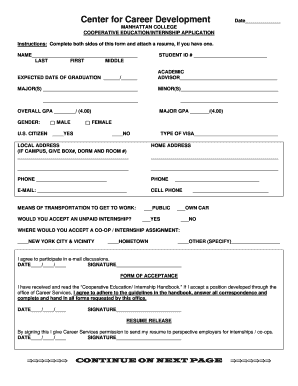

Look at the different templates and choose one that works best for you.

Here's a list of four basic steps to successfully complete the Guarantee:

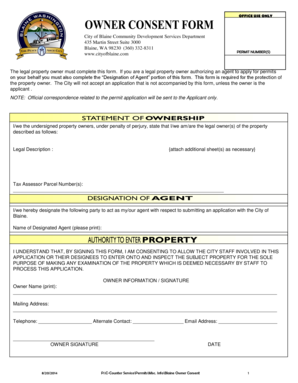

Signing, of course, is necessary because it makes the document legally binding. You can also notarize it.

You're given the option to add your signature in the most convenient way possible. Type it, draw it, upload it from your device, or take a picture of it with your camera.