Household Budget Worksheet

What is household budget worksheet?

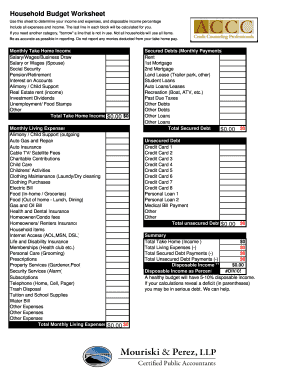

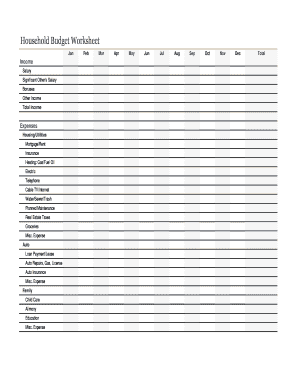

A household budget worksheet is a tool that helps individuals and families track their income and expenses. It provides a clear overview of their finances, enabling them to make informed decisions about their spending and saving habits. With a household budget worksheet, users can easily identify areas where they can cut back on expenses and allocate more funds towards their financial goals.

What are the types of household budget worksheet?

There are several types of household budget worksheets available to suit different needs and preferences. Some common types include: 1. Simple Budget Worksheet: This type of worksheet includes basic categories for income and expenses, making it easy for beginners to start tracking their finances. 2. Detailed Budget Worksheet: As the name suggests, this type of worksheet provides a more detailed breakdown of income and expenses. It may include subcategories, such as groceries, transportation, and entertainment. 3. Zero-based Budget Worksheet: This worksheet requires users to allocate all their income towards different categories, ensuring that each dollar is accounted for. 4. Envelope Budget Worksheet: This type of worksheet involves allocating cash into different envelopes representing different spending categories. It helps users limit their spending and stay within their budget. 5. Online Budget Worksheet: With the advancement of technology, online budget worksheets are becoming increasingly popular. These worksheets can be accessed and updated online, allowing users to track their finances conveniently from anywhere with an internet connection.

How to complete household budget worksheet

Completing a household budget worksheet is a straightforward process that can greatly benefit your financial well-being. Follow these steps to complete your household budget worksheet: 1. Gather all necessary financial documents, such as bank statements, pay stubs, and receipts. 2. In the income section of the worksheet, list all sources of income, including salaries, bonuses, and any other additional income. 3. In the expenses section, categorize your expenses into different categories, such as housing, transportation, groceries, and entertainment. 4. Track your expenses for a certain period, such as a month, and record them accurately in the worksheet. 5. Calculate the total income and total expenses. Compare the two to determine if you have a surplus or a deficit. 6. Analyze your spending patterns and identify areas where you can cut back on expenses or reallocate funds towards your financial goals. 7. Update your household budget worksheet regularly to track your progress and make necessary adjustments. By following these steps and regularly updating your household budget worksheet, you can gain a better understanding of your financial situation and make informed decisions to achieve your financial goals.

pdfFiller is the only PDF editor users need to get their documents done.