Household Budget Percentages

What is household budget percentages?

Household budget percentages refer to the allocation of expenses in a budget into different categories based on their proportionate share of the total budget. By breaking down expenses into percentages, individuals can better understand and manage their spending habits.

What are the types of household budget percentages?

There are several types of household budget percentages that individuals can consider. These include:

Housing: This category includes expenses related to rent or mortgage payments, property taxes, maintenance, and utilities.

Transportation: This category encompasses expenses such as car payments, gas, insurance, parking, and public transportation costs.

Food: This category covers expenses related to groceries, dining out, and any other food-related costs.

Debt: This category includes payments towards student loans, credit cards, personal loans, or any other outstanding debts.

Savings: This category represents the amount of money individuals allocate towards saving for emergencies, retirement, or other future financial goals.

Entertainment: This category includes expenses for recreational activities, hobbies, travel, and leisure.

Healthcare: This category covers expenses related to health insurance premiums, medical bills, prescriptions, and any other healthcare costs.

Education: This category encompasses expenses for tuition fees, books, supplies, and any other educational costs.

Personal Care: This category includes expenses for personal grooming, clothing, and other personal care items.

Miscellaneous: This category represents any other expenses that do not fit into the above categories.

How to complete household budget percentages

Completing household budget percentages can be done by following these steps:

01

Determine your total income: Calculate your total monthly income from all sources.

02

Track your expenses: Keep a record of all your expenses for a certain period, typically a month.

03

Categorize your expenses: Allocate each expense into the corresponding budget category.

04

Calculate the percentages: Divide the total spending in each category by the total income, and multiply by 100 to get the percentage.

05

Adjust and optimize: Analyze the percentages and identify areas where you may need to adjust or optimize your spending.

06

Set goals and create a budget plan: Based on the percentages, set realistic goals and create a budget plan that aligns with your financial objectives.

07

Monitor and review regularly: Continuously monitor your expenses, review the budget plan, and make necessary adjustments as needed.

Empowering users to create, edit, and share documents online, pdfFiller offers unlimited fillable templates and powerful editing tools. With pdfFiller, individuals have everything they need to efficiently manage their documents and get things done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

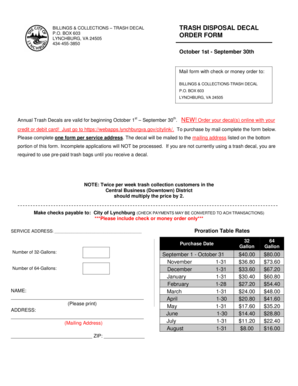

Related templates