Loan Contract Template

What is Loan Contract Template?

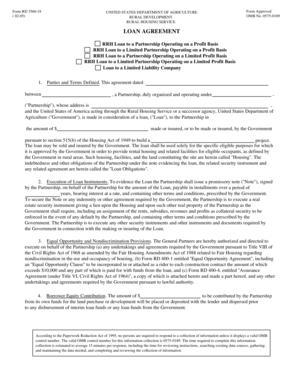

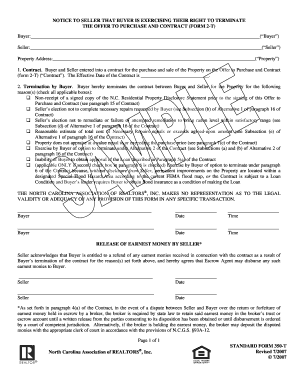

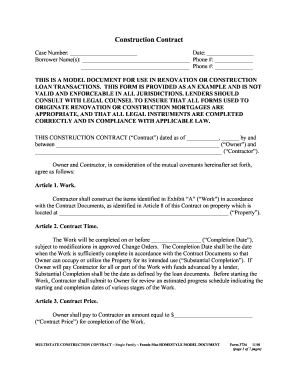

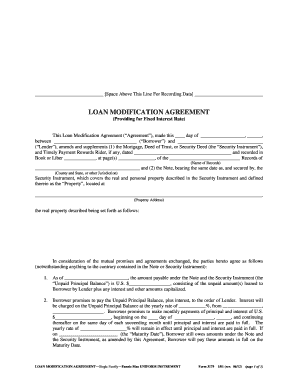

A Loan Contract Template is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. It specifies the amount of the loan, the interest rate, repayment schedule, and any other relevant details of the loan agreement.

What are the types of Loan Contract Template?

There are several types of Loan Contract Templates tailored to different loan agreements:

Personal Loan Contract Template

Business Loan Contract Template

Mortgage Loan Contract Template

Student Loan Contract Template

How to complete Loan Contract Template

Completing a Loan Contract Template is a simple process that involves the following steps:

01

Fill in the borrower and lender information

02

Specify the loan amount and interest rate

03

Outline the repayment schedule and any penalties for late payments

04

Review the terms and conditions carefully before signing

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. It is the only PDF editor users need to get their documents done efficiently.

Video Tutorial How to Fill Out Loan Contract Template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I make a loan agreement between friends?

Ask for a plan. Review the borrower's finances and help them set up a budget that includes your monthly repayment. Make sure they understand this is a loan, not a gift. Set terms that both sides agree can be enforced … and enforce them! Keep your distance. Get it down on paper.

How do you write a short loan agreement?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Can I write my own loan agreement?

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

Can a loan agreement be handwritten?

There are no legal differences between typed and handwritten agreements when it comes to enforceability. When most people think of a contract, a formally typed, the professional contract usually comes to mind. Nonetheless, a handwritten contract can be as valid as one that's typed.

What should a loan contract include?

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Does a personal loan agreement need to be notarized?

Does a personal loan agreement need to be notarized? No, a personal loan agreement does not need to be notarized to be legally binding — it simply needs to be signed by each party to the agreement.

Related templates