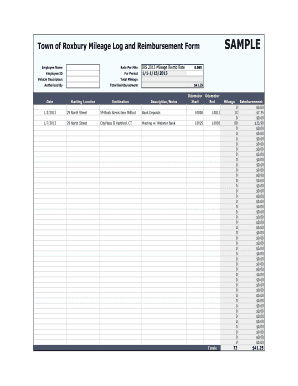

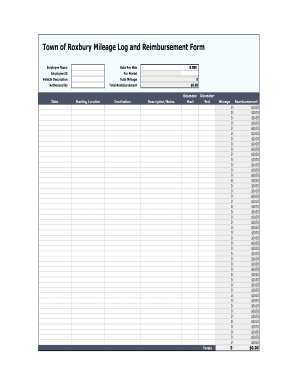

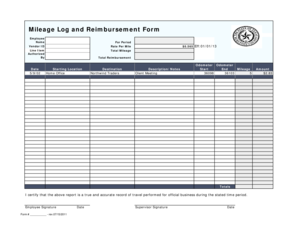

What is Mileage Log With Reimbursement Form?

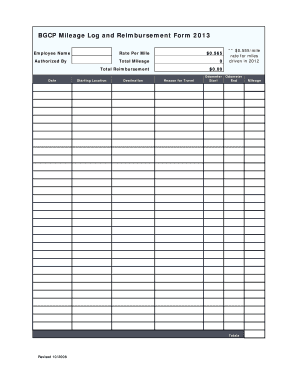

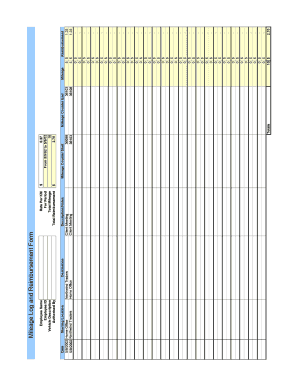

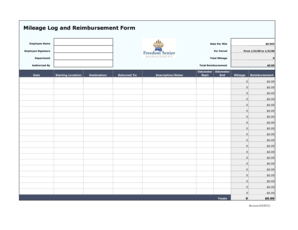

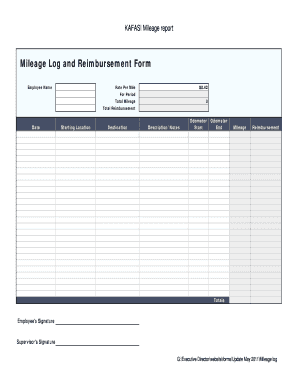

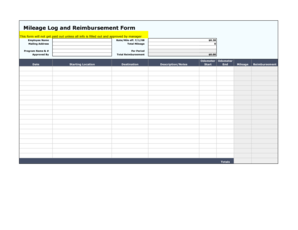

A Mileage Log With Reimbursement Form is a document used by individuals or businesses to keep track of the distance travelled for business purposes. It serves as a record of mileage for reimbursement or tax deduction purposes. This form includes details such as the date, starting and ending locations, purpose of the trip, and the number of miles driven.

What are the types of Mileage Log With Reimbursement Form?

There are different types of Mileage Log With Reimbursement Forms available to suit various needs. Some common types include:

Printable Mileage Log Forms: These forms can be printed and filled out manually. They are suitable for individuals or businesses who prefer handwritten documentation.

Electronic Mileage Log Forms: These forms are typically created and filled out electronically using spreadsheet software or specialized mileage tracking apps. They offer the convenience of automated calculations and easy data entry.

Mobile Apps: There are several mobile apps available that allow users to track their mileage and generate reimbursement forms on the go. These apps often provide additional features such as GPS tracking and expense management.

How to complete Mileage Log With Reimbursement Form

Completing a Mileage Log With Reimbursement Form is a straightforward process. Here are the steps to follow:

01

Start by entering the date of the trip in the designated space.

02

Record the starting location of your trip, including the address or any other relevant details.

03

Note down the purpose of the trip, whether it's for client meetings, business errands, or any other work-related activity.

04

Record the ending location of the trip.

05

Enter the total number of miles driven during the trip.

06

If applicable, add any additional expenses related to the trip, such as parking fees or tolls.

07

Finally, review the form for accuracy and ensure all necessary information is included.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.