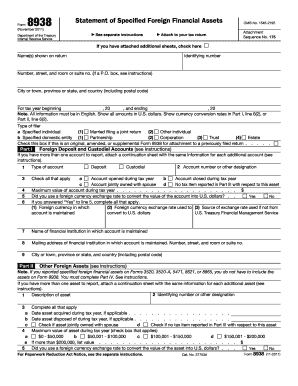

8938 Form

What is 8938 Form?

The 8938 Form, also known as the Statement of Specified Foreign Financial Assets, is a document required by the IRS for taxpayers who have certain foreign financial assets that meet the reporting threshold. It is crucial to understand the purpose and requirements of this form to comply with tax laws.

What are the types of 8938 Form?

There are two main types of 8938 Form that individuals may need to file: 1. Form 8938 for Individuals: This is the standard form that individuals must complete if they meet the reporting threshold. 2. Form 8938 for Joint Filers: This form is used when filing jointly with a spouse if both individuals meet the reporting requirements.

How to complete 8938 Form

Completing the 8938 Form may seem intimidating, but with the right guidance, it can be a straightforward process. Here are the steps to complete the form: 1. Gather all necessary information: Before starting the form, ensure you have all the required financial data and supporting documents. 2. Identify reportable assets: Determine which assets need to be reported on the form based on the reporting threshold and specific guidelines provided by the IRS. 3. Fill in personal details: Enter your personal information, including name, address, tax identification number, and the year of the form. 4. Provide asset details: Fill in the relevant information for each reportable asset, including the description, maximum value, and income generated from each asset. 5. Calculate and report the aggregate value: Aggregate the values of all reportable assets and report the total on the form. 6. Sign and date the form: Review the completed form and sign and date it before submission.

When it comes to completing the 8938 Form hassle-free, users can rely on the power of pdfFiller. With pdfFiller, users can effortlessly create, edit, and share their documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that caters to all your document needs.