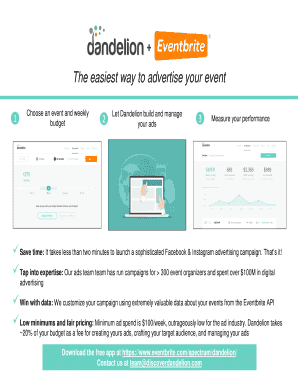

Weekly Budget App

What is a weekly budget app?

A weekly budget app is a digital tool designed to help users track and manage their finances on a weekly basis. It provides a convenient way to record income and expenses, set budget goals, and monitor spending habits.

What are the types of weekly budget app?

There are several types of weekly budget apps available to users, each offering unique features and functionalities to cater to different financial needs. Some common types include:

How to complete weekly budget app?

Completing a weekly budget app is an essential step towards better financial management. Follow these simple steps to make the most out of your weekly budget app:

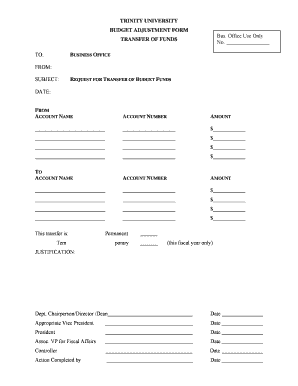

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.