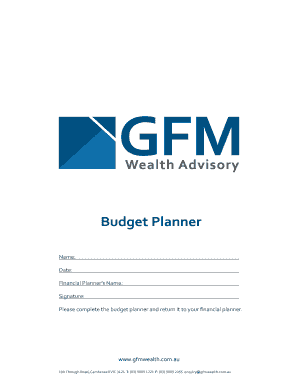

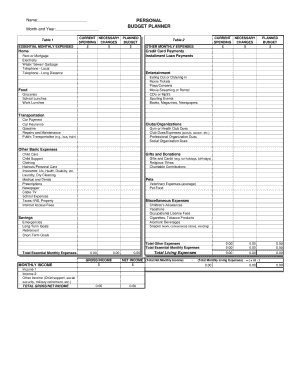

What is a weekly budget planner printable?

A weekly budget planner printable is a tool that helps individuals track and manage their personal finances on a weekly basis. It is a printable template that can be filled in with income and expenses for each week, allowing users to have a clear overview of their financial situation.

What are the types of weekly budget planner printable?

There are several types of weekly budget planner printables available to suit different needs and preferences. Some common types include:

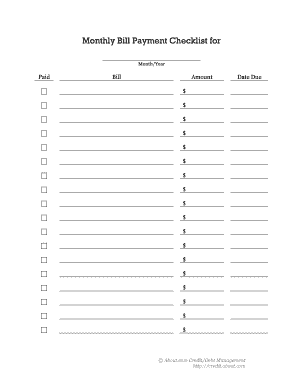

Basic weekly budget planner: This type provides a simple template with spaces to fill in income and expenses for each week.

Categorized weekly budget planner: This type allows users to categorize their expenses, making it easier to track and analyze spending habits.

Visual weekly budget planner: This type utilizes charts or graphs to visually represent income and expenses, providing a quick and easy way to understand financial data.

Digital weekly budget planner: This type can be filled in and saved electronically, allowing for easy editing and storage of financial information.

How to complete a weekly budget planner printable

Completing a weekly budget planner printable is a straightforward process that can be done in a few simple steps:

01

Start by gathering all necessary financial documents, such as pay stubs, bills, and receipts.

02

List your sources of income for the week, including wages, freelance work, or any other forms of income.

03

Next, list your expenses for the week, categorizing them as necessary. This can include bills, groceries, transportation costs, entertainment expenses, etc.

04

Calculate your total income and total expenses for the week.

05

Analyze your budget by comparing your income and expenses. Identify areas where you may need to cut back or make adjustments.

06

Make any necessary changes to your budget to ensure it is balanced and aligned with your financial goals.

07

Monitor your budget throughout the week by updating it with any new income or expenses.

08

Review your budget at the end of the week to assess your financial progress and make any adjustments for the following week.

pdfFiller is an innovative online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor for getting documents done efficiently.