Asset Allocation Form Templates

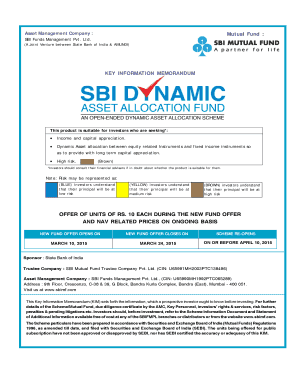

What are Asset Allocation Form Templates?

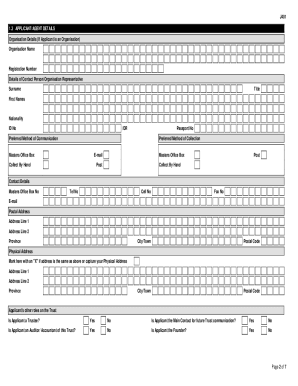

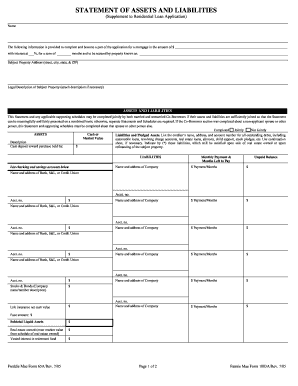

Asset allocation form templates are pre-designed documents that help individuals and businesses effectively manage their investment portfolios. These templates provide a structured way to allocate assets across different classes like stocks, bonds, real estate, and cash.

What are the types of Asset Allocation Form Templates?

There are several types of asset allocation form templates available to users. Some common types include:

Traditional Asset Allocation Forms

Modern Portfolio Theory Forms

Strategic Asset Allocation Forms

Tactical Asset Allocation Forms

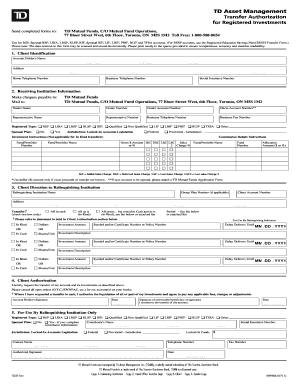

How to complete Asset Allocation Form Templates

Completing asset allocation form templates is a straightforward process that involves the following steps:

01

Review your current investment portfolio and financial goals

02

Determine your risk tolerance and investment time horizon

03

Allocate assets based on your risk profile and investment objectives

04

Regularly review and adjust your asset allocation as needed

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Asset Allocation Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

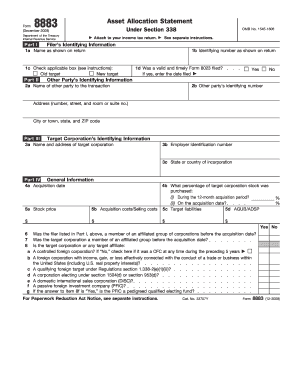

What are the 4 types of asset allocation?

Read on to find out. Strategic Asset Allocation. This type of asset allocation adheres to a static mix that is very much practical in terms of mutual funds. Tactical Asset Allocation. In the long run, a strategic asset allocation may seem too rigid. Dynamic Asset Allocation. Insured Asset Allocation. Conclusion.

How do you present asset allocation?

Asset Allocation 101 Asset allocation involves dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. The process of determining which mix of assets to hold in your portfolio is a very personal one.

How to do proper asset allocation?

A diversified portfolio should be diversified at two levels: between asset categories and within asset categories. So in addition to allocating your investments among stocks, bonds, cash equivalents, and possibly other asset categories, you'll also need to spread out your investments within each asset category.

What is an example of asset allocation?

Investors may use different asset allocations for different objectives. Someone who is saving for a new car in the next year, for example, might invest their car savings fund in a very conservative mix of cash, certificates of deposit (CDs), and short-term bonds.

What is asset allocation form?

An asset allocation form is a questionnaire that is used to help investors determine which investment portfolio is right for their assets.

How do you explain asset allocation?

Asset allocation involves dividing your investments among different assets, such as stocks, bonds, and cash. The asset allocation decision is a personal one. The allocation that works best for you changes at different times in your life, depending on how long you have to invest and your ability to tolerate risk.

Related templates