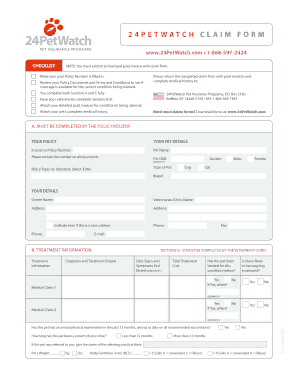

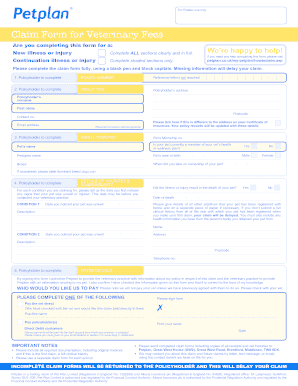

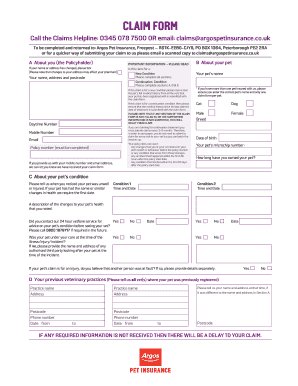

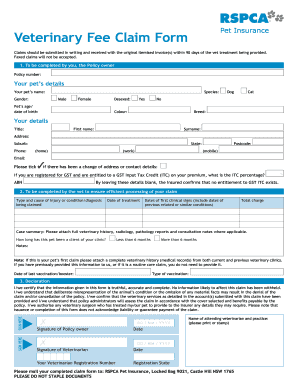

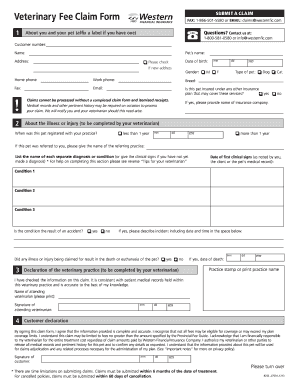

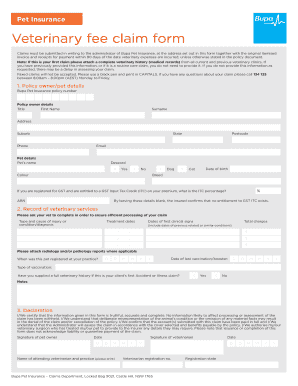

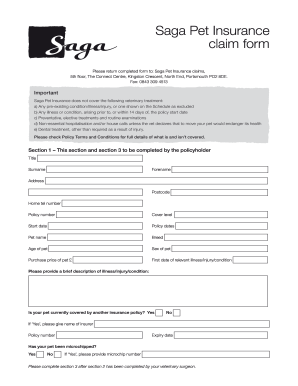

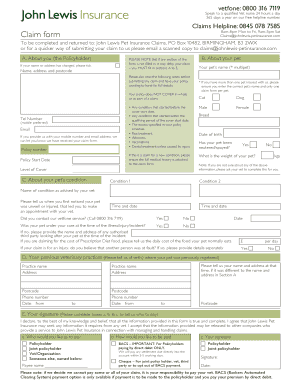

Pet Insurance Claim Form Templates

What are Pet Insurance Claim Form Templates?

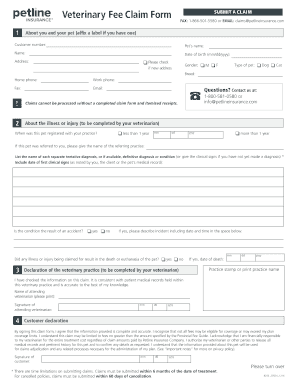

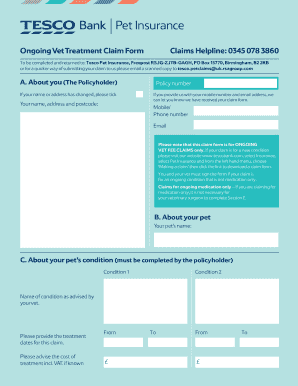

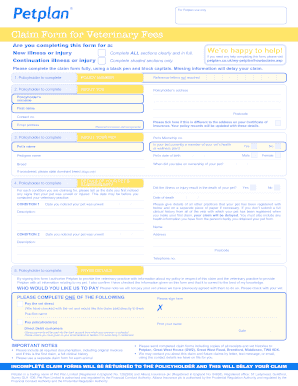

Pet insurance claim form templates are pre-designed forms that pet owners can use to submit claims to their insurance companies for reimbursement of veterinary expenses.

What are the types of Pet Insurance Claim Form Templates?

There are several types of pet insurance claim form templates available, including:

Accident and illness claim forms

Wellness plan claim forms

Prescription medication claim forms

Routine care claim forms

Emergency care claim forms

How to complete Pet Insurance Claim Form Templates

Completing pet insurance claim form templates is easy and straightforward. Here are some tips to help you fill out the form accurately:

01

Gather all necessary documents, such as invoices and medical records.

02

Provide accurate information about your pet, including their name, breed, and age.

03

Detail the reason for the claim and provide supporting documentation.

04

Submit the completed form to your insurance company either online or by mail.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Pet Insurance Claim Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the most common claims for pet insurance?

In 2021, the five most common pet insurance claims included skin conditions, gastrointestinal issues, ear infections, seizures, and urinary tract infections.

What does 90 reimbursement mean?

For example, if you have a 90% reimbursement percentage, that means the company will pay 90% of the vet bill after the deductible is met, and you will pay 10%. So, let's say you have a policy with a $200 deductible and a 90% reimbursement rate, and you got a vet bill for $1,000.

Does deductible get reimbursed for pet insurance?

Annual deductibles must be paid toward vet costs each annual policy term. Once you meet your deductible, your insurer will reimburse you up to your reimbursement level. You'll be responsible for your annual deductible when your policy renews the following year.

How do I make a claim on my pet cover?

How to claim on pet insurance? Details about you and your pet, including its microchip number. Information about the illness, injury or condition you're claiming for. Your pet's diagnosis and treatment – your vet might need to provide this information. Treatment costs – again, your vet may need to provide these.

What does 70 reimbursement mean pet insurance?

Most plans offer between 70-90% reimbursement. This means that when you submit a claim, all the charges that fall within the coverage limitations will be paid back to you at whichever percentage you chose when you enrolled your pet.

How do I fight pet insurance denial?

If your claim is denied by the pet insurance provider, and you disagree with the decision, you have the option to appeal. To do so, contact the insurer's customer care department.