Get the free IL-4852 Substitute for Unobtainable Form W-2 - revenue state il

Show details

You should file Form IL-4852, Substitute for Unobtainable Form W-2, if you did not receive or were not able to obtain a ...

We are not affiliated with any brand or entity on this form

Instructions and Help about il-4852 substitute for unobtainable

How to edit il-4852 substitute for unobtainable

How to fill out il-4852 substitute for unobtainable

Instructions and Help about il-4852 substitute for unobtainable

How to edit il-4852 substitute for unobtainable

To edit the il-4852 substitute for unobtainable tax form, utilize a reliable PDF editor such as pdfFiller. This tool allows users to modify fields and add necessary details directly on the document. Make sure that all changes are saved to prevent loss of information. After editing, it is crucial to review the form for accuracy before submission.

How to fill out il-4852 substitute for unobtainable

Filling out the il-4852 substitute for unobtainable involves several steps:

01

Access the form through the IRS website or a tax preparation software.

02

Complete all required fields truthfully, including personal information and any income details.

03

Double-check entries to ensure compliance with tax regulations.

04

Use pdfFiller for ease of filling and editing, ensuring your data is properly entered.

Latest updates to il-4852 substitute for unobtainable

Latest updates to il-4852 substitute for unobtainable

Stay informed about any updates to the il-4852 substitute for unobtainable by checking the IRS website regularly. Changes may arise in tax laws or procedures that affect how this form is filed and its relevance in specific situations.

All You Need to Know About il-4852 substitute for unobtainable

What is il-4852 substitute for unobtainable?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About il-4852 substitute for unobtainable

What is il-4852 substitute for unobtainable?

The il-4852 substitute for unobtainable is an IRS form that taxpayers use when they do not receive a necessary tax document, such as Form W-2 or 1099, from their employer or payor. This substitute form allows filers to report their income and tax amounts based on their own records, ensuring compliance with tax reporting requirements.

What is the purpose of this form?

The primary purpose of the il-4852 substitute for unobtainable is to provide a means for taxpayers to report their earnings accurately when the original tax forms are lost or not received. By utilizing this form, taxpayers can avoid penalties for underreporting income and ensure their tax filings are complete and accurate.

Who needs the form?

Taxpayers who do not receive their W-2 or 1099 forms by the tax filing deadline must file the il-4852 substitute for unobtainable. This situation often arises for individuals who have changed jobs or worked for multiple employers throughout the year.

When am I exempt from filling out this form?

You may be exempt from filling out the il-4852 substitute for unobtainable if you received all your necessary tax documents in a timely manner or if you do not have any reportable income. Always verify if you qualify based on specific IRS guidelines and consult a tax professional if unsure.

Components of the form

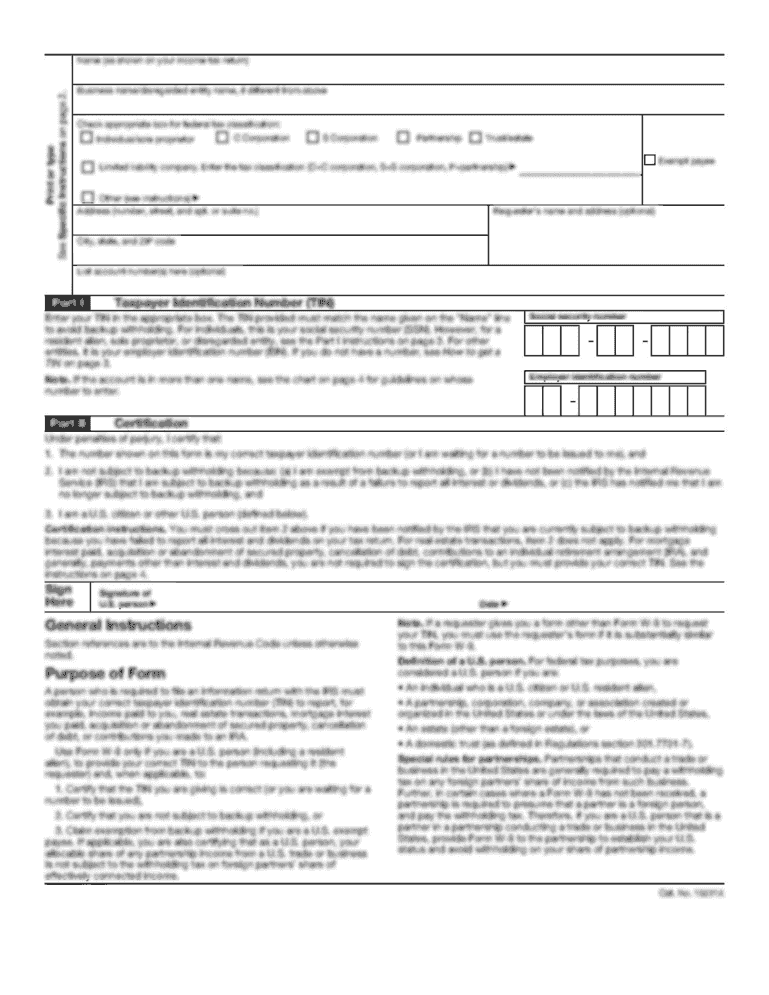

The il-4852 substitute for unobtainable includes several components, such as personal identification details, the reporting period, wages received, withholding amounts, and any other relevant data. Filling in these sections accurately is crucial to avoid complications during processing.

What are the penalties for not issuing the form?

Failing to issue the il-4852 substitute for unobtainable or submitting incorrect information can result in penalties, including fines, interest on unpaid taxes, or audits. It is essential to ensure that the form is filed correctly and on time to mitigate these risks.

What information do you need when you file the form?

When filing the il-4852 substitute for unobtainable, you will need relevant personal information, such as your Social Security number, total wages received, and any taxes withheld. Accurate record-keeping is vital to furnish this data effectively.

Is the form accompanied by other forms?

The il-4852 substitute for unobtainable can often be accompanied by other IRS forms, such as Form 1040, depending on your tax situation. Always check IRS instructions to ensure you are providing all necessary documentation with your submission.

Where do I send the form?

The completed il-4852 substitute for unobtainable form should be sent to the appropriate IRS office based on your state of residence. Use the IRS website or consult a tax professional for directions on the correct mailing address to ensure timely processing.

See what our users say