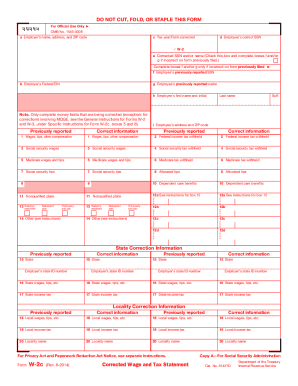

IRS W-2c 1991 free printable template

Instructions and Help about IRS W-2c

How to edit IRS W-2c

How to fill out IRS W-2c

About IRS W-2c 1991 previous version

What is IRS W-2c?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-2c

What should I do if I realize there is an error on my submitted W-2C 1991 form?

If you discover an error after submitting your W-2C 1991 form, promptly file a corrected version as soon as possible. Indicate the adjustments clearly, and keep records of both the original and corrected forms for your files. It's important to stay proactive to avoid potential issues with tax reporting.

How can I track the status of my W-2C 1991 form submission?

To verify the receipt and processing of your W-2C 1991 form, you can check the IRS website or contact their support directly. Ensure that you have your submission details handy, as this will help in locating the status efficiently. Common e-file rejection codes can also be found online, which may assist if you encounter problems.

Are there any specific privacy measures I should consider when submitting a W-2C 1991 form?

When filing a W-2C 1991 form, it's essential to ensure the security of personal information. Use secure connections and reliable e-filing services that comply with data protection regulations. Retain copies of your forms in a safe location to prevent unauthorized access.

What should I know about filing a W-2C 1991 form on behalf of someone else?

If you are filing a W-2C 1991 form on behalf of another individual, ensure you have authorization, such as a Power of Attorney (POA). Familiarize yourself with their correct information and double-check any details to prevent errors during the submission process.

What types of errors are most commonly made when submitting the W-2C 1991 form?

Common errors when filing the W-2C 1991 form include misreporting income amounts, incorrect Social Security numbers, and not submitting the correct form when necessary. To avoid these pitfalls, always verify the accuracy of the information prior to submission and consult tax professionals if uncertain.

See what our users say