CA CDTFA-106 (formerly BOE-106) 2010 free printable template

Show details

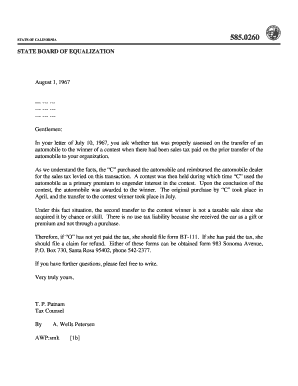

BOE-106 (FRONT) REV. 15 (8-10) STATE OF CALIFORNIA VEHICLE/VESSEL USE TAX CLEARANCE REQUEST BOARD OF EQUALIZATION NAME OF CLAIMANT TELEPHONE NO. EMAIL ADDRESS (street, city, state, zip code) NAME

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-106 formerly BOE-106

Edit your CA CDTFA-106 formerly BOE-106 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-106 formerly BOE-106 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA CDTFA-106 formerly BOE-106 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA CDTFA-106 formerly BOE-106. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-106 (formerly BOE-106) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-106 formerly BOE-106

How to fill out CA CDTFA-106 (formerly BOE-106)

01

Download the CA CDTFA-106 form from the California Department of Tax and Fee Administration website.

02

Fill in your name, address, and account number at the top of the form.

03

Indicate the period for which you are filing by entering the applicable dates.

04

Complete the 'Sales and Use Tax' section by entering the total sales and total taxable sales.

05

If applicable, fill in any exemptions and deductions in the respective sections.

06

Calculate the total amount due by subtracting any exemptions from the taxable sales.

07

Review the form for accuracy and completeness.

08

Sign and date the form at the bottom.

09

Submit the completed form either online through the CDTFA website or by mailing it to the appropriate address.

Who needs CA CDTFA-106 (formerly BOE-106)?

01

Businesses operating in California that are registered for sales and use tax.

02

Retailers who make sales of tangible personal property in California.

03

Service providers that are required to collect use tax on sales.

04

Wholesalers who may need to report transactions involving taxable sales.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay sales tax on a gifted car in CA?

If you received a vehicle or vessel as a gift, you are not required to pay California use tax on that gift.

Is it better to sell or gift a car to a family member in California?

Gifting a car is a better option than selling it for $1 in California, since vehicles given as gifts aren't subject to taxes. So you want to give someone a car as a gift. You might have heard that it's better to “sell” the car for a single dollar instead of giving it to the recipient outright.

How much is car gift tax in California?

Do you have to pay taxes on a gifted car in California? No! Under California law, you're not required to pay use tax on a vehicle you receive as a gift. Is it better to gift a car or sell it for $1 in California?

How does being gifted a car affect taxes?

ing to the IRS, you can give any individual up to $17,000 in 2023 without you having to pay any tax on that gift, which means that if the fair market value of the car is under $17,000, you won't have to pay a federal tax on a car gift.

How do I know if I owe use tax California?

You May Owe Use Tax. You may owe “use tax” if you made a purchase from an out-of-state retailer and were not charged California tax on the purchase. If you have not saved your receipts, you may calculate and pay estimated use tax on your 2021 California Income Tax return, based upon your income.

How does gifting a car work in California?

Gifts—Transfer or registration of a vehicle/vessel acquired by the applicant as a gift. The word “gift” must be entered on the back of the title (in lieu of a purchase price) and a REG 256 must be completed by the applicant.

How do I avoid sales tax on a used car in California?

How can I avoid paying sales tax on a used car? You will register the vehicle in a state with no sales tax because you live or have a business there. You plan to move to a state without sales tax within 90 days of the vehicle purchase. The vehicle was made before 1973. You are disabled.

How to avoid paying sales tax on a used car in California?

How can I avoid paying sales tax on a used car? You will register the vehicle in a state with no sales tax because you live or have a business there. You plan to move to a state without sales tax within 90 days of the vehicle purchase. The vehicle was made before 1973. You are disabled.

Do you pay sales tax on a used car from private seller in California?

If you buy from a dealer, sales tax will be collected at the point of sale. For a private-party sale, the buyer will pay tax to the California Department of Motor Vehicles (DMV) when registering the car.

How do I avoid paying sales tax on a car in California?

How can I avoid paying sales tax on a used car? You will register the vehicle in a state with no sales tax because you live or have a business there. You plan to move to a state without sales tax within 90 days of the vehicle purchase. The vehicle was made before 1973. You are disabled.

What is an example of a use tax?

Examples: A person buys a vehicle from a dealer in a neighboring state and the dealer does not charge sales tax on the vehicle. The buyer must pay use tax on the purchase price of the vehicle when he/she returns to his/her state and/or city.

Do you have to pay sales tax when you sell a car to a family member in California?

for tax exemption. In California, any vehicle transfer between family members (parents, children, grandparents, grandchildren, spouses, domestic partners, and minor siblings) is tax-exempt.

Can I buy a car in California and not pay sales tax?

If you are picking up the Car from dealership, you must pay CA Tax , and we will provide you a one -way trip sticker that allows you to go straight from dealership to out of state, which will alleviate paying for registration . But you must pay sales tax based on Ukiah,Ca . You must then also pay tax in your State.

Do I pay tax when I sell my car in California?

Vehicles sold through private party sales in California are subject to a use tax. Similar to a sales tax, this is collected for the storage, use, and consumption of personal property which includes vehicles. There are some instances where you may be exempt from a use tax.

Can you gift a car to a family member in California?

To transfer a vehicle between family members, submit the following: The California Certificate of Title properly signed or endorsed on line 1 by the registered owner(s) shown on the title. Complete the new owner information on the back of the title and sign it.

What qualifies as an agricultural exemption in California?

Purchases of farm equipment and machinery (including repair and replacement parts) for use by a qualified person and primarily used in producing and harvesting agricultural products, are subject to a partial exemption from tax.

What qualifies for California use tax?

You owe use tax on any item purchased for use in a trade or business and you are not registered, or required to be registered with the CDTFA to report sales or use tax. You owe use tax on purchases of individual items with a purchase price of $1,000 or more each.

Do I pay sales tax on a gifted car in California?

If you received a vehicle or vessel as a gift, you are not required to pay California use tax on that gift.

What is exempt from California use tax?

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices.

Do you have to pay sales tax on a used car in California?

When you're purchasing a new or used car, it's important to understand the taxes and fees you may face. California statewide sales tax on new & used vehicles is 7.25%. The sales tax is higher in many areas due to district taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the CA CDTFA-106 formerly BOE-106 in Gmail?

Create your eSignature using pdfFiller and then eSign your CA CDTFA-106 formerly BOE-106 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out CA CDTFA-106 formerly BOE-106 using my mobile device?

Use the pdfFiller mobile app to fill out and sign CA CDTFA-106 formerly BOE-106. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit CA CDTFA-106 formerly BOE-106 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like CA CDTFA-106 formerly BOE-106. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is CA CDTFA-106 (formerly BOE-106)?

CA CDTFA-106 (formerly BOE-106) is a form used by the California Department of Tax and Fee Administration to report sales and use tax on specified transactions, including sales of tangible personal property.

Who is required to file CA CDTFA-106 (formerly BOE-106)?

Any business or individual engaged in selling tangible personal property in California is required to file CA CDTFA-106 if their sales meet certain thresholds, or if they are otherwise required to report sales and use tax.

How to fill out CA CDTFA-106 (formerly BOE-106)?

To fill out CA CDTFA-106, you need to provide specific information such as your business name, account number, reporting period, and a detailed account of sales made within that period, including amounts and any applicable deductions.

What is the purpose of CA CDTFA-106 (formerly BOE-106)?

The purpose of CA CDTFA-106 is to facilitate the reporting and collection of sales and use tax by documenting taxable transactions and ensuring compliance with state tax laws.

What information must be reported on CA CDTFA-106 (formerly BOE-106)?

The information that must be reported on CA CDTFA-106 includes the seller's identification information, total sales, any exempt sales, taxable sales amounts, and the calculated sales tax due for the reporting period.

Fill out your CA CDTFA-106 formerly BOE-106 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-106 Formerly BOE-106 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.