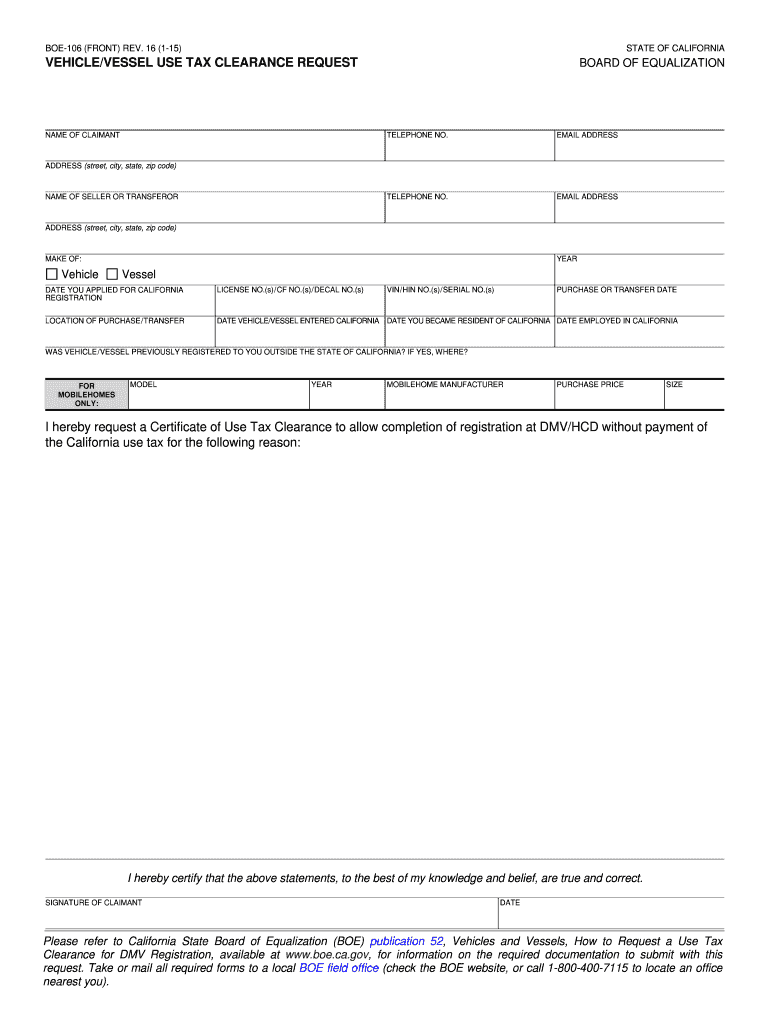

CA CDTFA-106 (formerly BOE-106) 2015 free printable template

Show details

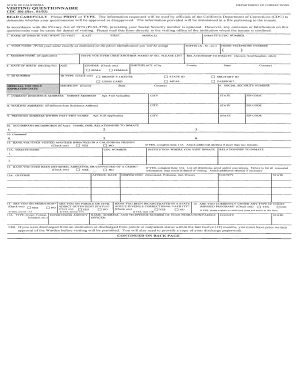

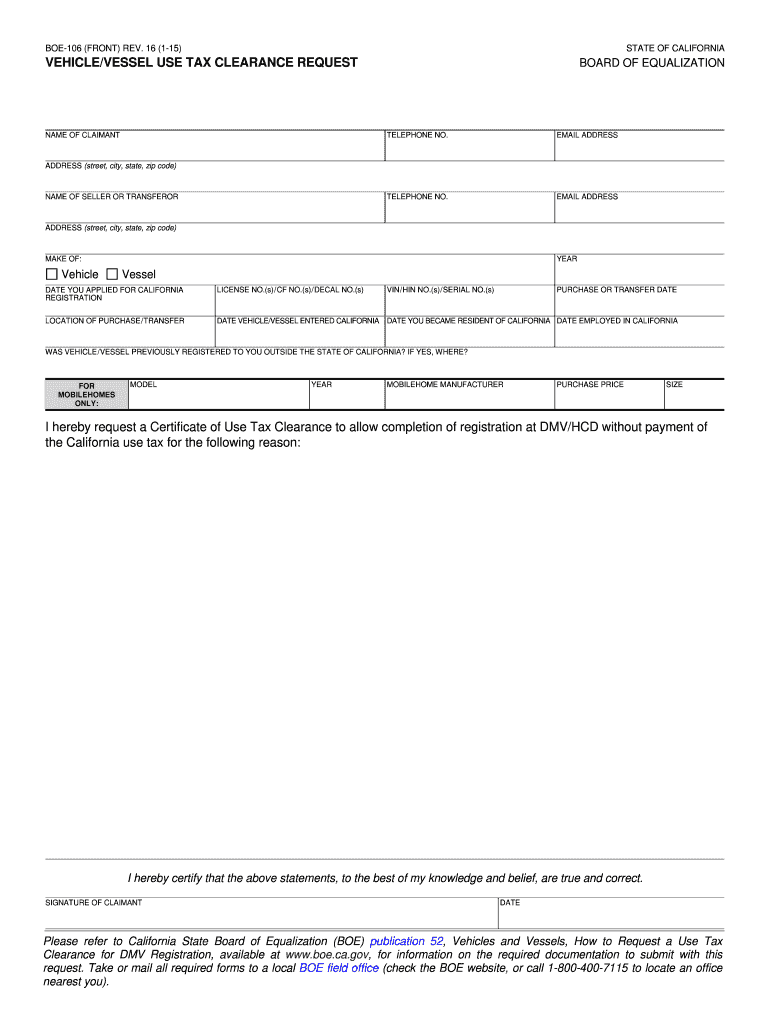

BOE-106 FRONT REV. 16 1-15 STATE OF CALIFORNIA VEHICLE/VESSEL USE TAX CLEARANCE REQUEST NAME OF CLAIMANT BOARD OF EQUALIZATION TELEPHONE NO. CLEAR PRINT BOE-106 BACK REV. 16 1-15 FOR BOE USE ONLY BRIEF STATEMENT OF FACTS EVIDENCE PRESENTED attach copies CONCLUSION Taxable Tax paid to an out-of-state dealer. Required For Test Period Not Yet Expired Copy of purchase agreement Out of state delivery statement BOE-111-AT letter provided to taxpayer Complete copy of BOE-106 packet to HQ CUTS...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-106 formerly BOE-106

Edit your CA CDTFA-106 formerly BOE-106 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-106 formerly BOE-106 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA CDTFA-106 formerly BOE-106 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA CDTFA-106 formerly BOE-106. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-106 (formerly BOE-106) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-106 formerly BOE-106

How to fill out CA CDTFA-106 (formerly BOE-106)

01

Begin by downloading the CA CDTFA-106 form from the California Department of Tax and Fee Administration website.

02

Enter your personal information, including your name, address, and phone number in the designated sections.

03

Provide your California seller's permit number on the form.

04

Fill out the relevant reporting period for which you are submitting the form.

05

Report your total sales and any exemptions that apply to your sales in the appropriate fields.

06

Calculate the total tax due based on the sales reported.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form as instructed, either by mail or electronically, along with any payment due.

Who needs CA CDTFA-106 (formerly BOE-106)?

01

Businesses and individuals who have made sales in California and are required to report their sales tax liability.

02

Anyone who has collected sales tax from customers and needs to remit it to the California Department of Tax and Fee Administration.

03

Businesses that qualify for any sales tax exemptions and wish to document them for compliance purposes.

Instructions and Help about CA CDTFA-106 formerly BOE-106

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I have California use tax?

You owe use tax on any item purchased for use in a trade or business and you are not registered, or required to be registered with the CDTFA to report sales or use tax. You owe use tax on purchases of individual items with a purchase price of $1,000 or more each.

Is there use tax on out of state cars in California?

Yes, unless you purchased and used your car outside California for at least 12 months before you brought it into the state. If you owe use tax, it will be based upon the purchase price of the car, minus whatever sales tax you paid to another state. You can pay the tax to the DMV when you register the car in California.

What is exempt from California use tax?

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices.

What purchases are subject to California use tax?

The use tax generally applies to the storage, use, or other consumption in California of goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchases shipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

How do I request a vehicle use tax clearance in California?

To apply for the use tax clearance certificate (CDTFA-111), use CDTFA's online services and select Request Use Tax Clearance for Registration with DMV/HCD under the Limited Access Functions. Or you may submit application form CDTFA-106, Vehicle/Vessel Use Tax Clearance Request.

Do you pay taxes on a gifted car in California?

If you received a vehicle or vessel as a gift, you are not required to pay California use tax on that gift. compensation (for example, a vehicle given to an employee as a bonus). balance of the loan still owed to the lender and any other consideration given to acquire the vehicle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CA CDTFA-106 formerly BOE-106 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like CA CDTFA-106 formerly BOE-106, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in CA CDTFA-106 formerly BOE-106?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your CA CDTFA-106 formerly BOE-106 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I edit CA CDTFA-106 formerly BOE-106 on an Android device?

You can make any changes to PDF files, such as CA CDTFA-106 formerly BOE-106, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is CA CDTFA-106 (formerly BOE-106)?

CA CDTFA-106 is a form used by the California Department of Tax and Fee Administration (CDTFA) for reporting sales and use tax on certain transactions. It is used to report changes in the tax status of previously reported transactions.

Who is required to file CA CDTFA-106 (formerly BOE-106)?

Any individual or business that has previously reported sales or use tax in California and needs to report a change in that information is required to file CA CDTFA-106.

How to fill out CA CDTFA-106 (formerly BOE-106)?

To fill out CA CDTFA-106, you need to provide your business information, including your seller’s permit number, the specific changes being reported, and any relevant details related to those changes. Ensure all calculations for tax adjustments are accurate and complete.

What is the purpose of CA CDTFA-106 (formerly BOE-106)?

The purpose of CA CDTFA-106 is to allow taxpayers to correct or update sales and use tax information previously submitted to the CDTFA, ensuring accurate tax reporting and compliance with state tax laws.

What information must be reported on CA CDTFA-106 (formerly BOE-106)?

The information that must be reported on CA CDTFA-106 includes the seller's permit number, names and addresses involved in the transactions, details on the changes being reported, and any adjustments to the tax amounts based on those changes.

Fill out your CA CDTFA-106 formerly BOE-106 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-106 Formerly BOE-106 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.