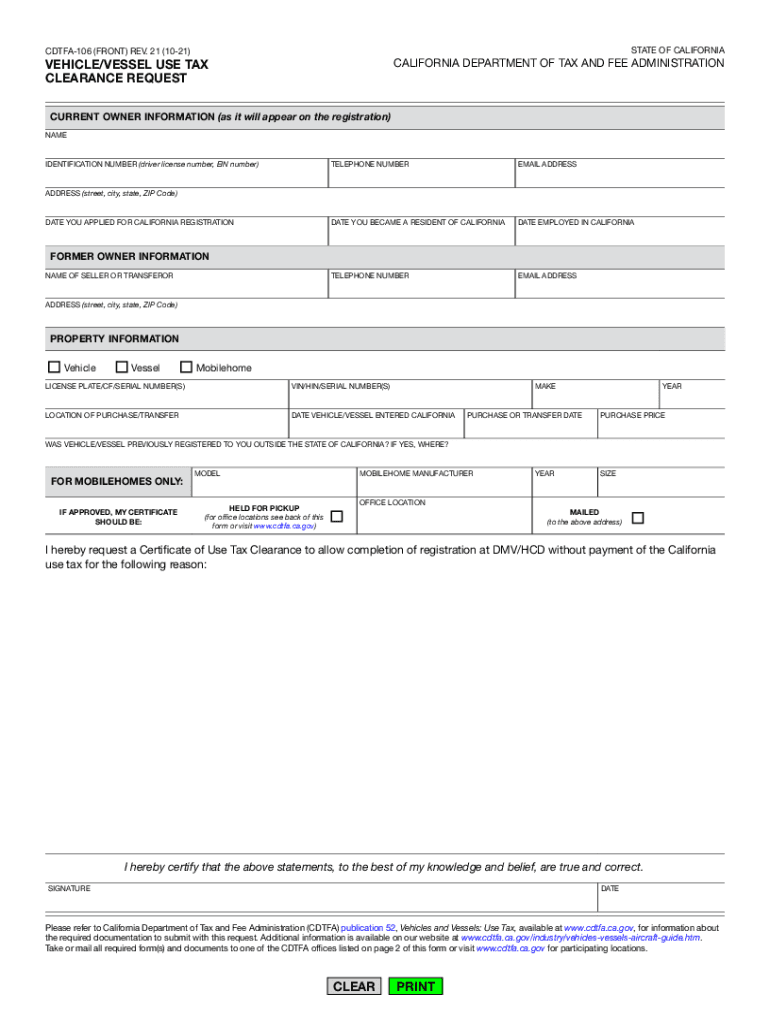

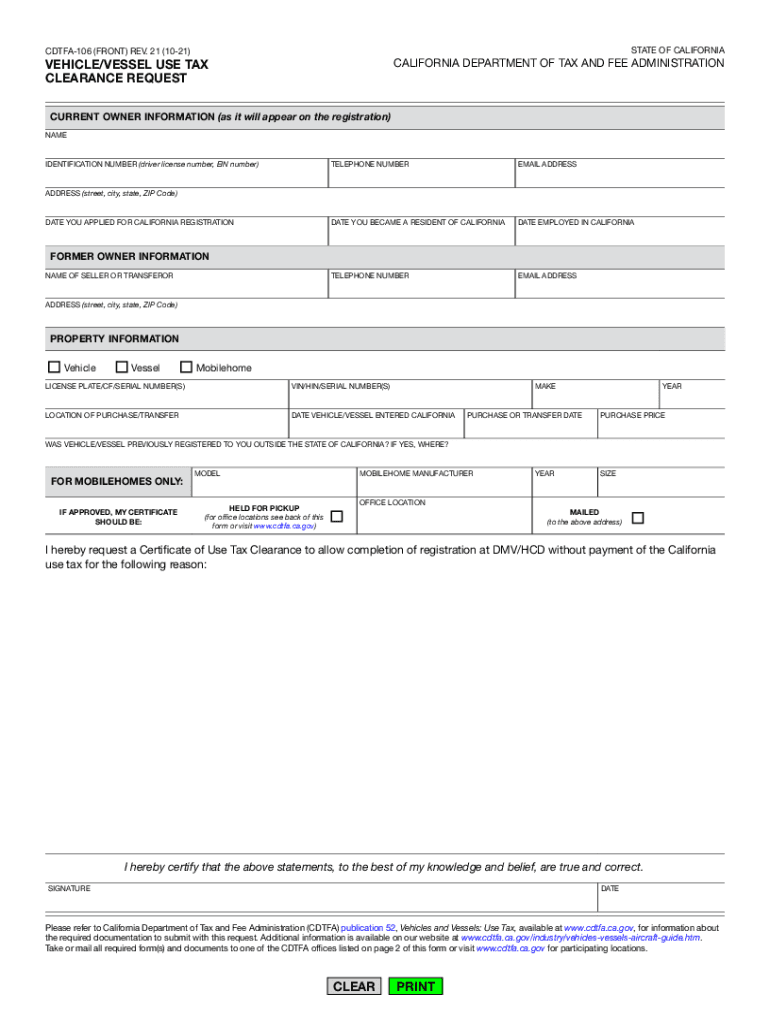

CA CDTFA-106 (formerly BOE-106) 2021 free printable template

Get, Create, Make and Sign CA CDTFA-106 formerly BOE-106

Editing CA CDTFA-106 formerly BOE-106 online

Uncompromising security for your PDF editing and eSignature needs

CA CDTFA-106 (formerly BOE-106) Form Versions

How to fill out CA CDTFA-106 formerly BOE-106

How to fill out CA CDTFA-106 (formerly BOE-106)

Who needs CA CDTFA-106 (formerly BOE-106)?

Instructions and Help about CA CDTFA-106 formerly BOE-106

In this video we will show you how to file Sales and Use tax return with one selling location using your Limited Access Code formerlyExpress Login We protect all the confidential information that you provide to us First go to the website CDTFACAGOV and at the top click on Login That will take you to the OnlineServices Portal To file a Sales and Use Tax return you cause your limited access code or login with a username and password For assistance with creating a username and password please watch our tutorials online On this screen you will see a list of available tax and fee programs In this example we are filing a Sales abuse tax return Click on the File Pay and View link located here We will demonstrate how to file a sales and use tax return using the limited access function On the CDTF online services page there are two ways you can file a return via the limited access function Click the File a Return blue button or under the heading Limited Access Functions select File a Return Either way you'll be directed to the same page the File a Return page Select the type of return you need to file In this case well select the Sale sand Use Tax Return link On this page we will choose one of two options to identify our sales and use tax account in order to proceed You can use your Account Number and LimitedAccess Code which used to be your Express Login Or you can use your Customer ID one of four selections in the drop-down menu and your Account Number In our example we will enter the AccountNumber and Limited Access Code At this point click Next and proceed to filing your return On the Select a Filing Period page select the period end date for which you are filing For this example we will click on September30th 2019 which represents the third quarter end date The third quarter begins July 1st and end son September 30th On the Business Activities page if you have never filed a return you will be prompted to answer questions related to your type of business activities After you have made your selections you will not see this screen again In our example our business did not conduct any of the business activities listed nor did we sell Motor Vehicle Fuel, so we will answer No to both questions and click Next to proceed On the Sales and Purchase Information page enter your total sales If your total sales includes sales taxes you have collected you may enter them as a deduction on the Nontaxable Sales Deductions page If you need help with this return click on the link Online Filing Instructions located here In this example we will enter 150000 in total sales which includes sales tax collected If you choose you can save your work at anytime by clicking the Save Draft button Enter your email address then enter it again to confirm it and click OK The Confirmation page will show your email address and a confirmation code You will need your email and confirmation code to retrieve your saved return, so we recommend that you print this page Now that you've saved...

People Also Ask about

Do I need to file CDTFA?

What is California sales tax number?

How long can you go without paying taxes in California?

How do I get a copy of my California sales tax certificate?

Where can I find my CDTFA account number?

How do I get a California sales tax ID?

How do I pay my CDTFA sales tax?

How do I pay sales tax for my business in California?

Do I need to register with CDTFA?

How do I find my CDTFA number?

Do I have to file sales tax in California?

How long do you have to pay California state taxes?

What happens if you don't pay sales tax in California?

What happens if you dont pay CDTFA?

How do I get a California seller's permit number?

What do you report to CDTFA?

What is the penalty for paying sales tax late in California?

What if I owe a large amount to the CDTFA?

How do I pay California use tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in CA CDTFA-106 formerly BOE-106?

How do I edit CA CDTFA-106 formerly BOE-106 straight from my smartphone?

How do I fill out CA CDTFA-106 formerly BOE-106 on an Android device?

What is CA CDTFA-106 (formerly BOE-106)?

Who is required to file CA CDTFA-106 (formerly BOE-106)?

How to fill out CA CDTFA-106 (formerly BOE-106)?

What is the purpose of CA CDTFA-106 (formerly BOE-106)?

What information must be reported on CA CDTFA-106 (formerly BOE-106)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.