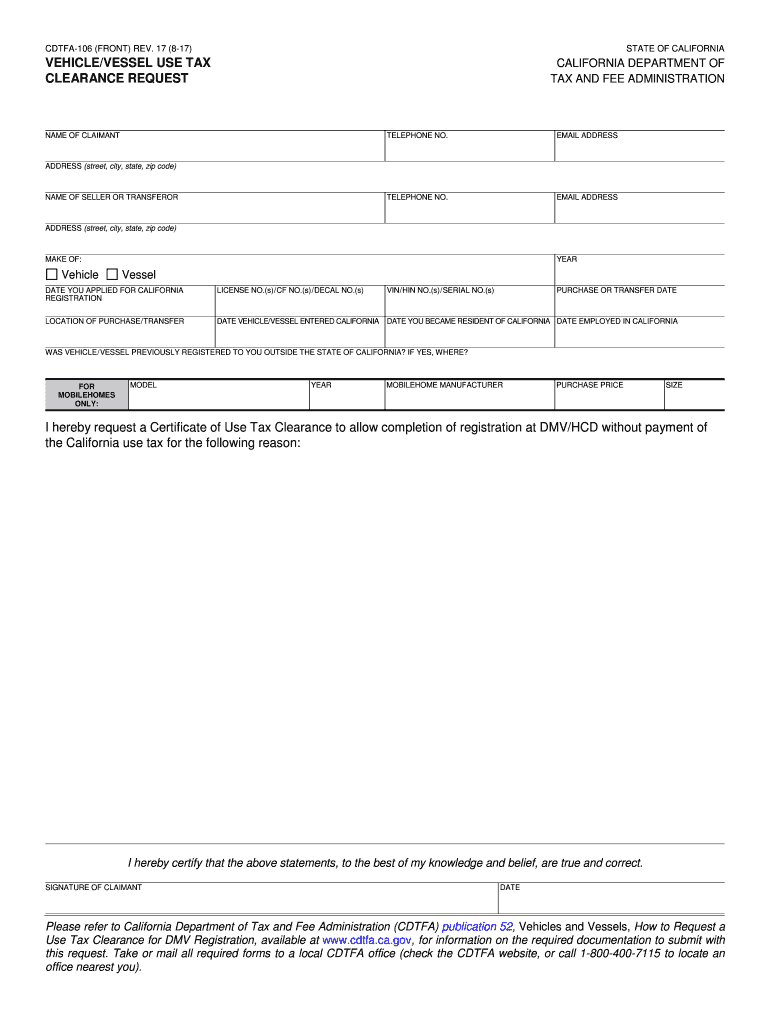

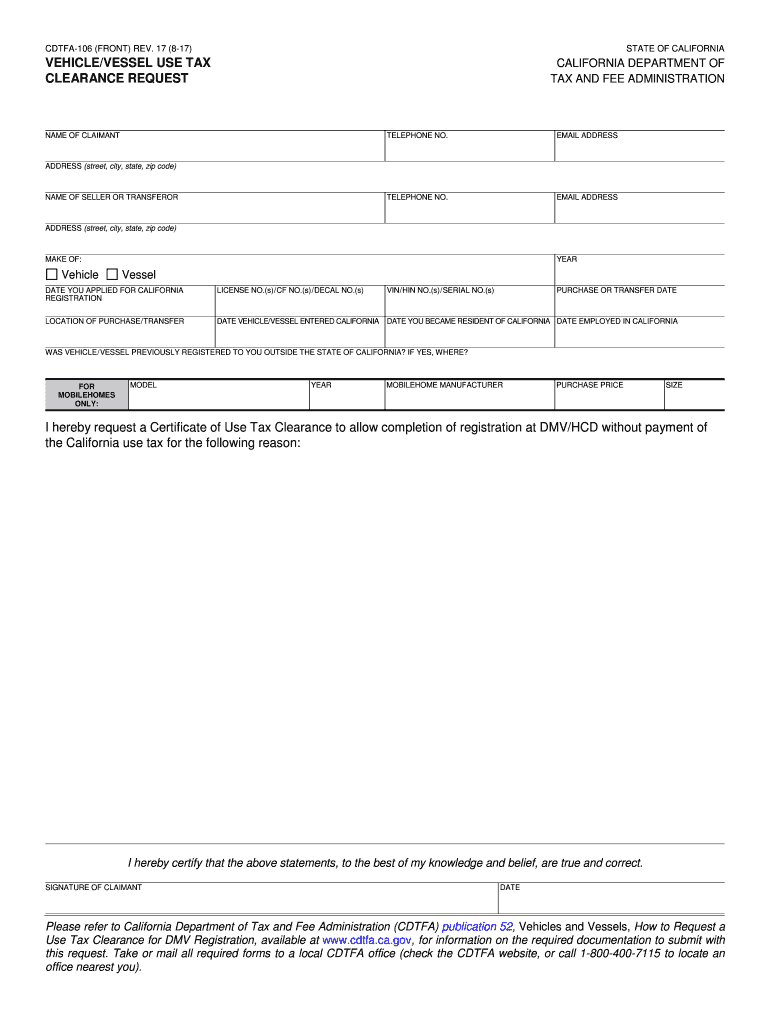

CA CDTFA-106 (formerly BOE-106) 2017 free printable template

Show details

CDTFA-106 (FRONT) REV. 17 (8-17) STATE OF CALIFORNIA VEHICLE/VESSEL USE TAX CLEARANCE REQUEST CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION NAME OF CLAIMANT TELEPHONE NO. EMAIL ADDRESS TELEPHONE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-106 formerly BOE-106

Edit your CA CDTFA-106 formerly BOE-106 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-106 formerly BOE-106 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA CDTFA-106 formerly BOE-106 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA CDTFA-106 formerly BOE-106. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-106 (formerly BOE-106) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-106 formerly BOE-106

How to fill out CA CDTFA-106 (formerly BOE-106)

01

Obtain a copy of the CA CDTFA-106 form from the California Department of Tax and Fee Administration website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your business information at the top of the form, including your name, address, and account number.

04

Provide the sales and use tax information as requested in the appropriate sections.

05

If applicable, include details about any exemptions that may apply to your sales.

06

Calculate the total amount due, following the provided guidelines and instructions.

07

Review your completed form for accuracy and completeness.

08

Submit the form by mail or electronically, as required, to the appropriate CDTFA office.

Who needs CA CDTFA-106 (formerly BOE-106)?

01

Any business or individual in California that sells tangible goods and needs to report sales and use tax.

02

Those claiming tax exemptions on specific sales must also fill out this form.

03

Businesses that are required to document their sales tax obligations to the CDTFA.

Instructions and Help about CA CDTFA-106 formerly BOE-106

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I have California use tax?

You owe use tax on any item purchased for use in a trade or business and you are not registered, or required to be registered with the CDTFA to report sales or use tax. You owe use tax on purchases of individual items with a purchase price of $1,000 or more each.

Is there use tax on out of state cars in California?

Yes, unless you purchased and used your car outside California for at least 12 months before you brought it into the state. If you owe use tax, it will be based upon the purchase price of the car, minus whatever sales tax you paid to another state. You can pay the tax to the DMV when you register the car in California.

What is exempt from California use tax?

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices.

What purchases are subject to California use tax?

The use tax generally applies to the storage, use, or other consumption in California of goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchases shipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

How do I request a vehicle use tax clearance in California?

To apply for the use tax clearance certificate (CDTFA-111), use CDTFA's online services and select Request Use Tax Clearance for Registration with DMV/HCD under the Limited Access Functions. Or you may submit application form CDTFA-106, Vehicle/Vessel Use Tax Clearance Request.

Do you pay taxes on a gifted car in California?

If you received a vehicle or vessel as a gift, you are not required to pay California use tax on that gift. compensation (for example, a vehicle given to an employee as a bonus). balance of the loan still owed to the lender and any other consideration given to acquire the vehicle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA CDTFA-106 formerly BOE-106 for eSignature?

Once you are ready to share your CA CDTFA-106 formerly BOE-106, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out the CA CDTFA-106 formerly BOE-106 form on my smartphone?

Use the pdfFiller mobile app to complete and sign CA CDTFA-106 formerly BOE-106 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete CA CDTFA-106 formerly BOE-106 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your CA CDTFA-106 formerly BOE-106. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is CA CDTFA-106 (formerly BOE-106)?

CA CDTFA-106 is a form used by the California Department of Tax and Fee Administration (CDTFA) to report transactions related to the sale of tangible personal property, particularly for those who have made sales that may be subject to use tax.

Who is required to file CA CDTFA-106 (formerly BOE-106)?

Any individual or business that sells tangible personal property in California or has a use tax liability related to the purchase of goods must file CA CDTFA-106.

How to fill out CA CDTFA-106 (formerly BOE-106)?

To fill out CA CDTFA-106, individuals must provide details about their sales, including the total sales amount, any exempt sales, and the sales tax collected. Specific instructions can be found on the form itself or on the CDTFA website.

What is the purpose of CA CDTFA-106 (formerly BOE-106)?

The purpose of CA CDTFA-106 is to collect information on sales transactions for the calculation of use tax liabilities and to ensure compliance with California tax regulations.

What information must be reported on CA CDTFA-106 (formerly BOE-106)?

The information that must be reported includes the seller's details, total sales amount, exempt sales, sales tax collected, and other relevant transaction information.

Fill out your CA CDTFA-106 formerly BOE-106 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-106 Formerly BOE-106 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.