TX Comptroller 50-135 2005 free printable template

Show details

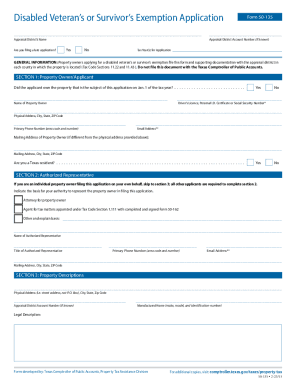

50-135 (Rev. 11-05/9) 11.22 Rule 9.415 APPLICATION FOR DISABLED VETERAN'S OR SURVIVOR'S EXEMPTION Appraisal district name Address YEAR Phone (area code and number) The application covers property

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 50-135

Edit your TX Comptroller 50-135 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 50-135 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX Comptroller 50-135 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller 50-135. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-135 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 50-135

How to fill out TX Comptroller 50-135

01

Obtain the TX Comptroller 50-135 form from the Texas Comptroller's website or your local tax office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out the taxpayer information section with your name, address, and taxpayer ID number.

04

Provide details about the property for which you are claiming an exemption, including location and use.

05

Complete any applicable sections related to specific exemptions you are applying for.

06

Attach any required documentation to support your exemption request.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form by the deadline to your local appraisal district.

Who needs TX Comptroller 50-135?

01

Individuals or entities seeking property tax exemptions in Texas.

02

Taxpayers who own or occupy property that qualifies for specific exemptions under Texas law.

03

Non-profit organizations, schools, or government entities that may qualify for tax relief.

04

Any person or business that believes their property is eligible for an exemption based on specific criteria outlined by the Texas Comptroller.

Fill

form

: Try Risk Free

People Also Ask about

Do 100% disabled veterans pay sales tax on vehicles in Texas?

Motor Vehicle Sales and Use Tax Motor vehicles are exempt from tax if they are modified to be used by someone with orthopedic disabilities to help them drive or ride in the vehicle. The modified vehicle must be used at least 80 percent of the time to transport, or be driven by, a person with an orthopedic disability.

At what age do you not have to pay property taxes in Texas?

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

What is the senior exemption for property taxes in Texas?

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

Do your property taxes go down when you turn 65 in Texas?

Property tax deferral for seniors You may be aware that seniors can apply for an exemption from Texas property taxes. This is true: when you reach the age of 65, you can file an affidavit with the chief appraiser in your district to exempt yourself from the collection of taxes on your property.

Do disabled veterans get federal tax breaks?

Disabled veterans may be eligible to claim a federal tax refund based on: an increase in the veteran's percentage of disability from the Department of Veterans Affairs (which may include a retroactive determination) or.

At what age do you stop paying school taxes in Texas?

At what age do you stop paying school taxes in Texas? Never! Unless they are totally exempt from property taxes, a homeowner continues to pay property tax even after age 65, so long as they live in that house. Homeowners aged 65 and above are eligible for a "tax-ceiling".

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my TX Comptroller 50-135 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your TX Comptroller 50-135 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit TX Comptroller 50-135 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign TX Comptroller 50-135. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete TX Comptroller 50-135 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your TX Comptroller 50-135 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is TX Comptroller 50-135?

TX Comptroller 50-135 is a form used in Texas to report property owned by a nonprofit organization, specifically for claiming an exemption from property taxation.

Who is required to file TX Comptroller 50-135?

Nonprofit organizations that wish to claim property tax exemptions in Texas must file TX Comptroller 50-135.

How to fill out TX Comptroller 50-135?

To fill out TX Comptroller 50-135, provide the organization's name, address, description of the property, and the basis for the exemption, following the form's specific instructions.

What is the purpose of TX Comptroller 50-135?

The purpose of TX Comptroller 50-135 is to allow nonprofit organizations to apply for property tax exemptions on properties they own and use for exempt purposes.

What information must be reported on TX Comptroller 50-135?

The information required includes the name and address of the organization, a detailed description of the property, the reason for the exemption, and any other relevant details as specified by the form.

Fill out your TX Comptroller 50-135 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 50-135 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.