TX Comptroller 50-135 2017 free printable template

Show details

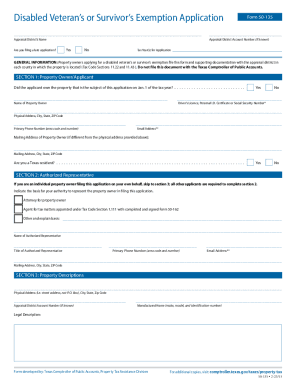

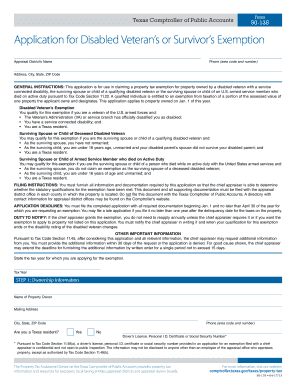

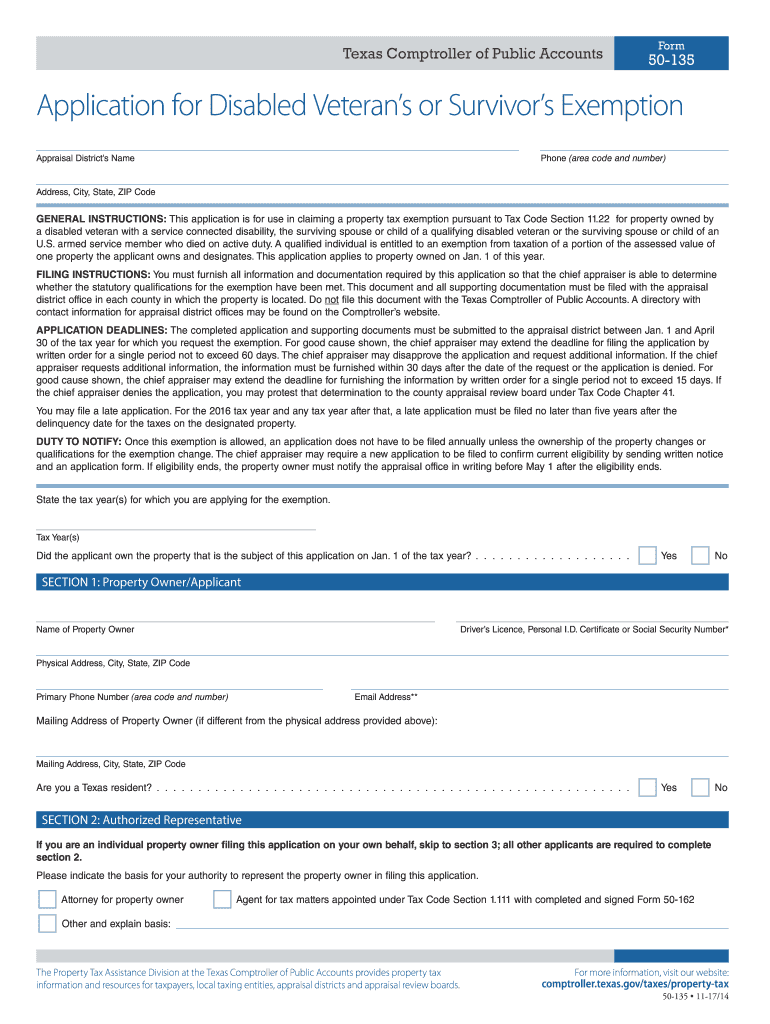

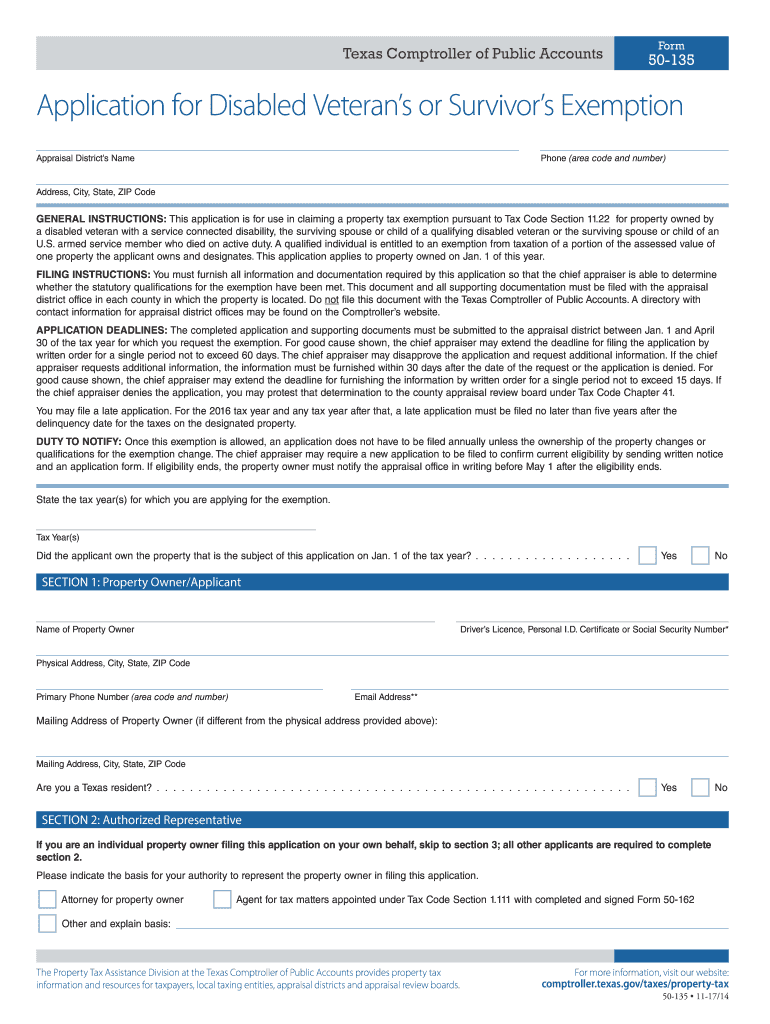

Texas Comptroller of Public Accounts Form 50-135 Application for Disabled Veteran s or Survivor s Exemption Appraisal District s Name Phone area code and number Address City State ZIP Code GENERAL INSTRUCTIONS This application is for use in claiming a property tax exemption pursuant to Tax Code Section 11. For more information visit our website comptroller. texas. gov/taxes/property-tax 50-135 11-17/14 Provide the following information for the individual with the legal authority to act for...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax person

Edit your tax person form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax person form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax person online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax person. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 50-135 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax person

How to fill out TX Comptroller 50-135

01

Obtain a copy of Form 50-135 from the Texas Comptroller's website.

02

Fill out the property owner's information, including name and address.

03

Provide the name and location of the property for which the exemption is requested.

04

Indicate the type of property and whether it is used for religious, charitable, or educational purposes.

05

Complete Section 1, indicating the specific exemption being sought.

06

Attach any required documentation that supports your exemption claim, such as IRS tax-exempt status.

07

Sign and date the form certifying that the information provided is true and correct.

08

Submit the completed form to the local appraisal district where the property is located.

Who needs TX Comptroller 50-135?

01

Organizations seeking a property tax exemption in Texas, generally non-profits, educational institutions, or religious organizations.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1099 tax form?

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. The payer fills out the form with the appropriate details and sends copies to you and the IRS, reporting payments made during the tax year.

What is the difference between a 1099 and W-2?

Wages and other payments to employees are reported on Form W-2, while payments to independent contractors are reported on a Form 1099. Each business must classify its workers as either employees or independent contractors to file the appropriate form.

Is a 1040 a w2?

"No, 1040 is not the same as a W-2. W-2 is a form provided by the employer to the employee that states the gross wages in a given year and all the tax withheld and deductions," says Armine Alajian, CPA and founder of the Alajian Group, a company providing accounting services and business management for startups.

What is a 1099 tax form used for?

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. The payer fills out the form with the appropriate details and sends copies to you and the IRS, reporting payments made during the tax year.

What is a 1040 form used for?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Is form 540 the same as 1040?

The most common California income tax form is the CA 540. This form is used by California residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tax person online?

pdfFiller makes it easy to finish and sign tax person online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make changes in tax person?

With pdfFiller, the editing process is straightforward. Open your tax person in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit tax person on an Android device?

You can make any changes to PDF files, like tax person, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is TX Comptroller 50-135?

TX Comptroller 50-135 is a form used in Texas for property owners to report certain property tax information to the state comptroller's office.

Who is required to file TX Comptroller 50-135?

Property owners who are seeking a property tax exemption or those who have experienced changes in property use or ownership may be required to file TX Comptroller 50-135.

How to fill out TX Comptroller 50-135?

To fill out TX Comptroller 50-135, you need to provide property identification, ownership details, and specific information regarding any property tax exemptions being requested or reported.

What is the purpose of TX Comptroller 50-135?

The purpose of TX Comptroller 50-135 is to ensure that the Texas comptroller's office has accurate and up-to-date information about properties for assessing property taxes and granting exemptions.

What information must be reported on TX Comptroller 50-135?

The information that must be reported on TX Comptroller 50-135 includes property owner's name, address, property account number, exemption type, and any changes in property use or ownership.

Fill out your tax person online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Person is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.