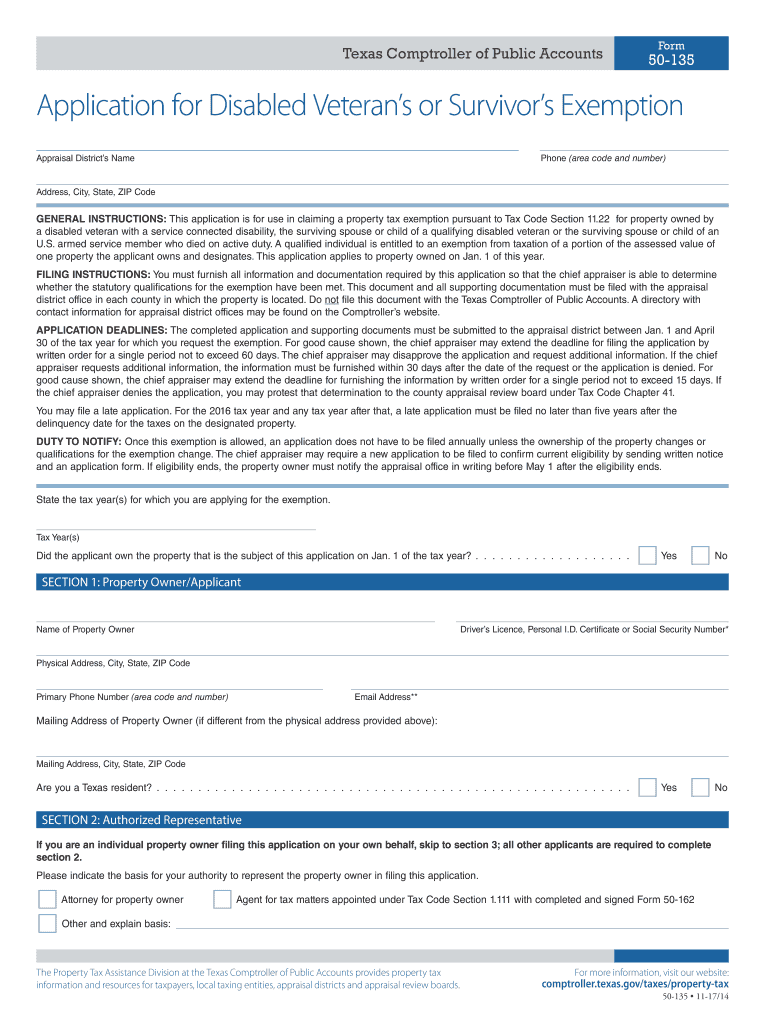

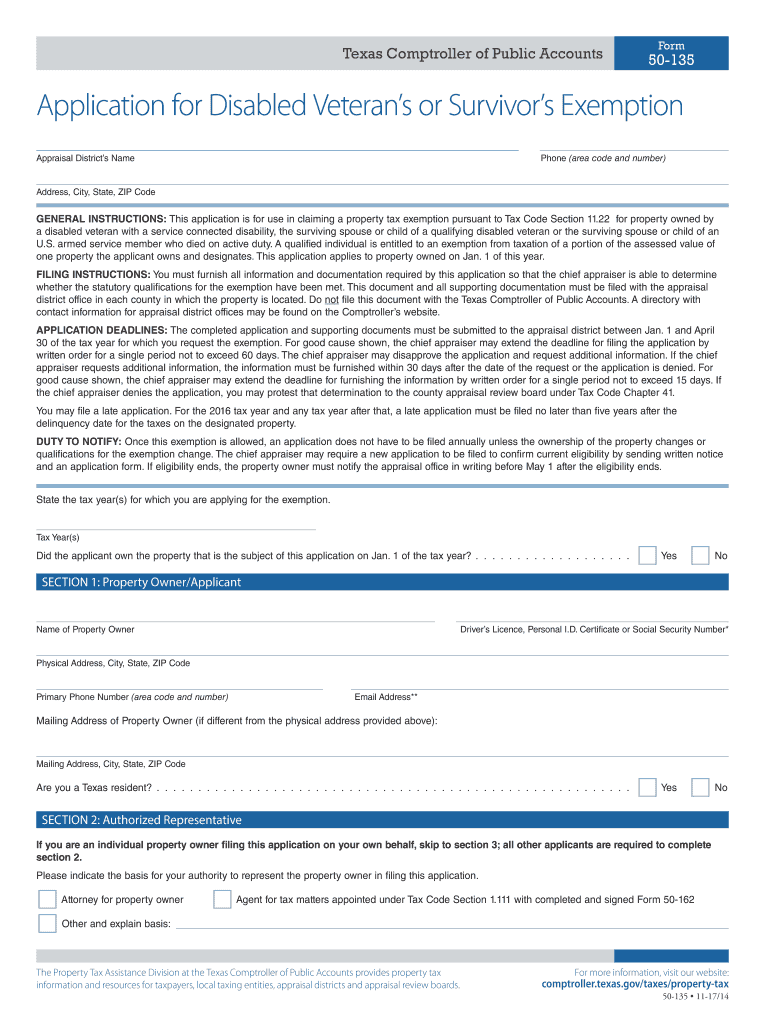

TX Comptroller 50-135 2017 free printable template

Get, Create, Make and Sign TX Comptroller 50-135

How to edit TX Comptroller 50-135 online

Uncompromising security for your PDF editing and eSignature needs

TX Comptroller 50-135 Form Versions

How to fill out TX Comptroller 50-135

How to fill out TX Comptroller 50-135

Who needs TX Comptroller 50-135?

Instructions and Help about TX Comptroller 50-135

Well howdy everyone and having a bit of spare time recently couldn't#39’t resist taking a look at quite rare and potentially interesting lens which not many people have heard of chemokine fifty to one hundred thirty-fivemillimeter F 2.8 it#39’s discontinued now but with a bit of luck you can still find them over on eBay found mine for 275 pounds or about 400dollars which seems pretty good value for a fast telephoto zoom lens Tokinaintroduced this lens to the market atPhotokina back in that 2006 so to get him on a bit now it#39’s been specially designed for APC digital cameras so two#39’t work properly if you#39;reusing more expensive full-frame digital Strand I love the whole concept behind this lens the extremely useful focal range of50 to 100 35 millimeters is intended to mimic a 70 to 200 millimeter lenses when used on a full-frame camera, although it actually works out to be the equivalent of 80 to 200 16 millimeters on a Canon camera 50 millimeters is certainly much wider than 70, so that makes this land a lot more suited to general-purpose use than a lens that starts at 70 millimeters the wide F 2.8 maximum aperture makes this a fast telephoto zoom lens it lets a lot of light for telephoto lens making it potentially suitable for shooting sports low-light work and indoors photography it#39’s also very good for portrait work potentially giving you very nice out-of-focus backgrounds the other advantage of this lens is that because it#39’s designed for cameras with smaller APC sensor it can be a lot smaller than a normal F 2 point 8telephoto zoom lens I mean here#39’s one of canons 70 to 200 millimeter F 2.8 lenses as you can see compared to the Tokinalensit'’s enormous not to mention being considerably heavier the Toking lens however will fit quite easily into normal sized camera bag this could be useful lens for video work with its fa stand constant maximum aperture however unfortunately it#39’s a bit too old to have image stabilization as you can see harsh you#39’ll really want to used tripod let#39’s take a look at build quality as always with a Toking density#39’s very solidly built and quite weighty it has a useful tripod mount which doesn't#39’t come off the lens at all the lens comes with a very deep lens hood which is useful and nicely flocked on the inside the lenses zoom ring works smoothly but not perfectly evenly butte lens zooms internally which is nice touch the large focus ring turns fairly smoothly and is just precise enough for accurate manual focusing push the ring forward to switch the lens autofocus and stirring it safely decoupled from the focus motor the front element of the lens does not extend or rotate the autofocus on this lens is pretty old-school it#39’s a bit slow and pretty noisy you#39’re also treated to mighty clump when it reaches by to endow its focus pot which is prettyattention-grabbingthe tested autofocus accuracy of this lens was poor it seemed to miss focus about 15 percent of the time overall the...

People Also Ask about

Are disabled veterans exempt from property taxes in Nueces County?

How do you qualify for homestead exemption in Texas?

How does disability affect property taxes in Texas?

Does Texas waive property taxes for disabled veterans?

What is a DV4 exemption in Texas?

What is the property tax code for disabled veterans in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my TX Comptroller 50-135 directly from Gmail?

How do I complete TX Comptroller 50-135 online?

Can I create an eSignature for the TX Comptroller 50-135 in Gmail?

What is TX Comptroller 50-135?

Who is required to file TX Comptroller 50-135?

How to fill out TX Comptroller 50-135?

What is the purpose of TX Comptroller 50-135?

What information must be reported on TX Comptroller 50-135?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.