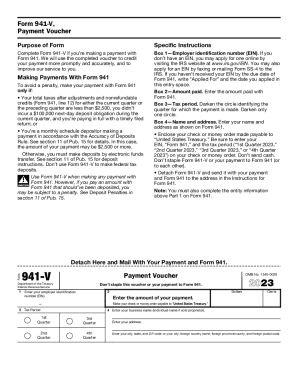

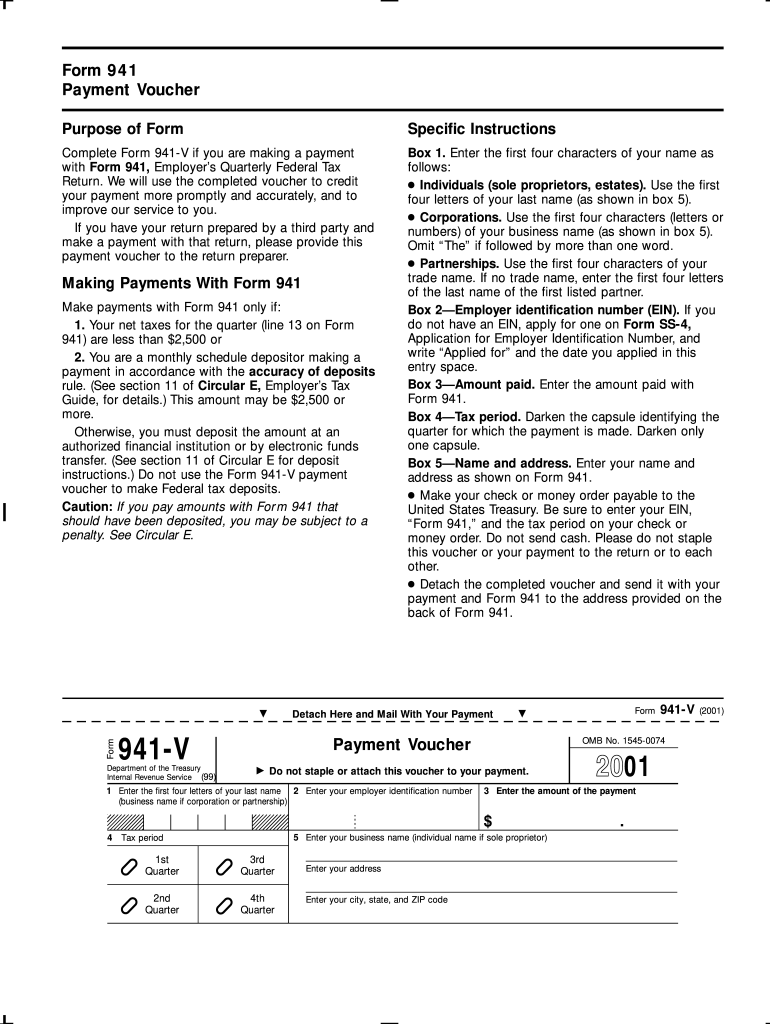

IRS 941-V 2001 free printable template

Instructions and Help about IRS 941-V

How to edit IRS 941-V

How to fill out IRS 941-V

About IRS 941-V 2001 previous version

What is IRS 941-V?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 941-V

What should I do if I realize I made an error after filing the 941 v 2001 form?

If you discover an error after submitting the 941 v 2001 form, you should file an amended return using Form 941-X. This allows you to correct any mistakes and ensure accurate reporting. It's important to submit the amended form as soon as you notice the error to avoid potential penalties.

How can I track the status of my submitted 941 v 2001 form?

To track the status of your 941 v 2001 form, you can use the IRS's online tool or call their dedicated helpline. Keep your details handy, such as your Employer Identification Number (EIN) and the submission date. This will help you efficiently verify receipt and processing of your form.

Are there any privacy considerations when filing the 941 v 2001 form electronically?

When e-filing the 941 v 2001 form, it’s crucial to ensure that you use a secure platform that protects your sensitive data. Additionally, verify that your e-signature meets IRS standards, as this ensures the integrity and privacy of your submission.

What if I receive a notice from the IRS after I filed my 941 v 2001 form?

If you receive a notice from the IRS concerning your 941 v 2001 form, carefully read the communication to understand the issue. Prepare any requested documentation and respond promptly to the IRS to resolve the matter, maintaining a record of all correspondence for your files.

Can I file the 941 v 2001 form on behalf of someone else?

Yes, you can file the 941 v 2001 form on behalf of someone else if you have the appropriate authority, such as Power of Attorney (POA). Ensure that you include all necessary information pertaining to the individual or business you represent, as IRS guidelines require clear identification.

See what our users say