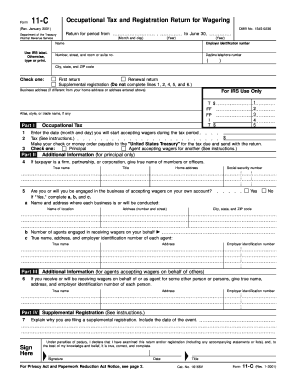

IRS 1099-MISC 2001 free printable template

Instructions and Help about IRS 1099-MISC

How to edit IRS 1099-MISC

How to fill out IRS 1099-MISC

About IRS 1099-MISC 2001 previous version

What is IRS 1099-MISC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-MISC

How can I send [SKS] to be eSigned by others?

When your [SKS] is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete [SKS] online?

pdfFiller makes it easy to finish and sign [SKS] online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit [SKS] in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your [SKS], which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is IRS 1099-MISC?

IRS 1099-MISC is a tax form used to report miscellaneous income, such as payments made to independent contractors or freelancers, rental payments, and other types of income that do not fall under traditional employment.

Who is required to file IRS 1099-MISC?

Businesses that have paid at least $600 in a year to a non-employee for services performed during the tax year, as well as those who paid rent, prizes, or awards, are required to file IRS 1099-MISC.

How to fill out IRS 1099-MISC?

To fill out IRS 1099-MISC, you need to provide the payer's and recipient's information including name, address, and Taxpayer Identification Number (TIN). You also need to report the total amount paid in the relevant boxes for the type of income being reported.

What is the purpose of IRS 1099-MISC?

The purpose of IRS 1099-MISC is to ensure that the IRS receives information about income earned by non-employees, thereby helping to monitor tax compliance and prevent underreporting of income.

What information must be reported on IRS 1099-MISC?

The information that must be reported on IRS 1099-MISC includes the payer's TIN, recipient's TIN, the total amount paid, the type of payment (e.g., rents, nonemployee compensation), and any federal or state tax withheld if applicable.

See what our users say