IRS 1065 - Schedule K-1 2008 free printable template

Show details

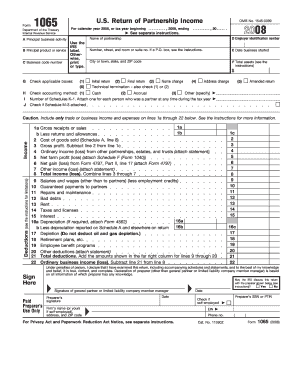

651108 Final K12008Schedule K1 (Form 1065) Department of the Treasury Internal Revenue Serviceman For calendar year 2008, or tax year beginning, 20Partners Share of Income, Deductions, See back of

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1065 - Schedule K-1

How to edit IRS 1065 - Schedule K-1

How to fill out IRS 1065 - Schedule K-1

Instructions and Help about IRS 1065 - Schedule K-1

How to edit IRS 1065 - Schedule K-1

To edit the IRS 1065 - Schedule K-1, you can utilize a tool like pdfFiller that allows users to make changes directly to the PDF. Start by uploading your completed or partially filled form to the platform. Once uploaded, you can modify text, add annotations, or sign as necessary before finalizing the document.

How to fill out IRS 1065 - Schedule K-1

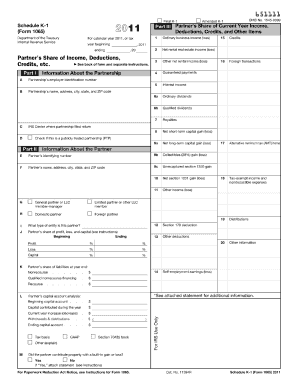

Filling out the IRS 1065 - Schedule K-1 requires accurate information about your partnership and your share of income during the tax year. Follow these steps:

01

Obtain a copy of the form from the IRS website or via a tool like pdfFiller.

02

Begin with Part I, entering the partnership's information such as its name, address, and EIN (Employer Identification Number).

03

Fill in Part II, detailing your share of income, deductions, and credits.

04

Complete Part III, which provides information necessary for the IRS to identify the partner receiving the K-1.

05

Review the completed form for accuracy before submitting it alongside your tax return.

About IRS 1065 - Schedule K-1 2008 previous version

What is IRS 1065 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1065 - Schedule K-1 2008 previous version

What is IRS 1065 - Schedule K-1?

The IRS 1065 - Schedule K-1 is a tax form used to report income, deductions, and credits allocated to partners in a partnership. This form is part of the IRS Form 1065, which partnerships file to report their financial activities for the year. Each partner receives a K-1 detailing their share of the partnership's earnings and losses, which they must include on their individual tax returns.

What is the purpose of this form?

The purpose of the IRS 1065 - Schedule K-1 is to provide the IRS with detailed information about partnership operations and income distribution among partners. It ensures transparency regarding income allocation, which is essential for tax compliance. By providing accurate information, partnerships facilitate correct tax reporting for all partners involved.

Who needs the form?

The IRS 1065 - Schedule K-1 is required for all partnerships operating in the U.S. Whenever a partnership distributes income or losses to its partners, it must issue K-1 forms. This applies to general partnerships, limited partnerships, and limited liability companies (LLCs) that choose to be taxed as partnerships.

When am I exempt from filling out this form?

You may be exempt from filling out the IRS 1065 - Schedule K-1 if your partnership does not have any operational income to report or if you are a partner who does not receive a distribution or allocation of items for the year. However, this exemption is rare, as most partnerships generate some form of income.

Components of the form

The IRS 1065 - Schedule K-1 comprises three main parts. Part I includes information about the partnership, such as its name and address. Part II reports the partner's share of income, deductions, and credits. Part III includes details identifying the partner receiving the K-1, ensuring that each partner's information is distinct for IRS purposes. Reviewing these sections carefully is crucial for accurate reporting.

What are the penalties for not issuing the form?

If a partnership fails to issue IRS 1065 - Schedule K-1 to its partners, it may face penalties from the IRS. The penalties can vary based on the number of months the form is late. The partnership may also incur additional interest on unpaid tax liabilities resulting from non-reporting. Accurate and timely issuance is essential to avoid these consequences.

What information do you need when you file the form?

When filing the IRS 1065 - Schedule K-1, you will need specific information such as the partnership's name, address, EIN, and financial details including income, losses, deductions, and credits allocated to the partners. Additionally, you'll need the partner's identification details, including their name and Social Security Number (SSN) or Employer Identification Number (EIN) if applicable.

Is the form accompanied by other forms?

Yes, the IRS 1065 - Schedule K-1 is typically accompanied by Form 1065 itself, which reports the partnership's overall financial information. Partners may also be required to attach a Form 1040 or other relevant forms when filing their individual tax returns, depending on their circumstances.

Where do I send the form?

The IRS 1065 - Schedule K-1 does not get submitted directly to the IRS; rather, partners must include it with their personal tax returns. The partnership itself submits Form 1065 to the IRS, and it is critical that each partner retains their K-1 form for their records when filing their individual tax returns.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Just started using. Seems pretty easy to navigate.

Just subscribed but my first form was excellently done. Intuitive and easy to negotiate the Dashboard. I really liked the alignment lines that assist to keep things neat when typing data into the field. Look forward to learning more about the capabilities. Thanks

See what our users say