IRS 8862 2000 free printable template

Show details

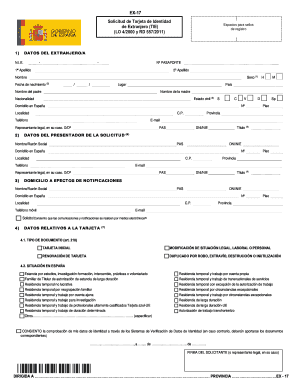

Cat. No. 25145E Rev. 11-2000 Form 8862 Rev. 11-2000 Page the year entered on line 1 see instructions before answering b Was this person the child s parent or grandparent c Did this person live with the child for the entire year entered on line 1 and care for the child as if the child were his or her own with this person by an authorized placement agency and was also placed with this person by an agency f Enter this person s name and social security number see instructions g Is your modified AGI...adjusted gross income for the year entered on line 1 higher than the modified AGI of every person listed on line 7f 8a Was the child under age 19 at the end of the year entered on in lines 8b 8e for this child. Form Rev* November 2000 Department of the Treasury Internal Revenue Service Information To Claim Earned Income Credit After Disallowance Attach to your tax return* Attachment Sequence No* See separate instructions. Part I See your tax return instructions for the year for which you are...filing this form to make sure you can take the earned income credit EIC and to find out who is a qualifying child. All Filers Enter the year for which you are filing this form for example 1999 2000 etc* Were you or your spouse if filing a joint return a qualifying child of another person during the year entered on line 1 Next if you do not have a qualifying child go to Part II. If you do have a qualifying child go to Part III. 43A Your social security number Name s shown on return Before you...begin OMB No* 1545-1619 No Yes Filers Without a Qualifying Child Caution* See your tax return instructions for the year entered on line 1 to be sure you can take the EIC. 3a Enter the dates during the year shown on line 1 that your home was in the United States b If married filing a joint return enter the dates during the year shown on line 1 that your spouse s home was in the United States Filers With a Qualifying Child or Children Child 1 Caution* If you have two qualifying children complete...lines 4 8 for one child before going to the next column* Be sure you list your children here in the same order as you did on Schedule EIC. Is the child your son daughter adopted child grandchild or stepchild Next if you checked Yes for this child go to line 5a* If you checked No go to line 6a* 5a Did the child live with you in the United States for more than half of the year entered on line 1 b Enter the address es where you and the child lived during the year entered on line 1 c If the child...attended school or day care enter the name s of the school s or care provider s Next go to line 7a on the back for this child. 6a Are you related to the child or was the child placed with you by an authorized placement agency 6c* If you checked Yes continue. b Enter the child s relationship to you or the name of the placement agency. Enter both items if the child is related and was also placed with you by an agency c Did you care for the child as if he or she were your own child during the...entire year entered on line 1 For Paperwork Reduction Act Notice see page 2 of the separate instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8862

How to edit IRS 8862

How to fill out IRS 8862

Instructions and Help about IRS 8862

How to edit IRS 8862

To edit IRS Form 8862, the applicant can open the form in pdfFiller. The tool provides functionality to modify any field, ensuring that all information is accurate before submission. Users can also save the edited version for their records or for later use.

How to fill out IRS 8862

When filling out IRS Form 8862, taxpayers should ensure that they have all relevant documents at hand, including previous tax returns and any supporting documentation for the credits claimed. It is advisable to complete each section accurately to avoid delays or complications in processing. After filling out the form, review all entries for correctness.

About IRS 8 previous version

What is IRS 8862?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8 previous version

What is IRS 8862?

IRS Form 8862 is the "Eligibility Check for Claiming the Earned Income Credit" form, utilized by taxpayers who previously claimed this credit but had it denied in past tax years. This form enables eligible individuals to demonstrate that their situation has changed, allowing them to claim the credit again.

What is the purpose of this form?

The purpose of IRS Form 8862 is to certify a taxpayer's eligibility to claim the Earned Income Tax Credit (EITC) after previous disallowance. The form provides the IRS with the necessary information to confirm that the taxpayer meets all qualifications, thus facilitating the re-establishment of this tax credit.

Who needs the form?

Taxpayers who have previously claimed the EITC but were denied in prior years must complete Form 8862 to claim the credit again. This includes individuals whose eligibility has changed, such as a new income adjustment or changes in filing status that impact their qualification for the credit.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out IRS Form 8862 if their previous disallowance of the EITC was due to a lack of correct information or if they did not receive a disallowance notice. It is important to review the specific circumstances of prior filings to determine if filing is necessary.

Components of the form

IRS Form 8862 comprises several sections that gather information about the taxpayer's eligibility for the EITC. Key components include personal information, previous claims, and changes in circumstances. Each section must be completed accurately to facilitate proper review by the IRS.

What are the penalties for not issuing the form?

Failure to file IRS Form 8862 when required can result in the disallowance of the Earned Income Credit for the current tax year and potentially future years. Continuous non-compliance may also lead to further scrutiny from the IRS, which could affect other tax filings.

What information do you need when you file the form?

To file IRS Form 8862 correctly, taxpayers need personal identification details, prior tax return information that pertains to the EITC claims, and any supporting documentation that illustrates changes in circumstances. Accurate preparation is crucial to meet IRS requirements.

Is the form accompanied by other forms?

IRS Form 8862 is typically submitted alongside a taxpayer's annual income tax return, often Form 1040. Additional forms may accompany it depending on individual financial situations, such as documentation for other tax credits or deductions the taxpayer plans to claim.

Where do I send the form?

IRS Form 8862 should be submitted at the same time as the tax return to the appropriate IRS processing center within your state. It is advisable to check the latest guidance from the IRS to ensure the correct submission location.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It is good but the date format should be adjustable. Example: mm-dd-yyyy.

fast, easy to use and i love the ability to crete a templete

See what our users say