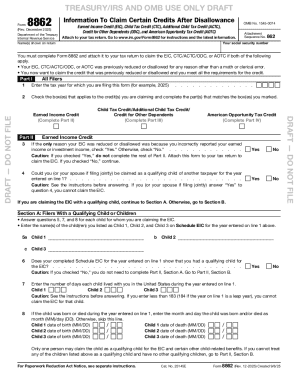

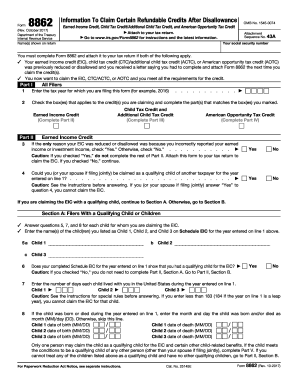

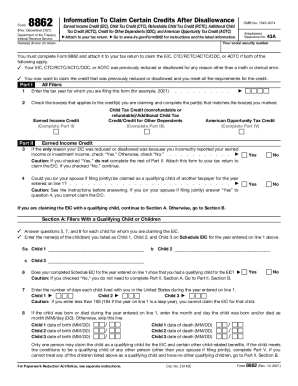

IRS 8862 2022 free printable template

Instructions and Help about IRS 8862

How to edit IRS 8862

How to fill out IRS 8862

About IRS 8 previous version

What is IRS 8862?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

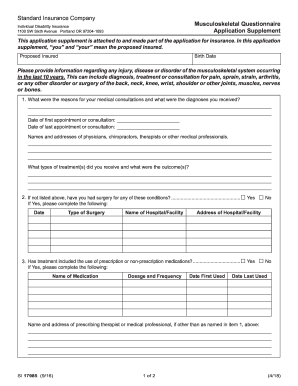

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8862

What should I do if I realize I've made a mistake on my IRS 8862 after filing?

If you discover an error on your IRS 8862 after submission, you can file an amended return. This involves completing a new IRS 8862 form with the correct information and specifying the changes. Make sure to attach any relevant documentation that supports your amendments to prevent delays in processing.

How can I track the status of my IRS 8862 once I've submitted it?

To track the status of your submitted IRS 8862, use the IRS 'Where's My Refund?' tool online. It allows you to check the processing status of your form and indicates if any additional information is required. Keep your tax information handy when using this service for ease of access.

What are some common errors filers make when submitting IRS 8862, and how can they be avoided?

Common errors when submitting IRS 8862 include mismatched names or Social Security numbers and omitting required signatures. To avoid these pitfalls, double-check all entries against your records and ensure that all required fields are filled accurately before submission.

Are electronic signatures accepted when filing IRS 8862, and what should I consider?

Yes, electronic signatures are accepted for IRS 8862 provided that you are e-filing through authorized software. Ensure the software you are using complies with IRS regulations for e-signatures to maintain validity and security of your submission.

What should I prepare if I receive an IRS notice after submitting my IRS 8862?

If you receive an IRS notice regarding your IRS 8862, first read it carefully to understand the issue. Gather any requested documentation and be prepared to provide clarifications or corrections. Respond promptly to avoid delays in processing your tax return.

See what our users say