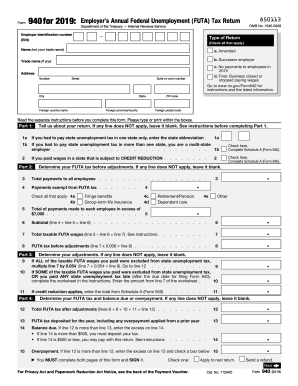

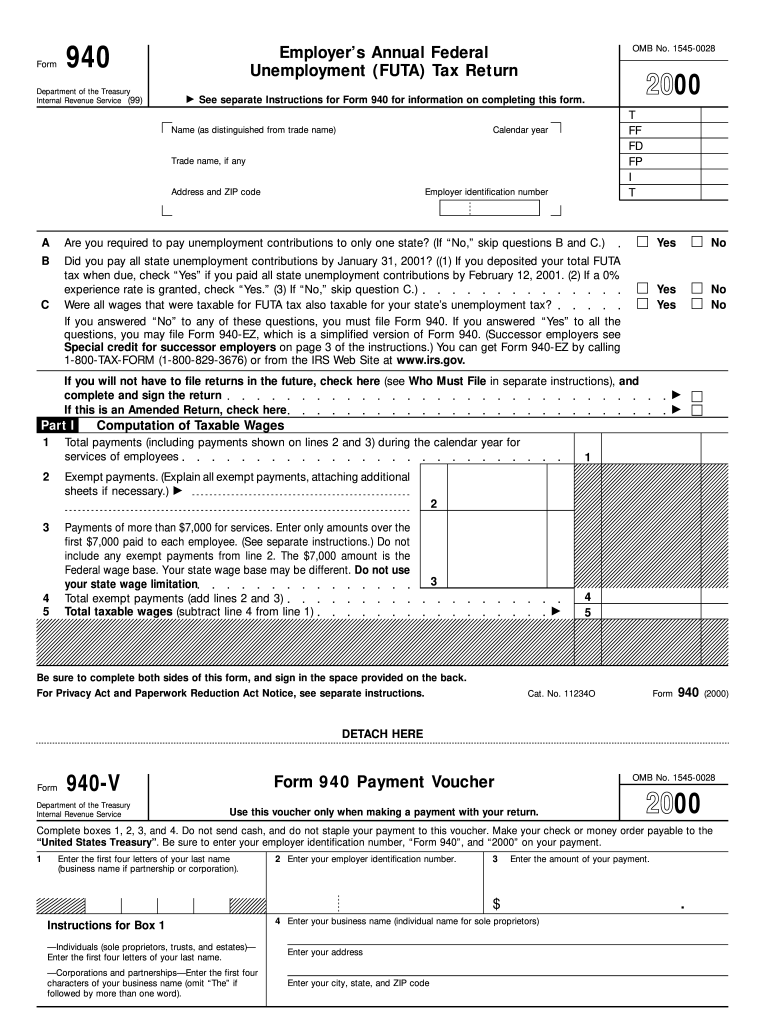

IRS 940 2000 free printable template

Instructions and Help about IRS 940

How to edit IRS 940

How to fill out IRS 940

About IRS 940 previous version

What is IRS 940?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

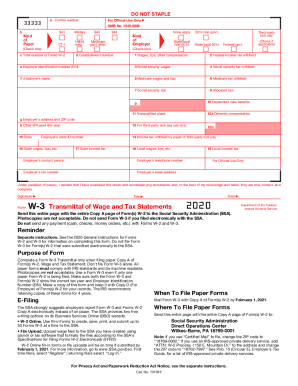

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 940

What should I do if I need to submit a corrected 2000 940 form?

If you need to correct a submitted 2000 940 form, you should file an amended version of the form indicating the corrections. Make sure to follow the guidelines for corrections provided by the IRS and include any additional documentation if necessary.

How can I check the status of my submitted 2000 940 form?

You can verify the receipt and processing of your submitted 2000 940 form through the IRS online tools or by contacting their support. Be aware of common e-file rejection codes and ensure you have your submission details ready for assistance.

Are e-signatures accepted for the 2000 940 form?

E-signatures are generally accepted for the 2000 940 form if the electronic submission meets IRS requirements. It’s advisable to consult current guidelines to ensure compliance with data security and privacy standards when signing electronically.

What should I do if I receive a notice regarding my 2000 940 form?

If you receive a notice or letter concerning your submitted 2000 940 form, carefully read the correspondence to understand the required action. Prepare any necessary documentation and respond to the notice promptly to address the issues raised.

How can I avoid common errors when filing a 2000 940 form?

To avoid common errors in your 2000 940 form, double-check all entries for accuracy, ensure that all required fields are completed, and review the filing instructions carefully. Keeping records of past submissions can also help in identifying frequent mistakes.

See what our users say