IRS 433-D 2012 free printable template

Show details

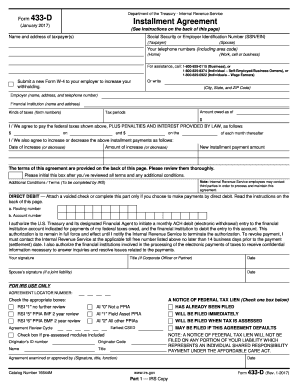

Form 433-D (Rev. January 2012) Department of the Treasury Internal Revenue Service Installment Agreement (See Instructions on the back of this page) Name and address of taxpayer(s) Social security

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 433-D

How to edit IRS 433-D

How to fill out IRS 433-D

Instructions and Help about IRS 433-D

How to edit IRS 433-D

To edit IRS Form 433-D, you can use online tools that allow for document editing, such as pdfFiller. This platform provides an intuitive interface for modifying the form's fields, ensuring that you can correct any errors or update information as necessary.

How to fill out IRS 433-D

Filling out IRS Form 433-D requires gathering financial information related to your income, expenses, and assets. Begin by clearly stating your name, Social Security number, and the details of your tax liability. Ensure that all fields are completed accurately to avoid delays in processing.

About IRS 433-D 2012 previous version

What is IRS 433-D?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 433-D 2012 previous version

What is IRS 433-D?

IRS Form 433-D is a document used primarily in the tax resolution process, particularly for setting up an installment agreement with the Internal Revenue Service (IRS). This form is crucial for individuals or businesses who seek to repay their tax debts over time rather than in a lump sum.

What is the purpose of this form?

The primary purpose of IRS Form 433-D is to provide the IRS with information regarding the taxpayer's ability to pay their tax liabilities. This form helps the IRS assess whether a taxpayer qualifies for a payment plan and allows them to determine a feasible monthly payment amount based on the taxpayer's financial situation.

Who needs the form?

Taxpayers who owe federal taxes and wish to establish an installment agreement must complete IRS Form 433-D. This is typically relevant for individuals and businesses facing financial difficulties but still want to comply with federal tax obligations.

When am I exempt from filling out this form?

You may be exempt from filling out IRS Form 433-D if you owe a small amount of tax, typically less than $10,000 (depending on other criteria), and can pay it within 120 days. In that case, you may not need a formal installment agreement.

Components of the form

IRS Form 433-D consists of several components including sections for personal information, financial disclosures about income, expenses, and asset details. Each component must be filled out accurately to ensure the IRS can evaluate your request for an installment agreement.

What are the penalties for not issuing the form?

If you do not file IRS Form 433-D when required, you risk incurring penalties such as additional interest on your unpaid tax balance and possible levy actions from the IRS. Timely submission is essential to avoid these negative consequences.

What information do you need when you file the form?

When filing IRS Form 433-D, you will need your personal identification information, details about your income (including pay stubs or bank statements), monthly living expenses, and information about your assets (such as real estate and vehicles). Having accurate figures is critical for a successful application.

Is the form accompanied by other forms?

IRS Form 433-D is generally sent along with Form 9465, the Installment Agreement Request. It may also be useful to provide supporting documents that detail your financial situation.

Where do I send the form?

After completing IRS Form 433-D, you should send it to the address specified in the instructions accompanying the form. This address often varies based on your location, so ensure you follow the guidelines provided by the IRS to avoid processing delays.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Great, Especially for do it yourself. Love it

Seems like a great program but not user friendly when trying to self-teach

See what our users say