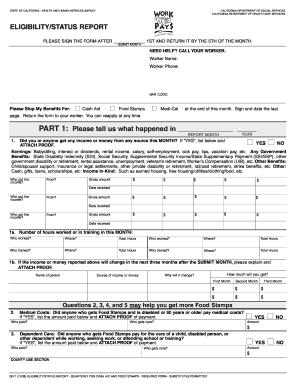

What is an Eligibility Status Report?

The Eligibility Status Report is also known as SAR 7 Form. It must be completed by households and sent to the county. The benefits may be discontinued if you provide wrong information in the form.

What is the Eligibility Status Report for?

This report is created for requesting, continuing or renewing the benefits for households. All fields in the form must be filled in. Remember that the amount of benefits may depend on the information you provide.

When is the Eligibility Status Report Due?

This form must be filed once in a year. Your first form must be submitted in six months after your application. Here is an example. If you send an application in May and your benefits are approved, your next task is to file your report in October. So September will be your Report Month and October will be your Submit Month.

Is the Eligibility Status Report Accompanied by Other Documents?

Yes. An applicant must attach a verification of earnings and received money during the reporting month.

What Information do I Include in the Eligibility Status Report?

In the form you must first indicate the name and phone number of the worker. After that choose the type of benefits you apply for: cash aid, food stamps, medical, etc. In the first part of the report tell what happened in a certain report month. Provide the gross amount of income and who got it. Indicate the number of worked hours. In the second part of the form you must tell what happened since the time of your last report. The document also includes the section called the Certification and Fraud Warning. The report must be dated and signed.

Where do I Send the Eligibility Status Report?

When you complete the report, send it to the California Department of Social Services (Health Care Services).