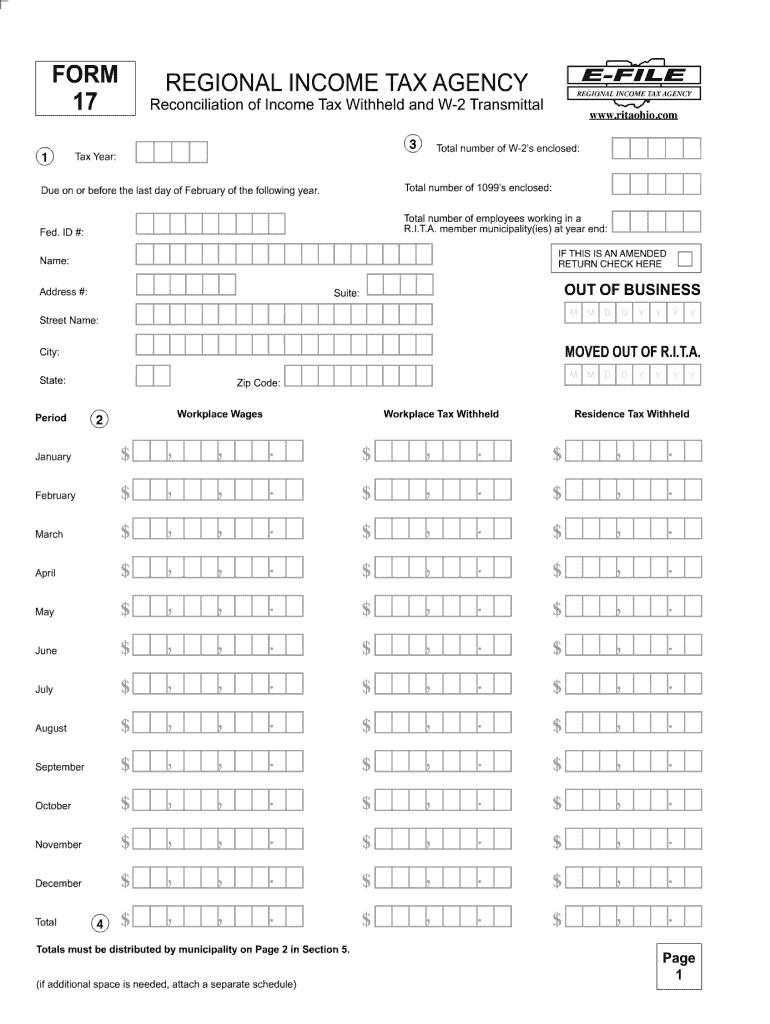

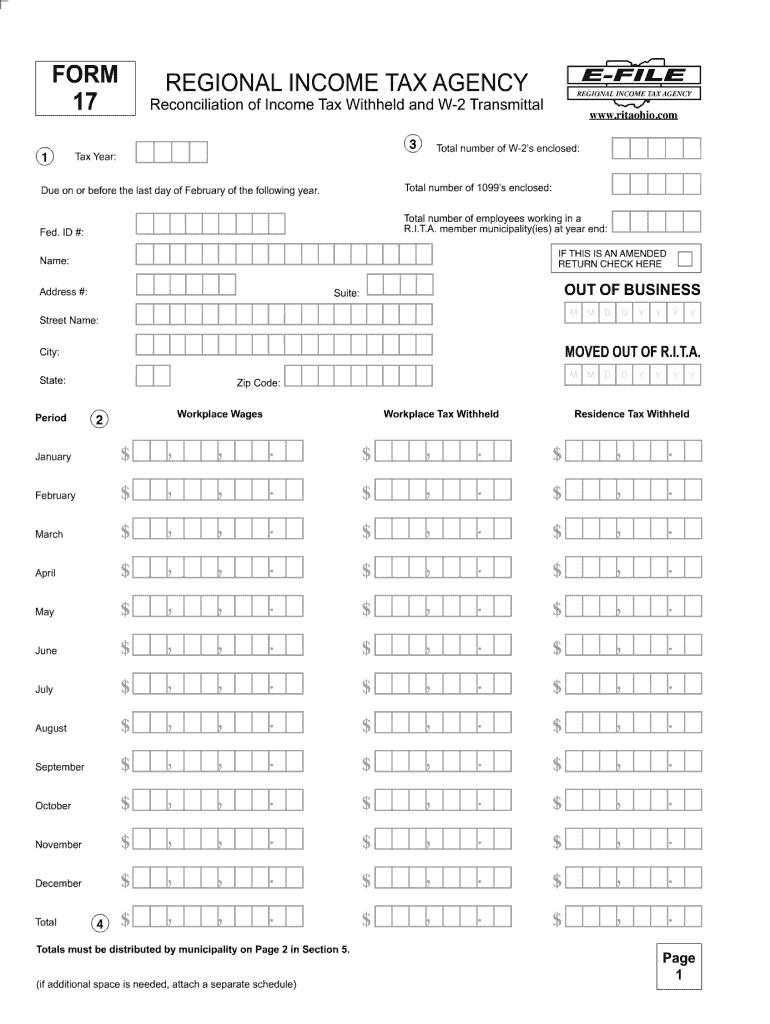

OH RITA 17 2012 free printable template

Get, Create, Make and Sign OH RITA 17

Editing OH RITA 17 online

Uncompromising security for your PDF editing and eSignature needs

OH RITA 17 Form Versions

How to fill out OH RITA 17

How to fill out OH RITA 17

Who needs OH RITA 17?

Instructions and Help about OH RITA 17

Today's tip of the day is regarding form 17 it's briefly just to bring this to your attention it would be strongly advised to speak to us if you are a husband and wife who own a property that's let out and one of you is a much higher earner than your spouse a form 17 designs the correct way can allow you to utilize and make the most of both of your text free allowances and potentially the twenty and forty percent tax bands

People Also Ask about

Do I have to pay Rita tax in Ohio?

Where to find Ohio tax forms?

What is Form 11 in Ohio?

What is form 11 RITA Ohio?

Do I have to file RITA Ohio?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete OH RITA 17 online?

Can I sign the OH RITA 17 electronically in Chrome?

How do I complete OH RITA 17 on an iOS device?

What is OH RITA 17?

Who is required to file OH RITA 17?

How to fill out OH RITA 17?

What is the purpose of OH RITA 17?

What information must be reported on OH RITA 17?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.