OH RITA 17 2022 free printable template

Show details

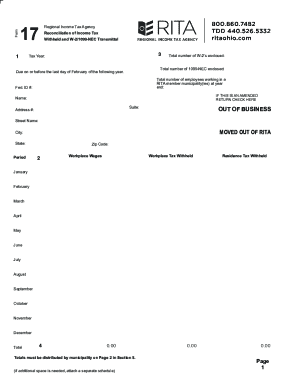

Form171Regional Income Tax Agency

Reconciliation of Income Tax

Withheld and W2/1099NEC Transmittal3Tax Year:Total number of W2s enclosed:Total number of 1099NEC enclosed:Due on or before the last

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH RITA 17

Edit your OH RITA 17 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH RITA 17 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH RITA 17 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OH RITA 17. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH RITA 17 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH RITA 17

How to fill out OH RITA 17

01

Start by obtaining the OH RITA 17 form from the appropriate regulatory body.

02

Fill out your personal information including your name, address, and contact details at the top of the form.

03

Provide the relevant identification number or Social Security Number as required.

04

Review the specific sections that pertain to your situation, whether it’s related to income, employment, or other factors.

05

Input any financial information asked for, such as your total income for the previous year.

06

Attach any necessary documents that support the information provided, like tax returns or pay stubs.

07

Double-check all entered information for accuracy and completeness.

08

Sign and date the form in the designated area.

09

Submit the completed form by the deadline, either electronically or by mail as instructed.

Who needs OH RITA 17?

01

Individuals who are applying for assistance or benefits that require the completion of OH RITA 17.

02

Taxpayers who need to report certain financial information for regulatory compliance.

03

People undergoing audits or verification processes related to their financial status.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay Rita tax in Ohio?

Am I required to file an annual RITA tax return? Residents of RITA municipalities who are 18 years of age and older must file an annual return, even if no tax is due.

What is Form 11 in Ohio?

Uniform Domestic Relations Form 11 (Answer to Complaint for Divorce With Children) Page 1. Supreme Court of Ohio.

What is Form 11 Rita Ohio?

Municipal Tax Withholding Statements (Form 11) and Annual Reconciliation of Income Tax Withheld (Form 17) forms can be filed at MyAccount. Other online options are listed at eFile Options for Tax Software Vendors.

What is Ohio Form 17?

FORM 17 INSTRUCTIONS A Reconciliation of Income Tax Withheld is required to be filed on or before the last day of February following the calendar year in which employee withholding deductions have been made by an employer.

How does RITA work in Ohio?

The Regional Income Tax Agency provides services to collect income tax for municipalities in the State of Ohio. RITA's Board of Trustees is authorized to administer and enforce the income tax laws of each of the participating municipalities.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my OH RITA 17 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your OH RITA 17 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I edit OH RITA 17 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign OH RITA 17 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete OH RITA 17 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your OH RITA 17, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is OH RITA 17?

OH RITA 17 is a tax form used for reporting income earned by residents of certain municipalities in Ohio for the purpose of local income taxation.

Who is required to file OH RITA 17?

Individuals who reside or work in municipalities that require local income tax filing are required to file OH RITA 17.

How to fill out OH RITA 17?

To fill out OH RITA 17, individuals must provide their personal information, income details, and any applicable deductions or credits, ensuring that all required fields are completed accurately.

What is the purpose of OH RITA 17?

The purpose of OH RITA 17 is to calculate and report local income taxes owed to the municipality of residence or work, ensuring compliance with local tax laws.

What information must be reported on OH RITA 17?

Information required on OH RITA 17 includes the taxpayer's name, address, Social Security number, total income, adjustments, deductions, and the amount of tax due.

Fill out your OH RITA 17 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH RITA 17 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.