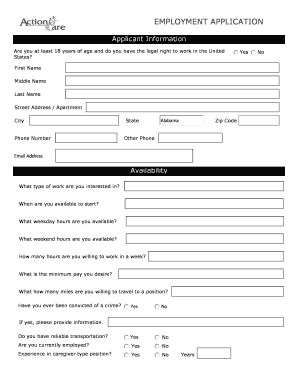

OH RITA 17 2020 free printable template

Show details

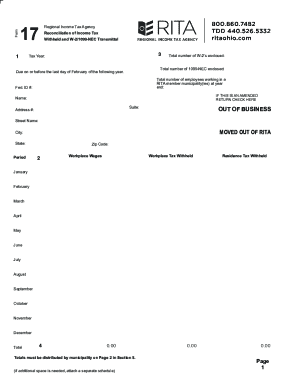

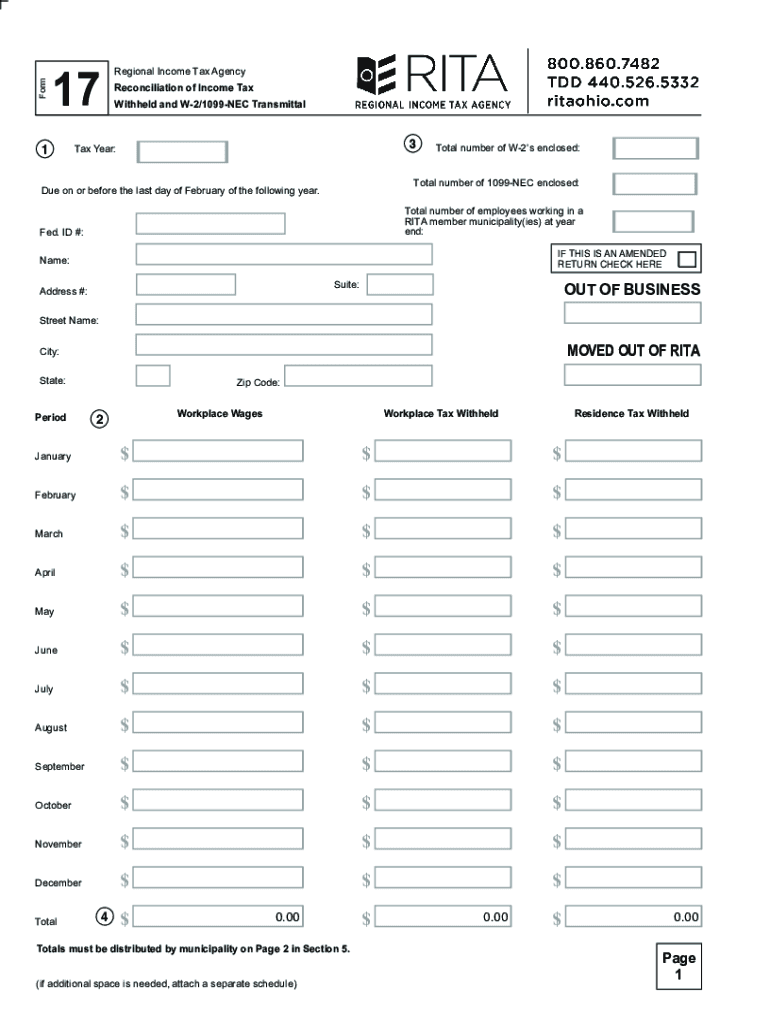

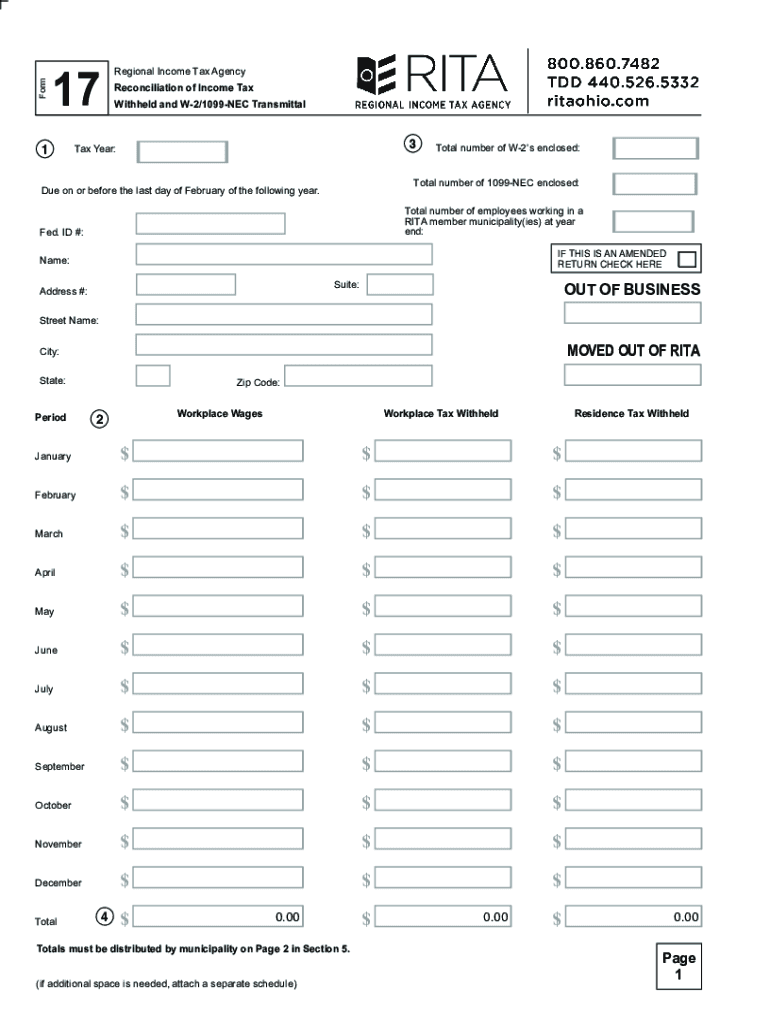

RESET FORMFormPRINT FORM171Regional Income Tax Agency

Reconciliation of Income Tax

Withheld and W2/1099NEC Transmittal3Tax Year:Total number of W2s enclosed:Total number of 1099NEC enclosed:Due on

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH RITA 17

Edit your OH RITA 17 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH RITA 17 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH RITA 17 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit OH RITA 17. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH RITA 17 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH RITA 17

How to fill out OH RITA 17

01

Gather all necessary documentation such as income records and identification.

02

Obtain the OH RITA 17 form from the relevant website or office.

03

Start filling out your personal details in the designated sections of the form.

04

Input your income information accurately as per the provided guidelines.

05

Double-check the information entered for accuracy and completeness.

06

Sign and date the form at the end to validate your submission.

07

Submit the completed form through the specified method (online, by mail, etc.).

Who needs OH RITA 17?

01

Individuals who are residents or earn income in Ohio and have tax liabilities.

02

Tax professionals assisting clients with their tax filings.

03

Businesses and organizations that require to report withholdings and earnings.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay Rita tax in Ohio?

Am I required to file an annual RITA tax return? Residents of RITA municipalities who are 18 years of age and older must file an annual return, even if no tax is due.

What is Form 11 in Ohio?

Uniform Domestic Relations Form 11 (Answer to Complaint for Divorce With Children) Page 1. Supreme Court of Ohio.

What is Form 11 Rita Ohio?

Municipal Tax Withholding Statements (Form 11) and Annual Reconciliation of Income Tax Withheld (Form 17) forms can be filed at MyAccount. Other online options are listed at eFile Options for Tax Software Vendors.

What is Ohio Form 17?

FORM 17 INSTRUCTIONS A Reconciliation of Income Tax Withheld is required to be filed on or before the last day of February following the calendar year in which employee withholding deductions have been made by an employer.

How does RITA work in Ohio?

The Regional Income Tax Agency provides services to collect income tax for municipalities in the State of Ohio. RITA's Board of Trustees is authorized to administer and enforce the income tax laws of each of the participating municipalities.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the OH RITA 17 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your OH RITA 17 and you'll be done in minutes.

How do I edit OH RITA 17 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing OH RITA 17.

How do I edit OH RITA 17 on an Android device?

You can make any changes to PDF files, like OH RITA 17, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is OH RITA 17?

OH RITA 17 is a municipal income tax return form used by residents of specific municipalities in Ohio to report and pay local income tax.

Who is required to file OH RITA 17?

Individuals who reside or work in municipalities that have a local income tax and meet certain income thresholds are required to file OH RITA 17.

How to fill out OH RITA 17?

To fill out OH RITA 17, taxpayers need to provide their personal information, report their income, claim any deductions or exemptions, and calculate the tax owed based on the local income tax rate.

What is the purpose of OH RITA 17?

The purpose of OH RITA 17 is to collect local income taxes from residents and workers of municipalities in Ohio, ensuring compliance with local tax laws.

What information must be reported on OH RITA 17?

The information that must be reported on OH RITA 17 includes taxpayer's name, address, Social Security number, total income, deductions, exemptions, and calculated local tax owed.

Fill out your OH RITA 17 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH RITA 17 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.