Get the free Preparing Payroll Manually - extension missouri

Show details

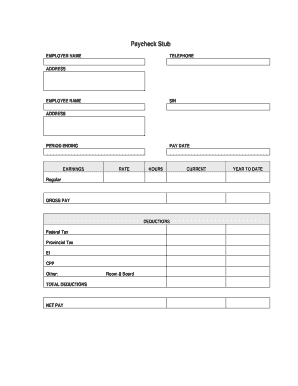

County Accounting ManualPreparing Payroll Manually For Payroll SubscribersContents: Payroll Voucher Template Issues Create Paycheck Manually Taxes Payroll Liabilities Generate Data for FormsManually

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign preparing payroll manually

Edit your preparing payroll manually form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your preparing payroll manually form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing preparing payroll manually online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit preparing payroll manually. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out preparing payroll manually

Who needs preparing payroll manually?

01

Small businesses with a limited number of employees: Small businesses that have a small number of employees may find it more cost-effective to manually prepare their payroll rather than investing in expensive payroll software or outsourcing this task to a payroll service provider.

02

Start-ups and new businesses: Start-ups and new businesses often have limited resources and may not have the budget to invest in payroll software or services. In such cases, preparing payroll manually can be a more viable option.

03

Businesses with unique payroll requirements: Some businesses may have complex payroll requirements that cannot be easily managed through automated software. Manual preparation allows them to customize and adapt their payroll processes according to their specific needs.

04

Businesses with simplified payroll processes: For some businesses with straightforward payroll processes, preparing payroll manually can be a simple and efficient way to handle their payroll responsibilities. This may include businesses with a small number of salaried employees or those with a consistent payroll structure.

How to fill out preparing payroll manually?

01

Gather necessary employee information: Collect all the required employee information such as social security numbers, addresses, tax withholding forms, pay rates, and hours worked.

02

Calculate gross wages: Calculate the gross wages for each employee based on their pay rate and hours worked. This can be done manually or by using a spreadsheet program.

03

Deduct taxes and other withholdings: Determine the appropriate amount of taxes and other withholdings to be deducted from each employee's gross wages. This includes income tax, social security tax, Medicare tax, and any other applicable deductions such as health insurance or retirement contributions.

04

Calculate net pay: Subtract the total deductions from each employee's gross wages to calculate their net pay, which is the amount they will receive after taxes and withholdings.

05

Prepare payroll records: Keep a record of each employee's gross wages, deductions, and net pay. This should include the pay period, dates worked, and any additional notes or adjustments.

06

Issue paychecks or direct deposits: Prepare physical paychecks or set up direct deposits to transfer each employee's net pay into their bank account.

07

File payroll tax returns: Ensure that all necessary payroll tax returns, such as Form 941, are completed and submitted to the appropriate tax authorities on time.

08

Keep payroll documentation: Maintain proper documentation of all payroll records, tax returns, and other relevant documents for future reference or potential audits.

Note: It's important to stay updated with the current tax laws and regulations governing payroll to ensure compliance. Consulting with a payroll professional or researching trusted sources can provide further guidance in this process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is preparing payroll manually?

Preparing payroll manually refers to the process of calculating employees' salaries, deductions, and taxes without the use of automated software or systems.

Who is required to file preparing payroll manually?

Employers who choose not to use payroll software or systems are required to file preparing payroll manually.

How to fill out preparing payroll manually?

To fill out preparing payroll manually, employers need to gather information on employees' hours worked, wages, deductions, and taxes. They then manually calculate net pay for each employee and prepare paychecks or direct deposits.

What is the purpose of preparing payroll manually?

The purpose of preparing payroll manually is to ensure employees are accurately paid for their work and that taxes and deductions are properly accounted for.

What information must be reported on preparing payroll manually?

Information such as employees' hours worked, wages, deductions, taxes withheld, and net pay must be reported on preparing payroll manually.

How do I execute preparing payroll manually online?

pdfFiller has made it simple to fill out and eSign preparing payroll manually. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out preparing payroll manually using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign preparing payroll manually and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit preparing payroll manually on an Android device?

You can edit, sign, and distribute preparing payroll manually on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your preparing payroll manually online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Preparing Payroll Manually is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.