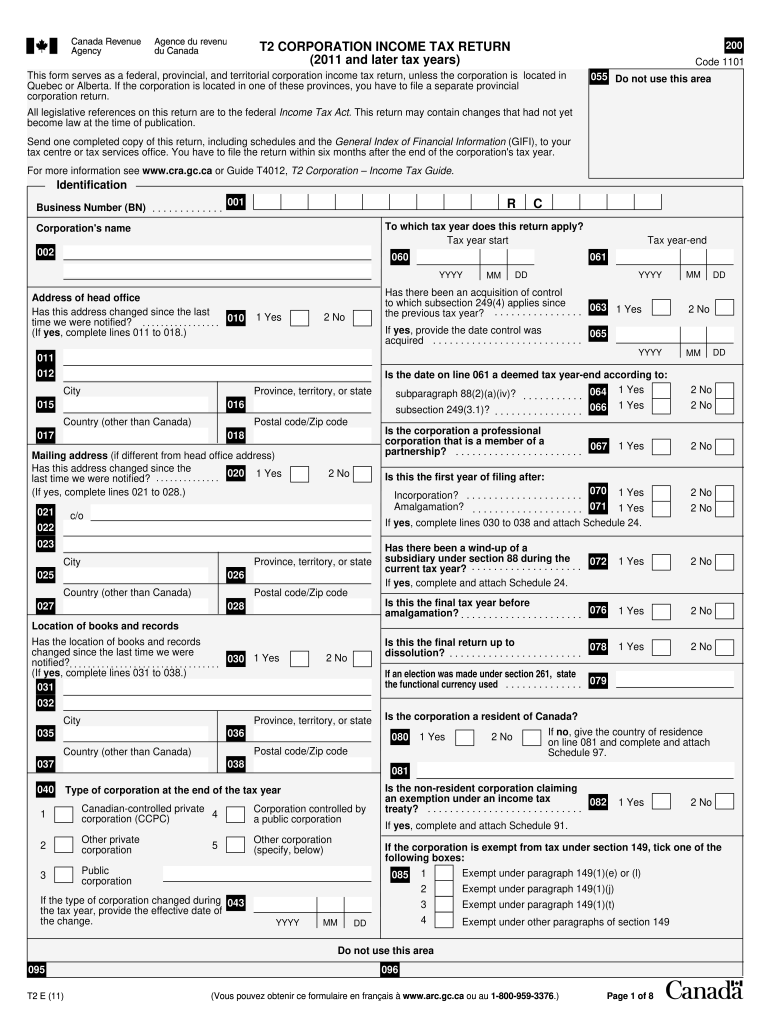

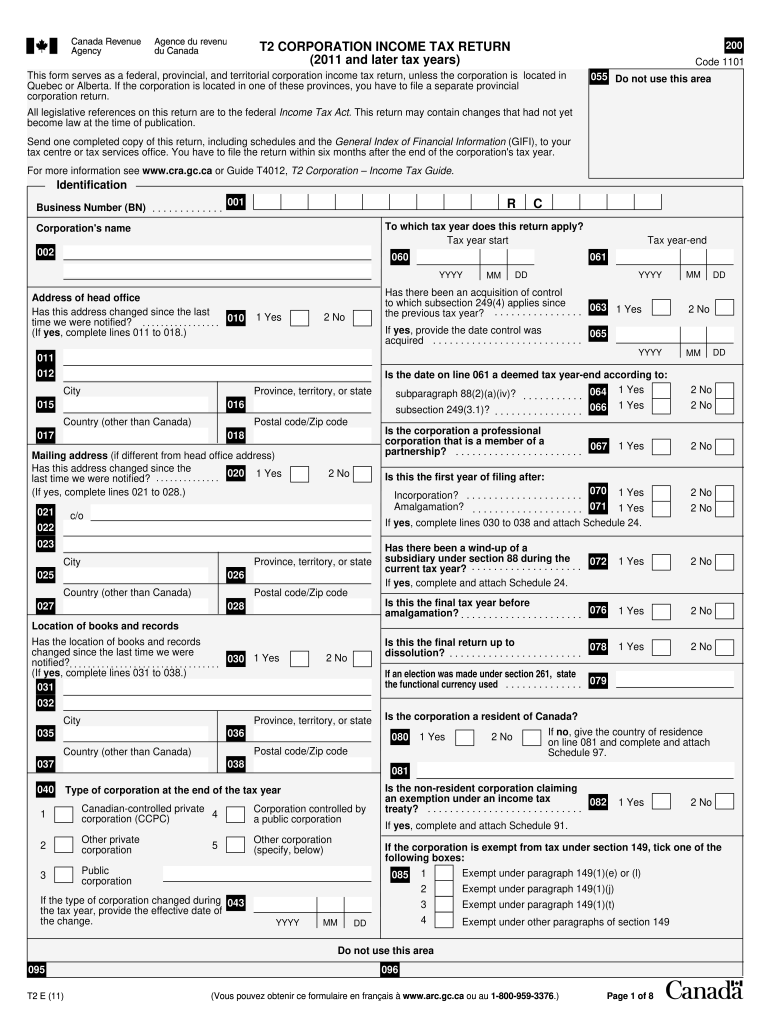

Canada T2 Corporation Income Tax Return 2011 free printable template

Get, Create, Make and Sign t2 income 2011

How to edit t2 income 2011 online

Uncompromising security for your PDF editing and eSignature needs

Canada T2 Corporation Income Tax Return Form Versions

How to fill out t2 income 2011

How to fill out Canada T2 Corporation Income Tax Return

Who needs Canada T2 Corporation Income Tax Return?

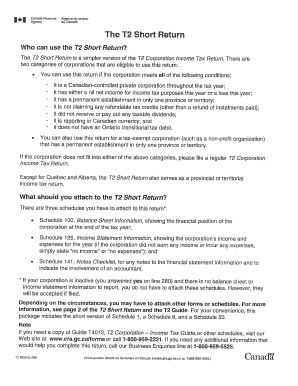

Instructions and Help about t2 income 2011

Hi my name is Alan Madden I am a chartered accountant and a tax expert in the Toronto Mississauga and Oakville regions of Ontario Canada today's short video is about how to prepare a corporation income tax return for a business in Canada I'm going to walk you through step by step the corporation income tax return process including the completion of all applicable schedules the hope is by the end of this video you'll be able to complete your own corporation income tax return so let's start in this example I'm using a fictitious company called tech consulting company Inc let's look at the income statement of this particular company tech consulting Inc has a December 31st 2010 year and with sales of $200,000 and expenses listed below totaling eighty-four thousand dollars at the bottom you'll see profit revenue minus expenses of a hundred and sixteen thousand dollars it's a profitable company let's take a look at the balance sheet or the statement of worth of tax consulting company Inc tech consulting company Inc has cash assets of eighty-three thousand one hundred dollars, so it's a healthy balance sheet total assets of a hundred forty-nine thousand one hundred total liabilities of thirteen thousand and equity representing the money retained inside the corporation of 136 100 before you start the preparation of your corporate income tax return you'll require both the income statement and balance sheet of your company now where do we get the schedules for the preparation of the tax return that's an easy answer it can be obtained from the Canada Revenue Agency's website zero four which is shown at the top bar CRA — AR CGC dot CA under search the site I'm now going to look for the schedules and I will type in t2 returns and schedules I'll hit the search button the 8th link under the search results is t2 returns and schedules it provides a listing of all the schedules that you could ever possibly need for the preparation of a company tax or chart in reality you only need a few of these schedules so pick and choose the ones that you require let's start with the basic schedules for the preparation of the tax return schedule 100 the balance sheet is a summary of the balance sheet information which I showed to you previously total assets of one hundred forty-nine thousand one hundred and total liabilities of thirteen thousand with equity of 136 one hundred the next schedule is schedule 125 the income statement again this schedule is a summarization of your company's income statement Harry we can see the sales operating expenses and net income for accounting on line nine ninety-seven zero for a hundred and sixteen thousand dollars those schedules are simple to complete the next schedule fifty is an information schedule on here you simply report the name of each shareholder in this case I put myself Alan Madden social insurance number and the number of shares owned schedule eight is the calculation of capital cost allowance on the tangible assets of the...

People Also Ask about

How do I get my T1?

What is a T1 form?

What is non business income?

What is foreign non business income on T2?

How do I get T2?

What is foreign source income for foreign tax credit?

What is a T3 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send t2 income 2011 for eSignature?

How do I execute t2 income 2011 online?

How do I edit t2 income 2011 straight from my smartphone?

What is Canada T2 Corporation Income Tax Return?

Who is required to file Canada T2 Corporation Income Tax Return?

How to fill out Canada T2 Corporation Income Tax Return?

What is the purpose of Canada T2 Corporation Income Tax Return?

What information must be reported on Canada T2 Corporation Income Tax Return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.