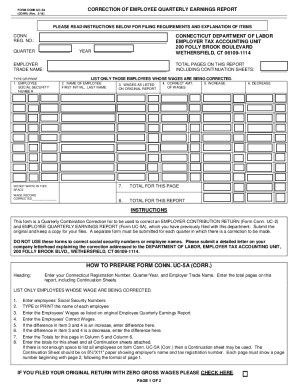

CT CONN UC-5A 2000 free printable template

Show details

UC 5A (REV. 6 ... EMPLOYEES LISTED ON PAGES OF “5 D TAPE SUBMITTED ... FORM CONN UH EMPLOYER CONTRIBUTION RETURN (REV. (B/00) ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CT CONN UC-5A

Edit your CT CONN UC-5A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT CONN UC-5A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CT CONN UC-5A online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CT CONN UC-5A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT CONN UC-5A Form Versions

Version

Form Popularity

Fillable & printabley

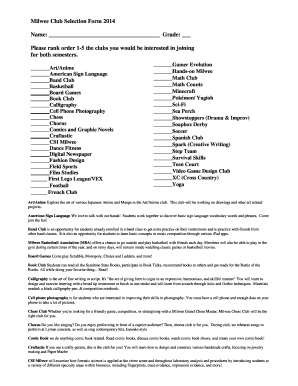

How to fill out CT CONN UC-5A

How to fill out CT CONN UC-5A

01

Obtain the CT CONN UC-5A form from the Connecticut Department of Labor website or your local Employment Security office.

02

Fill out your personal information including your name, address, and Social Security number at the top of the form.

03

Indicate the reason for your claim by checking the appropriate box and providing details if necessary.

04

Report your work history for the relevant period by listing employers, dates of employment, and reasons for separation.

05

Detail any income received during the claim period, including wages, bonuses, and any other compensations.

06

Review the form for accuracy and completeness to ensure all sections are filled out correctly.

07

Sign and date the form to verify the information provided is truthful.

08

Submit the completed form to the appropriate local workforce center or online via the Connecticut Department of Labor's portal.

Who needs CT CONN UC-5A?

01

Individuals who have experienced job loss or reduced hours and are seeking unemployment benefits in Connecticut.

02

Employees who are filing a claim due to layoff, termination, or other qualifying reasons.

Fill

form

: Try Risk Free

People Also Ask about

What is the SUTA rate for 2022 in Connecticut?

This is unchanged from the November 2022 level of 4.2%. The Connecticut unemployment rate was 5.1% in December 2021.

Is the $300 unemployment over in CT?

Yes, the additional $300 benefit payment will be included with each payment for every week that you receive a benefit, beginning with the week ending January 2, 2021, through week ending September 4, 2021, regardless of the date on which you receive that payment.

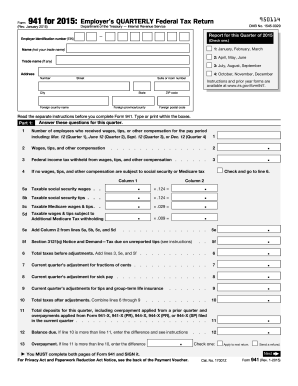

What will the payroll tax rates be in 2023?

Increase the payroll tax rate (currently 12.4 percent) to 16.0 percent in 2023 and later.

How to calculate unemployment benefits in CT?

Your weekly benefit rate is one twenty-sixth (1/26) of the average of total wages paid during the two (2) highest quarters in your base period.

What is CT uc2?

UC-2. Form reports tax calculation for employer. May be Current or delinquent Quarters. These forms are sorted by BOA and batched by DOL. Approximately 50 Employers/batch.

How much is unemployment in CT 2022?

The unemployment weekly benefit rate for filers with a new benefit year beginning on or after October 2, 2022, will increase by $18 to a maximum rate of $703 per week.

What is the maximum unemployment benefit in CT 2022?

The unemployment weekly benefit rate for filers with a new benefit year beginning on or after October 2, 2022, will increase by $18 to a maximum rate of $703 per week.

What is the CT unemployment tax rate for 2023?

The Connecticut 2023 SUI tax rates are dated December 30, 2022.. The new employer tax rate will decrease from 3.0% to 2.8%. The minimum and maximum unemployment tax rates for experienced employers will decrease from that of 2022 to be 1.7% and 6.6%, respectively. The 2023 taxable wage base remains $15,000.

How much will I get on unemployment in CT?

Your weekly benefit rate is one twenty-sixth (1/26) of the average of total wages paid during the two (2) highest quarters in your base period.

What is the FICA limit for 2023?

We call this annual limit the contribution and benefit base. This amount is also commonly referred to as the taxable maximum. For earnings in 2023, this base is $160,200.

What are the tax changes for 2023 in CT?

on Wednesday, January 4, 2023. In what would be the first reduction of the state income tax since 1996 and the largest since its adoption in 1991, Gov. Ned Lamont on Monday said he will ask the General Assembly to cut the 5 percent rate to 4.5 percent, and for those who make less than $50,000 to pay no income taxes.

What is the most you can get weekly from unemployment?

Your weekly benefit amount (WBA) ranges from $40 to $450. To get an estimate of what you will receive, use the unemployment benefit calculator.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CT CONN UC-5A online?

pdfFiller makes it easy to finish and sign CT CONN UC-5A online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit CT CONN UC-5A online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your CT CONN UC-5A and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the CT CONN UC-5A form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign CT CONN UC-5A and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is CT CONN UC-5A?

CT CONN UC-5A is a form used in Connecticut for reporting unemployment compensation contributions by employers.

Who is required to file CT CONN UC-5A?

Employers who are subject to unemployment compensation tax in Connecticut are required to file CT CONN UC-5A.

How to fill out CT CONN UC-5A?

To fill out CT CONN UC-5A, employers need to provide information such as their business details, total wages paid, and contributions owed. Detailed instructions are usually included with the form.

What is the purpose of CT CONN UC-5A?

The purpose of CT CONN UC-5A is to collect information from employers for the assessment of unemployment compensation taxes and to ensure compliance with state unemployment insurance laws.

What information must be reported on CT CONN UC-5A?

CT CONN UC-5A requires employers to report their identification information, total wages paid to employees, and the amount of unemployment compensation contributions owed.

Fill out your CT CONN UC-5A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT CONN UC-5a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.