SC DoR PT-100 2004 free printable template

Show details

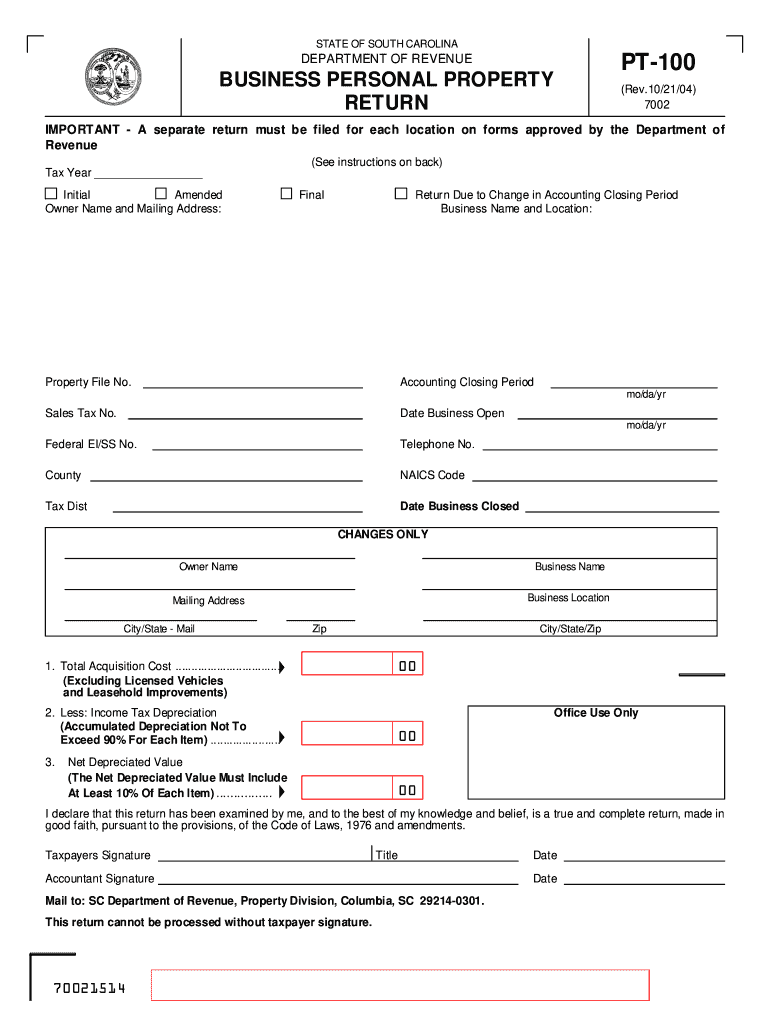

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE BUSINESS PERSONAL PROPERTY RETURN (See instructions on back) Final PT-100 (Rev.10/21/04) 7002 IMPORTANT A separate return must be filed for each location

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc final pt 100

Edit your sc final pt 100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc final pt 100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sc final pt 100 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sc final pt 100. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR PT-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sc final pt 100

How to fill out SC DoR PT-100

01

Start by obtaining the SC DoR PT-100 form from the official website or relevant authority.

02

Read the instructions provided on the first page carefully.

03

Fill out your personal information in the designated fields, including name, address, and contact details.

04

Provide any required identification information, such as Social Security Number or driver’s license number.

05

Answer all relevant sections regarding the purpose of filing the PT-100.

06

Include any additional documentation or evidence as specified in the instructions.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form at the bottom as required.

09

Submit the form either electronically or by mail to the designated authority.

Who needs SC DoR PT-100?

01

Individuals or businesses that need to report specific taxable transactions or events.

02

Property owners needing to document property-related transactions.

03

Professionals handling estate, trust, or other legal matters requiring formal reporting.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from property taxes in Charleston County?

The S.C. Homestead Tax-Exemption Program is for homeowners who are age 65 or older, and/or totally disabled, and/or totally blind as of December 31 preceding the tax year of the exemption. The program exempts up to $50,000 of the value of the home including up to five contiguous acres of property.

Who is exempt from paying property taxes?

From 2022, the exemption applies if someone lives in the property and they are not a joint owner of the property. For example, they may be a tenant, relative or friend. Property purchased, built or adapted for a person who is permanently and totally incapacitated to live there as their sole or main residence.

Who is exempt from property tax in Charleston?

The S.C. Homestead Tax-Exemption Program is for homeowners who are age 65 or older, and/or totally disabled, and/or totally blind as of December 31 preceding the tax year of the exemption. The program exempts up to $50,000 of the value of the home including up to five contiguous acres of property.

What is the ATI exemption in Charleston SC?

South Carolina law now allows a partial exemption from taxation of up to 25% of an “ATI fair market value” that is the result of an Assessable Transfer of Interest. The exemption allowed results in a “taxable value” of either 75% of the “ATI fair market value” or the current fair market value, whichever is higher.

What is the tax rate in Charleston 4?

Charleston, South Carolina's Sales Tax Rate is 9%

How do you abbreviate Charleston?

Chas | This one is pretty self-explanatory: just a catchy little abbreviation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sc final pt 100 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your sc final pt 100 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for the sc final pt 100 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your sc final pt 100 in seconds.

How do I fill out sc final pt 100 on an Android device?

Use the pdfFiller Android app to finish your sc final pt 100 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is SC DoR PT-100?

SC DoR PT-100 is a tax form used in South Carolina for reporting wages and withholding by employers.

Who is required to file SC DoR PT-100?

Employers who have withheld South Carolina income tax from employees' wages are required to file SC DoR PT-100.

How to fill out SC DoR PT-100?

To fill out SC DoR PT-100, employers need to provide information about their business, employee wages, and the amount of tax withheld.

What is the purpose of SC DoR PT-100?

The purpose of SC DoR PT-100 is to report and remit the state income tax withheld from employee wages to the South Carolina Department of Revenue.

What information must be reported on SC DoR PT-100?

SC DoR PT-100 requires reporting the employer's name and address, employee details, total wages paid, and the tax withheld during the reporting period.

Fill out your sc final pt 100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc Final Pt 100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.