SC DoR PT-100 2006 free printable template

Show details

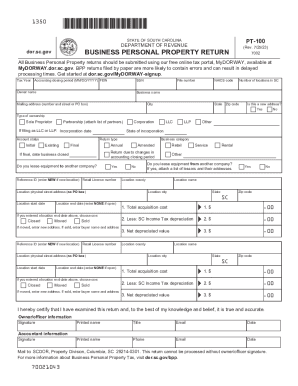

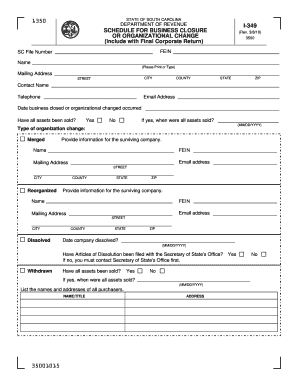

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE BUSINESS PERSONAL PROPERTY RETURN PT-100 Rev. 9/29/06 IMPORTANT - A separate return must be filed for each location on forms approved by the Department of Revenue. This is a scannable form which must be completed with black ink only. Tax Year New Amended Owner Name and Mailing Address See instructions on back Final Closing Acct. Return Due to Change in Accounting Closing Period Business Name and Locat...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your south carolina form pt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your south carolina form pt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit south carolina form pt online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit south carolina form pt. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

SC DoR PT-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out south carolina form pt

How to fill out South Carolina form PT:

01

First, gather all necessary information and documents, including your personal information, income details, and any applicable deductions or exemptions.

02

Review the form PT instructions carefully to ensure you understand the requirements and eligibility criteria.

03

Enter your personal information accurately and legibly in the designated sections of the form, including your name, address, social security number, and contact information.

04

Provide information regarding your income, including wages, salaries, tips, and any other earnings. Include any supporting documentation if required.

05

Deduct any applicable exemptions or credits, such as deductions for dependents, education expenses, or retirement contributions.

06

Calculate your South Carolina taxable income by subtracting total deductions and exemptions from your total income.

07

Determine your tax liability using the appropriate tax tables or tax rate schedule provided in the form PT instructions.

08

If you owe state taxes, include the payment in the designated section of the form. You may choose to pay electronically or by check.

09

If you are eligible for a refund, provide your bank account information for direct deposit or request a paper check to be mailed to you.

10

Double-check all information entered on the form for accuracy and completeness before submitting it.

11

Sign and date the form PT to certify the accuracy of the information provided.

12

Retain a copy of the completed form for your records.

Who needs South Carolina form PT:

01

Individuals who are residents of South Carolina and have earned income during the tax year.

02

Individuals who are non-residents of South Carolina but have earned income from South Carolina sources that is subject to state taxation.

03

Individuals who qualify for certain exemptions, credits, or deductions offered by the state of South Carolina and need to file form PT to claim those benefits.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is south carolina form pt?

South Carolina Form PT refers to the state tax form used by residents of South Carolina to report their annual personal income tax. This form, officially known as Form SC1040 PT, is used by taxpayers who have income from sources other than wages, such as rental income, self-employment income, or capital gains. It allows individuals to report their income, deductions, and credits to determine their tax liability or potential refund. Additionally, residents who are entitled to certain tax credits or exemptions can claim them on this form.

Who is required to file south carolina form pt?

Individuals who owe income tax to South Carolina but are not required to file a South Carolina Individual Income Tax Return (Form SC 1040) are required to file South Carolina Form PT. This includes nonresidents and part-year residents who earned income from South Carolina sources and have a South Carolina withholding amount that exceeds their income tax liability.

How to fill out south carolina form pt?

To correctly fill out South Carolina Form PT (Payment Voucher for Extension of Time to File Individual Income Tax), follow the steps below:

1. Provide your personal information:

- Taxpayer's SSN or FEIN: Enter the social security number or federal employer identification number of the taxpayer.

- Taxpayer's name: Enter the taxpayer's full name.

- Daytime phone number: Enter a phone number where you can be reached during the day.

2. Calculate the tentative total tax liability:

- You need to estimate your total tax liability for the year. Use your best judgment or consult a tax professional if needed.

- Enter the estimated amount on Line 1.

3. Calculate the total amount paid or being paid with the extension request:

- Add up all payments you have made or will make by the original due date of the return.

- Include estimated payments, tax withheld, any refund applied to the current year, and other credits.

- Enter the total amount on Line 2.

4. Determine the amount of any tax shortfall:

- Subtract the amount on Line 2 from the estimated tax liability on Line 1.

- If the result is zero or a negative value, you do not need to make a payment at this time.

- If the result is a positive value, enter it on Line 3.

5. Calculate the penalty for late payment or underpayment of estimated tax:

- Multiply the amount on Line 3 by the late payment penalty rate of 0.5% per month.

- Enter the penalty amount on Line 4.

6. Calculate the interest due:

- Multiply the amount on Line 3 by the annual interest rate.

- Divide the result by 12 months to get the monthly interest amount.

- Enter the interest amount on Line 5.

7. Determine the total amount due:

- Add the penalty amount on Line 4 to the interest amount on Line 5.

- Enter the total amount due on Line 6.

8. Signature declaration:

- Read the eligibility requirements and confirm that you meet them.

- Sign and date the form in the designated areas.

9. Payment method:

- Determine your preferred payment method (check, money order, or electronic funds withdrawal).

- Include the payment for the total amount due along with the Form PT.

10. Keep a copy:

- Make a copy of the completed form and any accompanying payment for your records.

Note: It is recommended to consult with a tax professional or refer to the instructions provided with the form to ensure accurate completion.

What is the purpose of south carolina form pt?

The purpose of South Carolina Form PT (Property Tax Return) is to provide property owners with a means to report their personal property (tangible and intangible) to the county assessor for tax assessment purposes. This form allows the assessor to determine the appropriate property tax liability for the owner based on the reported property value.

What information must be reported on south carolina form pt?

The South Carolina Form PT, also known as the Property Tax Return form, is used to report various information related to property for tax assessment purposes. The specific information required on the form may vary depending on the county and municipality, but generally, the following information is required:

1. Property Identification: The form will typically ask for the property's identification number, location (address), and legal description.

2. Property Classification: You may be required to indicate the type of property being reported, such as residential, commercial, agricultural, industrial, or vacant land.

3. Property Owner Information: The form will ask for the owner's name, mailing address, and contact information.

4. Income and Expense Details: If the property is used for rental or commercial purposes, you may need to report income and expense details related to the property.

5. Improvements: You may be required to list any improvements made to the property, such as additions or renovations.

6. Exemptions and Special Assessments: The form will typically have sections for reporting any available exemptions or special assessments that may apply to the property.

7. Market Value: You may need to provide an estimated market value for the property.

8. Additional Documentation: Depending on the county and municipality, you may need to attach additional documentation, such as a property survey, recent appraisal, or income statements.

It's essential to consult the South Carolina Department of Revenue or your local county assessor's office for specific instructions and requirements for completing Form PT in your area, as they may have variations or additional information needed.

What is the penalty for the late filing of south carolina form pt?

The penalty for the late filing of South Carolina Form PT varies depending on the amount of tax due. According to the South Carolina Department of Revenue, the penalties for late filing are as follows:

- If the tax is one month late, the penalty is 5% of the tax due, up to a maximum of $200.

- If the tax is two months late, the penalty increases to 10% of the tax due, up to a maximum of $200.

- If the tax is more than two months late, the penalty increases to 25% of the tax due, with no maximum limit.

- Additionally, interest is charged on any unpaid tax, with the rate determined by the South Carolina Department of Revenue.

It is important to note that these penalties and interest can accumulate over time, so it is advised to file the form and pay the tax as soon as possible to avoid further penalties and interest.

How can I edit south carolina form pt from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your south carolina form pt into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit south carolina form pt on an iOS device?

Use the pdfFiller mobile app to create, edit, and share south carolina form pt from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out south carolina form pt on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your south carolina form pt. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your south carolina form pt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.