SC DoR PT-100 2010 free printable template

Show details

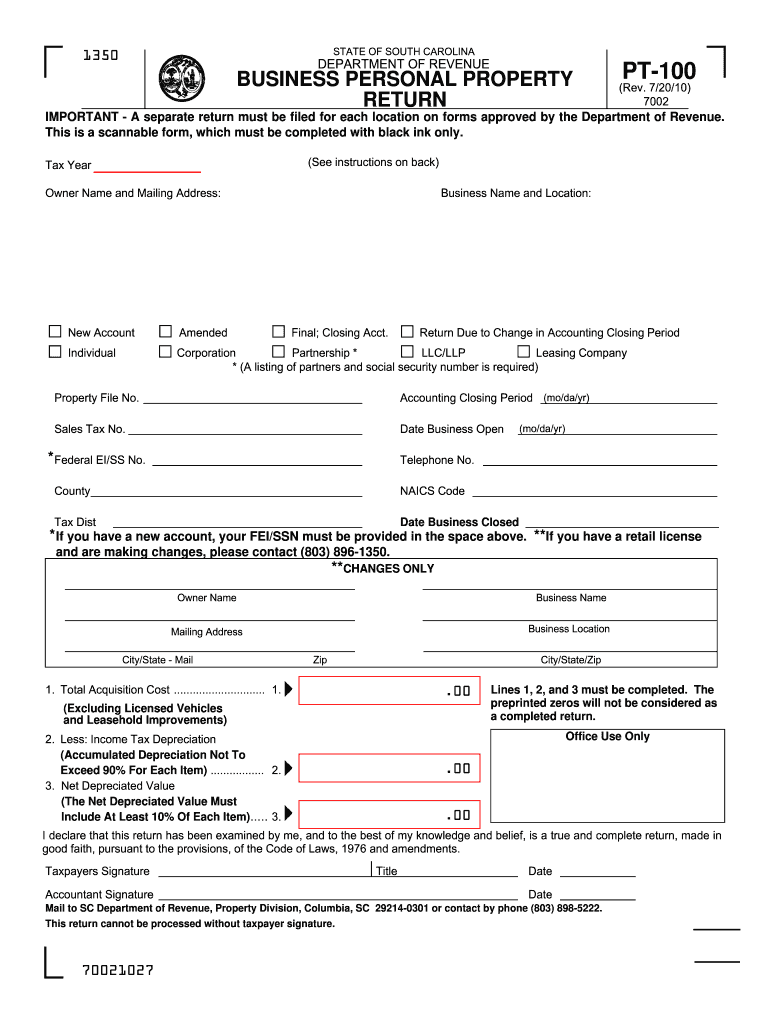

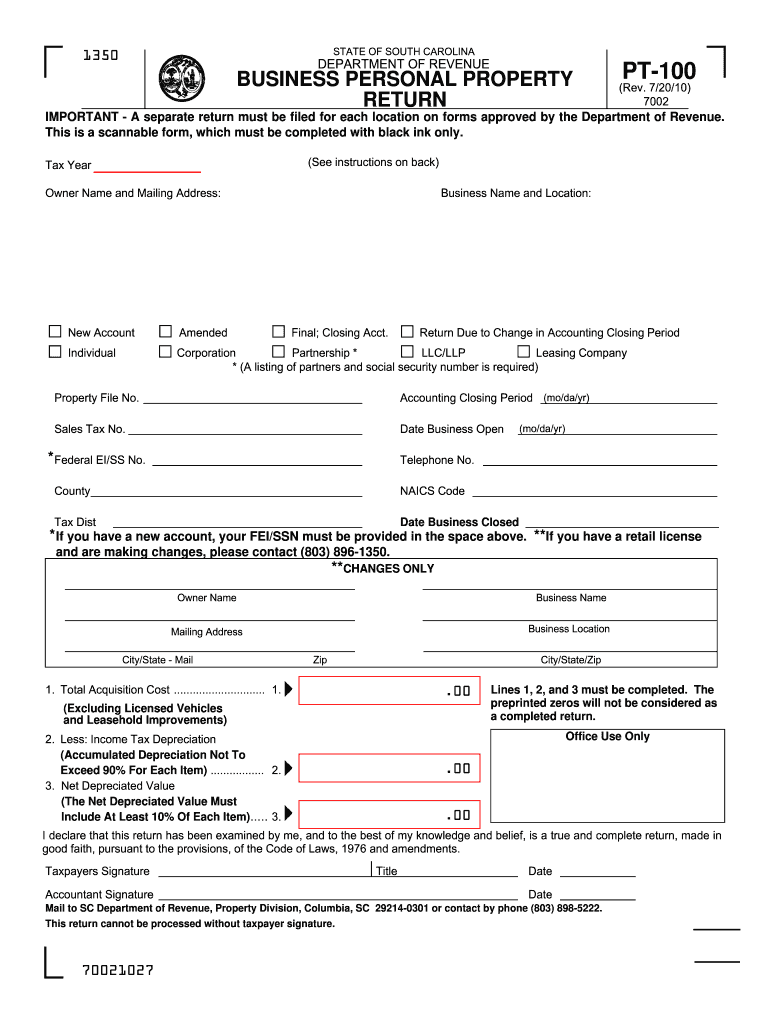

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE BUSINESS PERSONAL PROPERTY RETURN PT-100 Rev. 7/20/10 IMPORTANT - A separate return must be filed for each location on forms approved by the Department of Revenue. This is a scannable form which must be completed with black ink only. See instructions on back Tax Year Owner Name and Mailing Address Business Name and Location New Account Amended Individual Corporation Partnership LLC/LLP Leasing Company A listing of partners and social security...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc pt 100 online

Edit your sc pt 100 online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc pt 100 online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sc pt 100 online online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sc pt 100 online. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR PT-100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sc pt 100 online

How to fill out SC DoR PT-100

01

Begin by entering your personal information, including name and address, in the designated sections.

02

Provide your Social Security Number or tax ID where required.

03

Clearly indicate the type of transaction you are performing in the appropriate box.

04

Detail any amounts related to the transaction, ensuring calculations are accurate.

05

Attach any necessary supporting documentation as instructed in the form.

06

Review all information for accuracy and completeness before signing.

07

Submit the completed form by the specified deadline, either electronically or by mail.

Who needs SC DoR PT-100?

01

Individuals or organizations that are filing for tax credits or deductions.

02

Anyone involved in specific business transactions that require documentation.

03

Tax professionals who assist clients in tax-related activities.

04

Residents of jurisdictions that mandate the use of SC DoR PT-100 for certain filings.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from property taxes in Charleston County?

The S.C. Homestead Tax-Exemption Program is for homeowners who are age 65 or older, and/or totally disabled, and/or totally blind as of December 31 preceding the tax year of the exemption. The program exempts up to $50,000 of the value of the home including up to five contiguous acres of property.

Who is exempt from paying property taxes?

From 2022, the exemption applies if someone lives in the property and they are not a joint owner of the property. For example, they may be a tenant, relative or friend. Property purchased, built or adapted for a person who is permanently and totally incapacitated to live there as their sole or main residence.

Who is exempt from property tax in Charleston?

The S.C. Homestead Tax-Exemption Program is for homeowners who are age 65 or older, and/or totally disabled, and/or totally blind as of December 31 preceding the tax year of the exemption. The program exempts up to $50,000 of the value of the home including up to five contiguous acres of property.

What is the ATI exemption in Charleston SC?

South Carolina law now allows a partial exemption from taxation of up to 25% of an “ATI fair market value” that is the result of an Assessable Transfer of Interest. The exemption allowed results in a “taxable value” of either 75% of the “ATI fair market value” or the current fair market value, whichever is higher.

What is the tax rate in Charleston 4?

Charleston, South Carolina's Sales Tax Rate is 9%

How do you abbreviate Charleston?

Chas | This one is pretty self-explanatory: just a catchy little abbreviation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sc pt 100 online?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific sc pt 100 online and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete sc pt 100 online online?

pdfFiller has made it simple to fill out and eSign sc pt 100 online. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I complete sc pt 100 online on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your sc pt 100 online. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is SC DoR PT-100?

SC DoR PT-100 is a tax form used in South Carolina to report income and calculate the corresponding state taxes.

Who is required to file SC DoR PT-100?

Individuals or entities that have income subject to South Carolina state taxes are required to file SC DoR PT-100.

How to fill out SC DoR PT-100?

To fill out SC DoR PT-100, gather all necessary income information, complete the form with your personal and financial details, and ensure accuracy in reporting all deductions and credits.

What is the purpose of SC DoR PT-100?

The purpose of SC DoR PT-100 is to provide the South Carolina Department of Revenue with a detailed account of income and taxes owed to ensure compliance with state tax laws.

What information must be reported on SC DoR PT-100?

Information reported on SC DoR PT-100 includes total income, tax credits claimed, deductions, and other relevant financial information for the tax year.

Fill out your sc pt 100 online online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc Pt 100 Online is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.