SC DoR TC-44 2007 free printable template

Show details

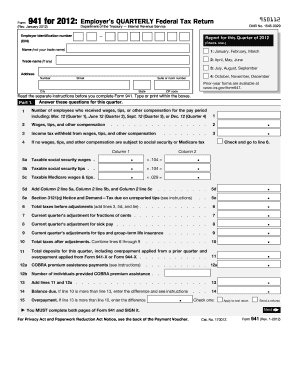

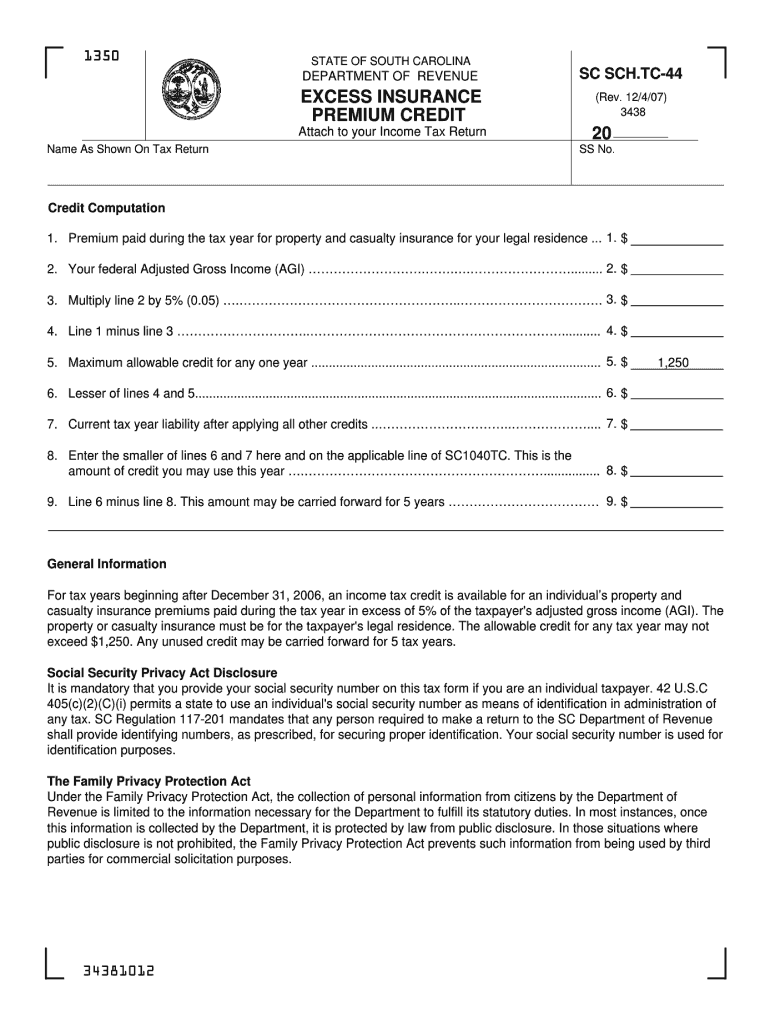

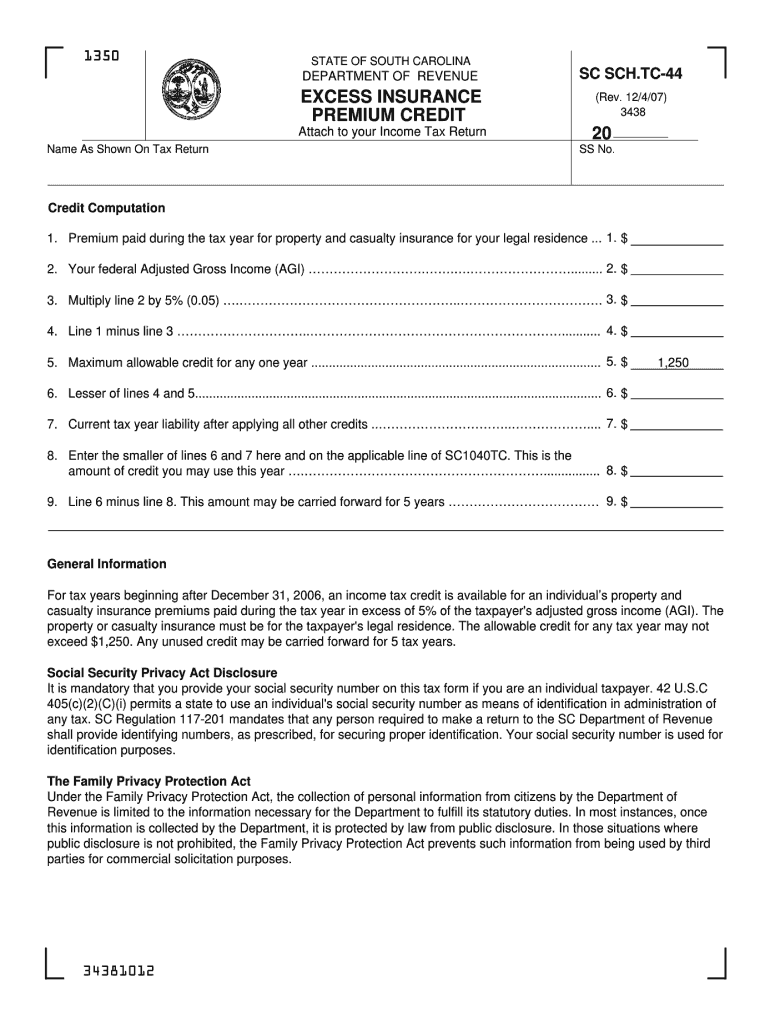

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SC SCH. TC-44 EXCESS INSURANCE PREMIUM CREDIT Rev. 12/4/07 Attach to your Income Tax Return Name As Shown On Tax Return SS No. Credit Computation 1. Premium paid during the tax year for property and casualty insurance for your legal residence. 1. 2. Your federal Adjusted Gross Income AGI. 2. 3. Multiply line 2 by 5 0. 05. 3. 4. Line 1 minus line 3. 4. 5. Maximum allowable credit for any one year. 5. 6. Lesser of lines 4 and 5. 6. 7. Current tax...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sc form credit 2007

Edit your sc form credit 2007 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc form credit 2007 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sc form credit 2007 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sc form credit 2007. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR TC-44 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sc form credit 2007

How to fill out SC DoR TC-44

01

Gather all necessary documents related to the transaction.

02

Begin by filling out the basic information section, including your full name and contact details.

03

Enter the date of the transaction in the appropriate field.

04

Provide a detailed description of the property involved in the transaction.

05

Include the names and contact information of all parties involved in the transaction.

06

Specify the type of transaction (e.g., sale, transfer, etc.).

07

Fill in any applicable financial details, such as sale price or financing terms.

08

Review the form for accuracy and completeness.

09

Sign and date the form if required.

Who needs SC DoR TC-44?

01

Individuals or entities involved in real estate transactions in South Carolina.

02

Real estate agents facilitating transactions.

03

Attorneys handling property transfers.

Fill

form

: Try Risk Free

People Also Ask about

What is the EITC credit for 2023 in South Carolina?

Eligible tax filers in South Carolina can currently claim a nonrefundable state EITC, with a credit worth 125% of the federal credit beginning in tax year 2023.

What is the drip trickle irrigation credit for SC?

The credit is for 25% of expenses made in a tax year. File a separate SCH TC-1 for each measure. Claim the credit only one time for each of the three measures. The credit is limited to a maximum of $2,500 in a tax year.

What is school tax credit for SC property tax?

The passage of Section 12 37 210(A)(47)(a) gives all owner-occupied residential property owners (legal residence classification - 4% ratio) credit on all of the school operating taxes, meaning that you are not paying any of the school district's operating taxes, only the school bonds.

What is SC excess insurance premium credit?

Excess Insurance Premium Credit: If you pay residential property and casualty insurance premiums in excess of 5% of your adjusted gross income, you may qualify for this credit. The credit is limited to $1,250 and has a five-year carryforward.

What is the tax rebate for 2023 in South Carolina?

As outlined in the legislation approving the rebates, the SCDOR set the rebate cap – the maximum amount taxpayers can receive – at $800. Rebates issued in March 2023 will also be capped at $800. Tax liability is what's left after subtracting your credits from the Individual Income Tax that you owe.

What is SC1040TC?

The credit for taxes paid to another state is available for a South Carolina resident or part-year resident who paid Income Tax to both South Carolina and another state on the same income. To claim the credit, you must have filed a return with the other state and had a tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sc form credit 2007 for eSignature?

When your sc form credit 2007 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute sc form credit 2007 online?

pdfFiller has made filling out and eSigning sc form credit 2007 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I edit sc form credit 2007 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing sc form credit 2007, you need to install and log in to the app.

What is SC DoR TC-44?

SC DoR TC-44 is a form used by businesses in South Carolina to report information related to the Department of Revenue's tax compliance for specific transactions.

Who is required to file SC DoR TC-44?

Any business entity in South Carolina that engages in certain transactions or activities subject to tax must file SC DoR TC-44.

How to fill out SC DoR TC-44?

To fill out SC DoR TC-44, you need to provide accurate details regarding the business's transactions, financial figures, and any relevant supporting documentation as instructed on the form.

What is the purpose of SC DoR TC-44?

The purpose of SC DoR TC-44 is to ensure that businesses comply with state tax regulations and accurately report their taxable activities to the South Carolina Department of Revenue.

What information must be reported on SC DoR TC-44?

The information that must be reported on SC DoR TC-44 includes business identification details, transaction types, amounts, and any applicable tax calculations.

Fill out your sc form credit 2007 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc Form Credit 2007 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.