CA PTA Toolkit 2011 free printable template

Get, Create, Make and Sign CA PTA Toolkit

Editing CA PTA Toolkit online

Uncompromising security for your PDF editing and eSignature needs

CA PTA Toolkit Form Versions

How to fill out CA PTA Toolkit

How to fill out CA PTA Toolkit

Who needs CA PTA Toolkit?

Instructions and Help about CA PTA Toolkit

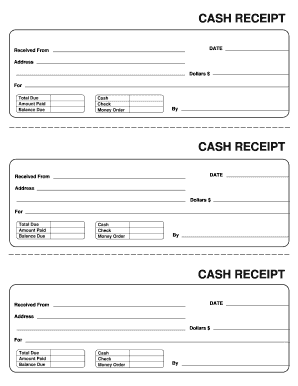

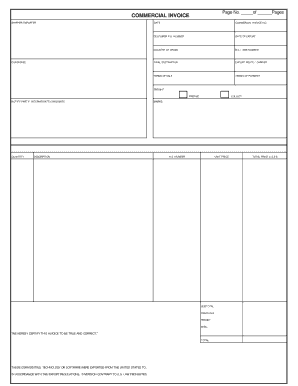

The California State PTA toolkit explains the PTA audit go to toolkit Capt an org click on the finance tab and drop to PTA audit the toolkit contains information on the audit schedule the purpose of an audit preparation for an audit procedure and recommendations and the audit report it also contains a job description for a PTA auditor the PTA auditor is an elected PTA officer and member of the PTA executive board if an auditor was not elected one may be appointed or hired the auditor must be impartial and not related to the president financial officers or any PT a check signer or chairman that handles PTA funds audits are performed at time specified in the bylaws PTA books must be audited semi-annually and at any time a financial officer resigns or no longer serves in that position a PTA audit is a formal review of pas financial records and its internal controls PTA financial records include financial records financial reports and financial forms the PTA executive board and the auditor should be familiar with each of these records the ledger is the principal book for recording financial transactions the ledger is used to track all receipts and disbursements it's a permanent record that must be retained forever the checkbook register is used to track the balance of the checking account all bank deposits checks written and any other account debits and credits are recorded and balanced in the checkbook register the cash receipt book is used to track coins and dollar bills received the treasurer or financial secretary must write a cash receipt for any coins or dollar bills received cash receipts are retained for seven years monthly bank statements with copies of canceled checks must be retained for seven years deposit slips are used to deposit funds to the PTA bank account the original slip is given to the bank a copy of the slip should be attached to the cash verification form that corresponds to the funds received deposit slips are retained for one year original receipts and invoices are attached to the payment authorization form that corresponds with the payment made receipts and invoices are retained for seven years the Executive Board and Auditor should be familiar with PTA financial reports' treasurer reports report the previous balance receipts disbursements and ending balance of each PTA bank account for the accounting period between meetings treasures also report budget updates financial secretary reports report receipts and deposits for each PTA bank account for the accounting period between meetings committee reports report the details of planned programs and activities including the date the program was approved by the Association and financial details the most recently approved audit reports report the ending account balances of the previous accounting period which are the beginning account balances for the subsequent accounting period they all feel aid the auditor with identifying any ongoing concerns and with recommendations audit...

People Also Ask about

Do I need a donation receipt for tax deduction?

How do I prove donations to my taxes?

What is a safe amount to claim for charitable donations?

How much should I put on a donation receipt?

What is a common donation amount?

How much can you write off for donations in CA?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CA PTA Toolkit without leaving Google Drive?

How do I complete CA PTA Toolkit online?

How can I edit CA PTA Toolkit on a smartphone?

What is CA PTA Toolkit?

Who is required to file CA PTA Toolkit?

How to fill out CA PTA Toolkit?

What is the purpose of CA PTA Toolkit?

What information must be reported on CA PTA Toolkit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.