The Salvation Army Valuation Guide for Donated Items 2004 free printable template

Show details

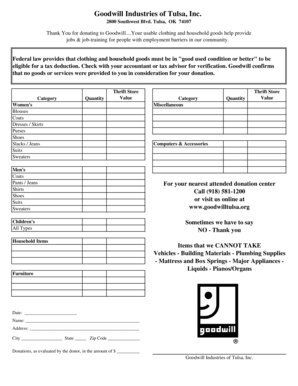

THE SALVATION ARMY VALUATION GUIDE FOR DONATED ITEMS The following is a list of the average prices in our thrift stores if the items are in good condition. New or expensive items would be higher and damaged material less. This list is for your guidance only. There are of course variables such as condition age antique value cleanliness repair needed and value when new. Furniture Air Conditioner Bars Bar Stools Bed Complete - Double Bed Complete - Single Bicycles Chest Clothes Closet China...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form Salvation Army Valuation Guide for Donated

Edit your form Salvation Army Valuation Guide for Donated form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form Salvation Army Valuation Guide for Donated form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form Salvation Army Valuation Guide for Donated online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form Salvation Army Valuation Guide for Donated. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

The Salvation Army Valuation Guide for Donated Items Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form Salvation Army Valuation Guide for Donated

How to fill out The Salvation Army Valuation Guide for Donated Items

01

Gather all items you plan to donate to The Salvation Army.

02

Obtain a copy of The Salvation Army Valuation Guide for Donated Items.

03

Review the categories of items listed in the guide, such as clothing, furniture, and appliances.

04

For each item, find its corresponding value in the guide based on its condition (new, excellent, good, fair, poor).

05

Make a list of all items with their estimated values based on the guide.

06

If necessary, adjust values for items that are unique or not clearly defined in the guide.

07

Complete a donation receipt or form, including the list of items and their values for your records.

Who needs The Salvation Army Valuation Guide for Donated Items?

01

Individuals or families planning to donate items to The Salvation Army.

02

Donors who want to claim tax deductions for their charitable contributions.

03

Anyone needing guidance on estimating the value of their donated items.

Fill

form

: Try Risk Free

People Also Ask about

How do you value a donated property?

You must consider all the facts and circumstances connected with the property, such as its desirability, use, and scarcity. For example, donated furniture that is in good used condition or better should not be evaluated at some fixed rate such as 15% of the cost of new replacement furniture.

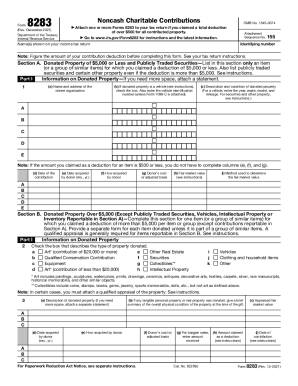

How much in charitable donations can I deduct in 2022?

Annual income tax deduction limits for gifts to public charities, including donor-advised funds, are 30% of adjusted gross income (AGI) for contributions of non-cash assets, if held more than one year, and 60% of AGI for contributions of cash.

What are the IRS donation values for 2022?

If you donate an item worth more than $5,000, you will most likely need to have it appraised. If you donate an item worth more than $50,000, you'll need to get a Statement of Value from the IRS, which will cost you at least $7,500.

How do you determine fair market value for donated items?

The cost of buying, building, or manufacturing property similar to the donated item should be considered in determining FMV. However, there must be a reasonable relationship between the replacement cost and the FMV. The replacement cost is the amount it would cost to replace the donated item on the valuation date.

How do you value donated items for tax purposes?

ing to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Fair market value is the price a willing buyer would pay for them.

How do you determine fair market value of donated items?

For property donations of under $5,000, you can determine the fair market value yourself and no appraisal is required.The IRS recommends that you consider all relevant factors, including: the item's cost or selling price. sales of comparable items. the item's replacement cost, and. an expert opinion.

How do I value my donated items to the IRS?

ing to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Fair market value is the price a willing buyer would pay for them. Value usually depends on the condition of the item.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form Salvation Army Valuation Guide for Donated?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your form Salvation Army Valuation Guide for Donated to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I sign the form Salvation Army Valuation Guide for Donated electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your form Salvation Army Valuation Guide for Donated in seconds.

How do I edit form Salvation Army Valuation Guide for Donated on an Android device?

With the pdfFiller Android app, you can edit, sign, and share form Salvation Army Valuation Guide for Donated on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is The Salvation Army Valuation Guide for Donated Items?

The Salvation Army Valuation Guide for Donated Items is a resource that provides suggested values for various items that individuals might donate to the organization. It offers a range of estimated values to help donors assess the worth of their contributions for tax deduction purposes.

Who is required to file The Salvation Army Valuation Guide for Donated Items?

Donors who wish to claim a tax deduction for their charitable contributions to The Salvation Army are required to refer to the Valuation Guide. It helps them to report the fair market value of the items they have donated.

How to fill out The Salvation Army Valuation Guide for Donated Items?

To fill out the Valuation Guide, donors should list the items they are donating, along with their estimated fair market values as suggested in the guide. It is important to keep a record of the items and their values for tax reporting purposes.

What is the purpose of The Salvation Army Valuation Guide for Donated Items?

The purpose of the Valuation Guide is to provide donors with a systematic way to assign a value to their donated goods, ensuring they can accurately report these contributions for tax deductions and promote transparency in charitable giving.

What information must be reported on The Salvation Army Valuation Guide for Donated Items?

Donors must report the items being donated, their estimated fair market values as per the guide, and any other relevant details as required for proper documentation of the charitable contribution.

Fill out your form Salvation Army Valuation Guide for Donated online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Salvation Army Valuation Guide For Donated is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.